Have you ever received a message promising guaranteed high returns with little to no risk? Or maybe you saw a flashy ad for a new crypto or stock opportunity that seemed “too good to miss”?

Welcome to the risky world of investment scams, where scammers use charm, urgency, and fake success stories to trick people out of their hard-earned money.

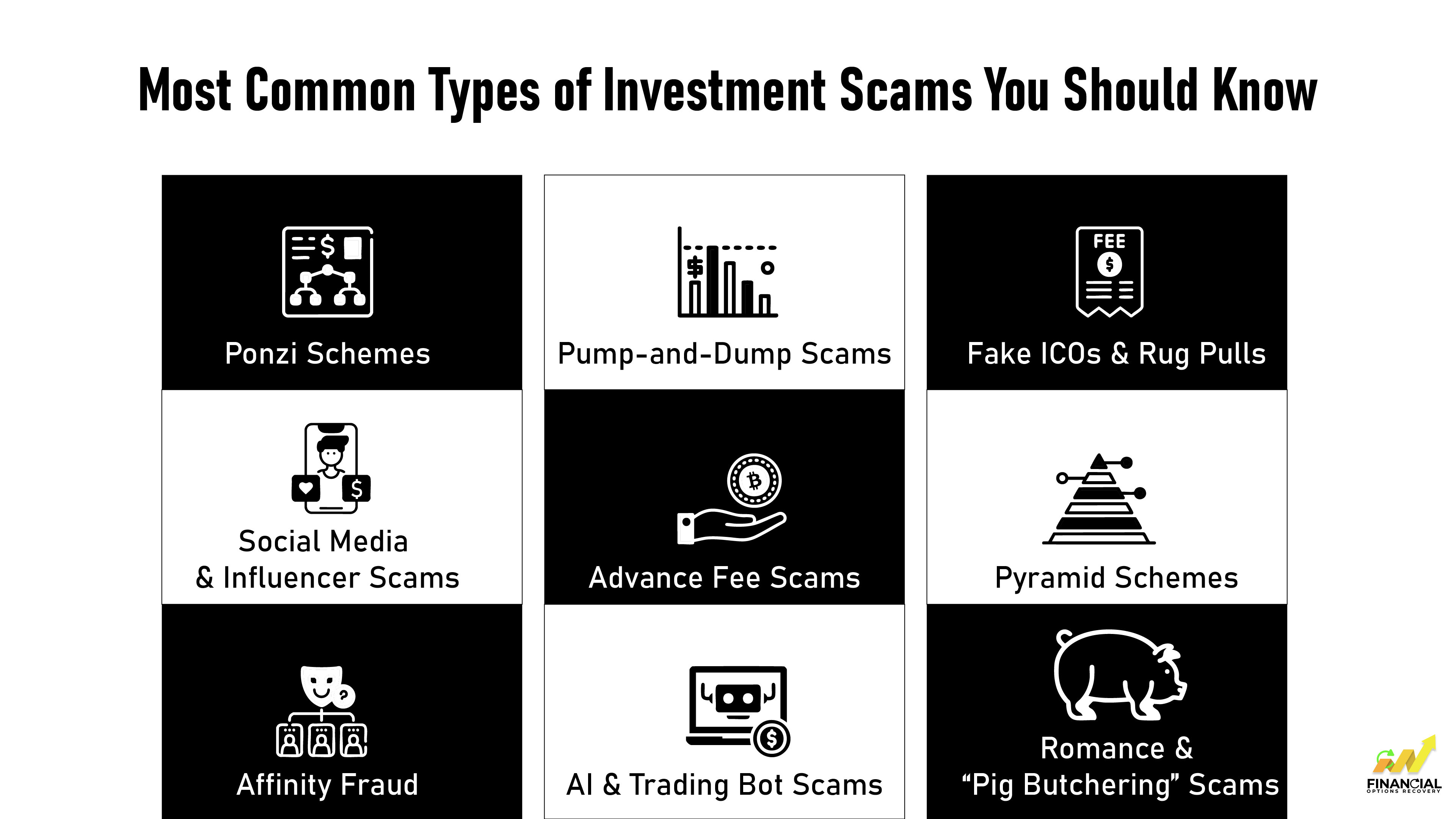

Moreover, these scams come in many forms: Ponzi schemes, fake trading platforms, crypto rug pulls, and even phony real estate deals.

In 2024, Americans reported losing $5.7 billion to investment scams, a 24% increase from 2023, according to the Federal Trade Commission (FTC).

