Ever trusted a trading platform, only to feel scammed, stuck, and helpless afterward?

You're not alone. Every week, thousands of people, especially first-time investors, get tricked by fake trading websites. Victims experience significant financial loss and reduced trust in investment platforms.

These scams are smart. They copy real platforms, fake customer support, and even show false profits on your screen. But the moment you try to withdraw your funds, poof, they disappear.

Whether it’s crypto, forex, or stock trading, scammers are everywhere.

If you've ever thought:

“It looked so real…” or

“I wish I had checked before investing…”

This guide is for you.

In this blog, we'll break down how to verify if a trading platform is legitimate, identify red flags and warning signs, and provide simple ways to protect yourself from online trading scams.

Because your money matters. And protecting it starts with knowing what to look for before you click “deposit.”

Table of Contents

In today’s digital world, fake trading platforms are growing fast, and so are the victims. These scam websites look sleek, offer “guaranteed profits,” and even display fake testimonials or live chat support. But behind the scenes? They’re designed to steal your money.

Scammers know that many people are searching for quick ways to grow their income, especially through crypto trading, forex apps, or new investment platforms. They take advantage of this by creating websites that look just like real trading platforms, using names, logos, and even fake licenses that seem legit.

And it’s working. People are losing thousands of lives thinking they’ve found a safe place to invest. From students trying to start passive income to retirees looking for stable returns, these fake platforms don’t discriminate. They target anyone who wants to make money online.

What’s worse? Many victims don’t realize they’ve been scammed until it’s too late when withdrawals are denied, accounts are frozen, or customer support vanishes.

