Bitcoin briefly climbed past $112,000 on Monday, signalling a potential recovery after a volatile week. Despite recent turbulence, some analysts argue that the cryptocurrency’s bull market is far from over.

Over the past week, Bitcoin has struggled to maintain momentum, with investors showing signs of fatigue. A sharp drop last week triggered two significant liquidation events across the crypto market. Monday’s early trading saw Bitcoin hit a 24-hour high of $112,293, its first time above $112,000 since Thursday’s slump. Currently, it trades around $111,835, according to CoinGecko.

Crypto investment firm XWIN Research Japan noted in a recent CryptoQuant report that, despite short-term volatility, Bitcoin’s long-term indicators suggest the bull market remains intact. Metrics such as long-term holder behavior and the Market Value to Realized Value` (MVRV) ratio indicate underlying resilience.

XWIN explained that recent pullbacks are more likely periods of “digestion” rather than the end of a rally. With the MVRV ratio at 2, meaning the average cost basis is roughly half the current price, investors are sitting on healthy gains, yet the market has cooled from overheated conditions. Historically, this phase often precedes Bitcoin’s strongest expansion.

Bitcoin’s MVRV ratio (purple) compared to its price (black) since late 2024. Source: CryptoQuant

Long-term investors are holding onto their Bitcoin rather than cashing out, which keeps supply tighter and could fuel new demand, pushing prices up. XWIN suggests this means the current cycle isn’t over yet and could set the stage for the next big move in Bitcoin’s bull run

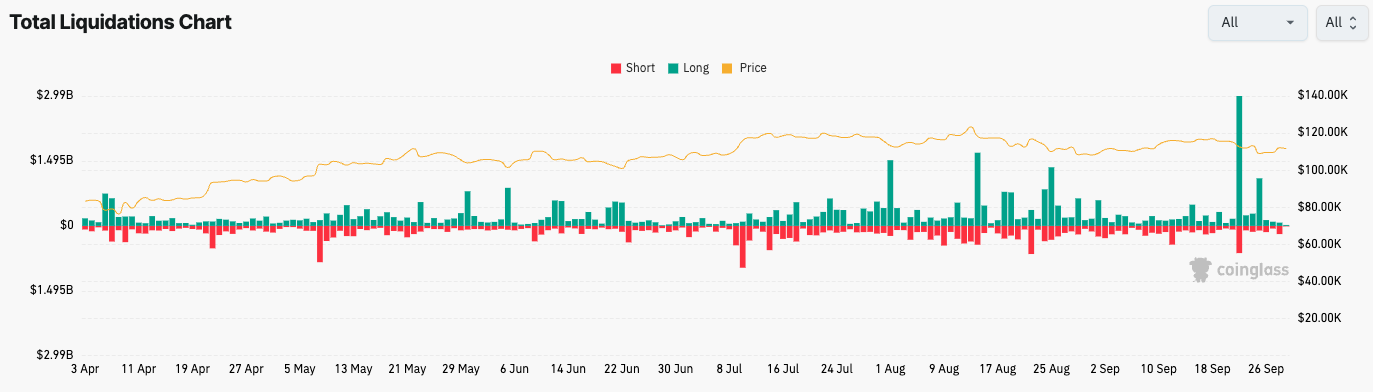

Monday’s recovery comes after more than $4 billion in crypto long positions were liquidated over the past week. The first blow came on September 22, when just under $3 billion in long positions were wiped out as Bitcoin fell below $112,000. A second wave of liquidations, totalling $1 billion, occurred on Thursday when the price dipped to $109,000.

The amount of long liquidations across the market surged on Monday, Sept. 22, and Thursday as Bitcoin fell. Source: CoinGlass

Bitcoin bore the brunt of Monday’s liquidations with $726 million in longs erased, while Ether accounted for the majority of Thursday’s losses with $413 million wiped out.

On a positive note, the Crypto Fear & Greed Index has risen to a “Neutral” reading of 50 out of 100, recovering from a period of “Fear.” This marks the first neutral sentiment since Friday, September 19, and indicates growing confidence as the market stabilizes.