And the damage isn’t just financial; victims often face emotional stress, anxiety, depression, and a lasting loss of trust in financial systems. Some even avoid investing altogether after being burned.

In this guide, you’ll learn the most common types of investment scams, their red flags, and how to avoid them, and also ways to recover lost funds.

Table of Contents

An investment scam is a deceptive scheme where fraudsters lure people into putting their money into fake or misleading financial opportunities, promising unrealistically high returns with little to no risk.

These scams come in many forms, from crypto Ponzi schemes and forex trading frauds to social media influencers promoting fake tokens or phishing links that mimic legitimate broker platforms.

You’ll often see these scams advertised as

Scammers frequently impersonate

And they operate across all channels:

Instagram, Telegram, Discord, YouTube, and even fake apps or clone websites.

Their goal is simple: build fake trust, take your money, then vanish. Most use anonymous crypto wallets, fake testimonials, and professionally designed materials to appear legitimate.

Investment scams aren’t random; they follow a calculated strategy designed to trick you step by step. Here’s how most scams unfold:

|

Real Investment |

Investment Scam |

|

Registered and regulated by authorities |

Operates without licenses or disclosure |

|

Offers realistic ROI over time |

Promises high, fast, risk-free returns |

|

Transparent about risks and track record |

Vague about strategy and founders |

|

Uses real contacts, websites, and business records |

Uses fake identities, domains, and testimonials |

|

Encourages questions and legal documentation |

Pushes urgency and discourages due diligence |

Pro Tip: A legitimate investment never pressures you to act now or send crypto upfront. If they say “limited slots” or “only today,” it’s likely a scam.

Scammers develop every day and discover new ways to make good use of your trust and steal your wallet. Whether the scammers are shady influencers, fake crypto tokens, or sweet-talking strangers, they don't only think of clever ways of stealing your money; they are also into emotional manipulation.

Here are 9 of the most common (and dangerous) types of investment scams in 2025 that you need to recognize fast and avoid even faster.

These are the most popular types of investment fraud. Scammers promise huge, consistent returns but pay early investors using money from new ones. There's no actual profit being made, just a house of cards waiting to collapse.

Example: BitConnect promised 1% daily returns. The token tanked overnight. Billions were lost.

Watch for: Unrealistically consistent returns, no clear explanation of how profits are generated, and referral bonuses.

Here, bad actors buy up a worthless token, hype it on Twitter or Telegram, and wait for retail investors to FOMO in. Once the price spikes, they sell, leaving others holding the bag.

Example: “Moon Token” was promoted across Reddit and Discord, then dumped overnight with a 90% loss in 24 hours.

Watch for: Anonymous team, huge social buzz but no product, and sudden price spikes.

Scammers launch flashy crypto projects, raise millions via “token sales,” then disappear without delivering anything. Often disguised with fancy whitepapers, buzzwords, and fake partnerships.

Example: The “Squid Game Token” soared 75,000%, then its creators vanished, taking $3 million.

Watch for: No working product, no third-party audit, and anonymous founders.

Impersonators clone celebrity accounts or create fake livestreams promising crypto giveaways or “insider tips.” You send crypto to “verify” your wallet and never get it back.

Example: Elon Musk giveaway scams on Twitter/X have tricked users out of millions. Read our in-depth guide on social media investment frauds to know how these work.

Watch for: “Send 1 ETH to get 2 ETH back,” unverified links, and fake blue checkmarks.

You're promised a loan, investment profit, or trading bonus but must first pay a tax, processing fee, or withdrawal charge. Once you pay, the scammer vanishes.

Example: Victims of fake “Crypto Trading Platforms” report losing thousands after paying endless withdrawal fees.

Watch for: Multiple fee requests, urgency, poor grammar, and lack of official support.

You make money not by investing but by recruiting others to do the same. It’s all about building downlines, not profits. Eventually, the scheme collapses under its own weight.

Example: “Forsage” promised ETH earnings via smart contracts. Turned out to be a glorified pyramid scheme.

Watch for: No real product or service, earnings based on recruitment, and vague ROI claims.

Scammers infiltrate communities, religious groups, cultural clubs, and even online forums and exploit trust to sell fake investment schemes.

Example: A pastor convinced his congregation to invest in a “faith-backed real estate fund.” It was fake.

Watch for: Unverified investment pitches from someone in your circle, lack of transparency, and emotional persuasion.

They claim their “AI-powered bot” guarantees daily profits just by depositing crypto and watching the magic. In reality, it’s a fake dashboard, and your money goes straight to the scammer.