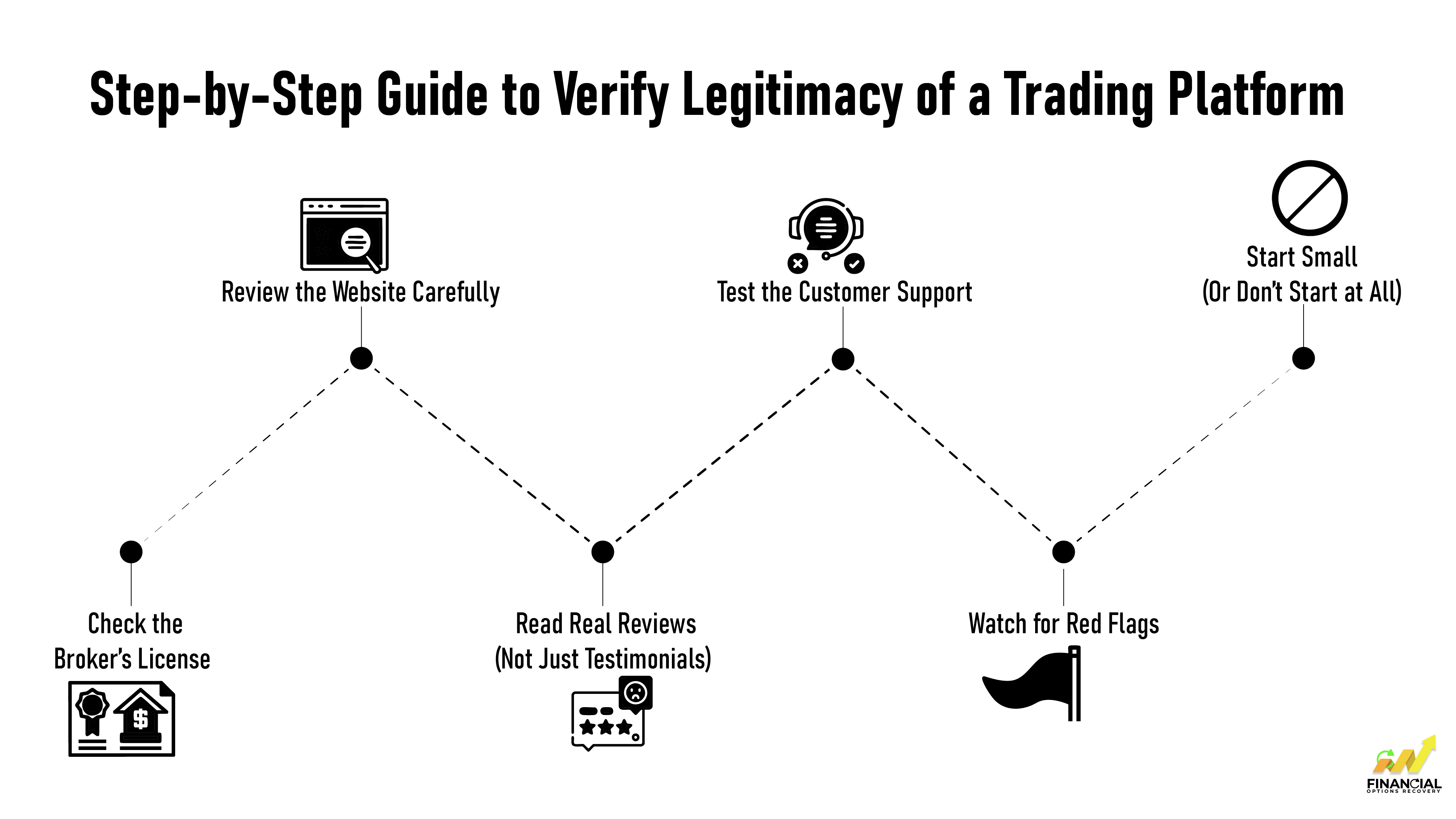

Not sure if a trading site is real or a scam? Here's how to verify trading platform legitimacy in a few easy steps:

These are all classic signs of fake trading sites.

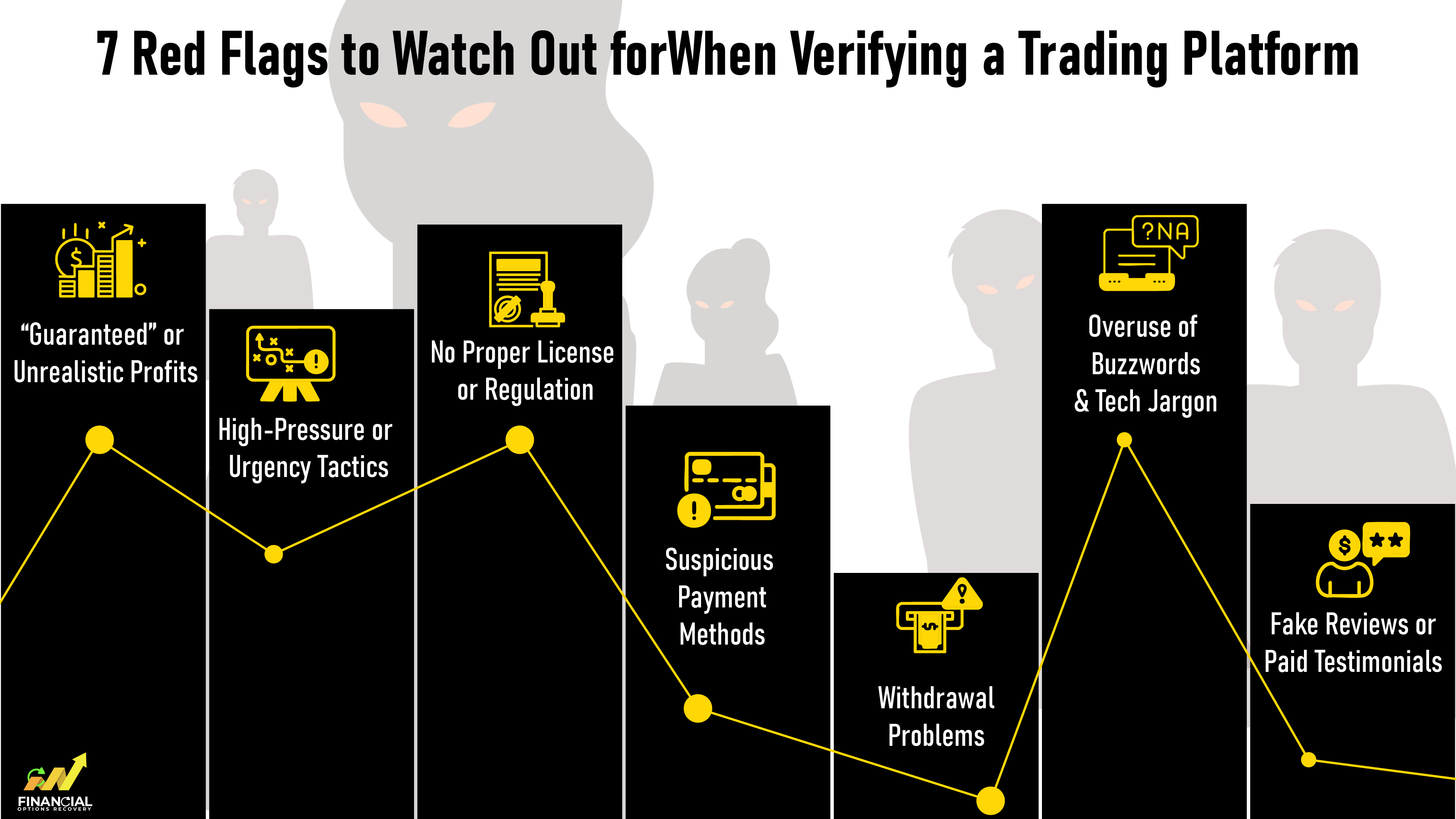

Before you invest, take a moment to scan for these common red flags in a trading platform. If even one feels off, pause. It could be a scam.

Not all trading platforms are created equal. Some are built to grow your money, others are designed to steal it. Before you invest, it's crucial to understand the key differences between a legit broker and a scam platform.

|

Feature |

Legit Trading Platform |

Scam Trading Platform |

|

Regulation Status |

Licensed and regulated by authorities (e.g. SEBI, FCA, FINRA) |

Unregulated or falsely claims regulation |

|

Transparency |

Full company details, real team, terms & policies clearly listed |

Vague or missing contact info, no legal disclosures |

|

Returns Promised |

No guaranteed profits; market risks clearly explained |

Promises fixed or high returns, “guaranteed profits” |

|

Payment Methods |

Secure, traceable methods (bank transfer, verified cards) |

Crypto-only, wire transfers, gift cards untraceable transactions |

|

Withdrawal Process |

Easy withdrawals, no hidden fees |

Withdrawals blocked, delayed, or require extra deposits |

|

Support Response |

Helpful, professional, and answers real questions |

Pushy, vague, or non-responsive after deposit |

|

Reviews & Reputation |

Verified reviews on independent platforms (e.g. Trustpilot, Reddit) |

Fake testimonials, paid reviews, or none at all |

|

Platform Appearance |

Functional UI, updated content, secure HTTPS encryption |

Flashy but buggy website, broken links, or fake dashboards |

|

Marketing Tactics |

Educates users about risk, no pressure to invest |

Uses urgency tactics: “limited-time offers,” bonuses, or countdown timers |

|

Technology Claims |

Realistic tools, regulated trading bots, if any |

Buzzwords like “AI bot,” “quantum engine,” with no proof AI investment scam |

Spotting these differences early can save you from major financial losses.

When in doubt, always research deeper. A few minutes of checking can protect your entire investment.

Feeling uneasy about a trading site? Maybe the numbers don’t add up… Or suddenly you can't withdraw your money. If your gut says something's wrong, trust it. You might be dealing with a scam trading platform, and acting quickly can make all the difference.

Here’s what you should do:

This step is key for investment fraud reporting.

If you’ve read this far, you’ve already taken an important step to protect your money and peace of mind. Most people only learn about scam platforms after losing their funds, but you’re being proactive. That’s powerful. You now know how to spot fake promises, check if a broker is regulated, and what to do if something feels off.

Here’s a bonus tip: Before signing up anywhere, type the platform’s name into Google followed by “scam” or “complaints.” It’s simple, fast, and can instantly reveal red flags.

To avoid scam platforms, stick to regulated brokers, avoid get-rich-quick claims, read third-party reviews, and always test withdrawals with a small amount first. If something feels too good to be true, trust your gut and walk away.

Lost money to a fake trading platform? Act fast, reach out to our trusted scam recovery specialists, and start your path to getting your money back.

Report it to your country’s financial regulator, the cybercrime portal, and global scam databases like Scamwatch. This creates a record and could help stop others from being scammed.

Not always. Many scam brokers operate only through apps to avoid scrutiny. Make sure the app is from a verified source, connected to a licensed company, and listed on Google Play or the App Store not sideloaded.

Unfortunately, yes. Always cross-check any license number or certificate on the official regulator’s website. Look for official logos and verify the company’s legal name and address. If something doesn’t match, it’s likely fake.

Payment methods like credit cards and bank transfers are safer because they are traceable and offer fraud protection. Avoid platforms that demand only cryptocurrency or untraceable payments, as these increase the risk of losing funds.

No, scammers often use fake or paid celebrity endorsements on social media. Always verify claims independently and never invest based solely on social media ads.