Example: Dozens of YouTube ads promoted “Quantum AI,” a scam falsely linked to Elon Musk.

Watch for: Fake testimonials, no verifiable trading history, and high-pressure signup tactics.

These long cons typically start on a dating app or social media. After the scammer has established an emotional connection, the scammer introduces a fraudulent investment platform, usually with a fake app or exchange.

Example: The $1.3 billion loss to romance-based investment fraud victims in 2023 in the US alone. For a deep dive into how these work and how to escape them, see our experts insights into crypto pig butchering scams.

Watch for: Emotional manipulation + request for money and investment advice from someone you have never met in real life.

Even the flashiest investment opportunity can be a total fraud. Here’s a quick-reference table of the most common red flags to help you spot a scam before it drains your wallet:

|

Red Flag |

What It Really Means |

|

Guaranteed High Returns |

No legit investment guarantees profits. High, risk-free returns are a common scam tactic. |

|

Unregistered or Unregulated Platforms |

Check for regulatory licenses (e.g., SEC, FCA, or MAS). Scam platforms often skip this step. |

|

Pressure to Act Quickly (Urgency) |

“Limited time only” or countdown clocks are used to rush your decision. |

|

Upfront Payments or Fees Required |

Real platforms don't ask for payment before services. Never pay to “unlock” profits. |

|

Anonymous or Fake Team Profiles |

Scammers use fake photos, names, or LinkedIn accounts to look credible. |

|

No Physical Address or Contact Support |

A missing address, fake customer support, or only a Telegram contact is a major red flag. |

|

Too Slick or Flashy Website Design |

Over-polished sites with no verifiable backend often hide fake projects. |

|

Fake Endorsements by Celebrities |

Scammers misuse names like Elon Musk or MrBeast to appear legit; always double-check. |

|

Unrealistic Whitepapers or Buzzwords |

“AI-backed,” “blockchain-secured,” or “quantum algorithm” with no clear use case |

|

Lack of Transparency About Investment Model |

If you don’t understand how it works or they avoid explaining, it’s a trap. |

|

No Way to Withdraw Funds |

If you can deposit easily but withdrawing requires extra fees, it’s likely a scam. |

|

Romantic or Emotional Pressure |

In romance scams, they gain emotional trust first, then ask you to invest. |

Want to protect your money from fraud? Follow these quick tips:

First things first: don’t panic; you’re not alone. Scams can happen to anyone, and there are real steps you can take to start recovering.

Cut ties with the scammer immediately. Block them on all platforms: email, Telegram, WhatsApp, or wherever they contacted you.

Take screenshots of messages, wallet addresses, transaction receipts, social media accounts, emails, and anything that shows what happened. This will help with investigations and recovery efforts.

Reporting helps others and increases your chances of recovery. Use these trusted sources:

If you sent money via wire transfer, crypto exchange, or credit card, report it immediately. Some banks and platforms may help freeze or trace funds, but timing is critical.

Work with platforms that are transparent, reliable, trusted and have real reviews like Financial Options Recovery, which specializes in investment scam recovery with personalized and ethical support.

Let’s face it, no one expects to fall for a crypto scam or a fake investment pitch. But these scams are designed to fool even the smartest people. If you’ve been scammed, remember this: you are not to blame.

What truly matters is what you do next. By reading this guide, you’ve learned how to:

That makes you smarter and more prepared than most. The first step to protecting your money is awareness, and you have already taken that first step. You can now take the knowledge you've gained to help another individual avoid the same mistake, it could be a friend, family member, or even a stranger scrolling on social media.

Consult professional and legitimate investment scam recovery experts todayand let us help you navigate the path to recovery with confidence and care.

Always verify links and profiles independently. Legitimate giveaways never ask you to send crypto first. Use official channels to confirm promotions. Enable two-factor authentication and avoid sharing sensitive wallet information.

Not always, but those tactics are often used in scams. Flash doesn’t mean safe. Verify everything: the domain age, team credentials, company registration, and whether real people are behind it. Don’t be blinded by design.

Yes, and they do. AI-driven bots can simulate live trades, generate fake profits, and even chat with you like a real advisor. If you can’t trace the platform or withdraw your money easily, it’s time to walk away.

Yes. Scammers exploit poorly coded smart contracts to steal funds, lock investors out, or execute rug pulls. Due diligence, including third-party audits and code reviews, is crucial before investing in DeFi or ICO projects.

Crypto giveaway scams often serve as entry points for larger investment fraud, tricking victims into sending funds to “verify” wallets or participate in fake promotions, which then lead to more complex Ponzi or phishing schemes.