Social media has become a new digital platform where people are pulled into numerous scams, with most of these scams involving investment fraud or social media investment scams. As most social media frauds attract people into investing in something worthless, con artists have a specific target audience, and for investment scams, they tend to target an older age group.

In the past two decades, social media has evolved and revolutionized the way people connect. Social media helps people connect with loved ones, learn about new things, learn new languages, or get new jobs. It has opened a new door of opportunities, but it also has many disadvantages, as it has allowed many scammers to take advantage of the technology and find new ways to loot people.

Since 2021, scams originating on social media platforms have accounted for $2.7 billion in reported losses, more than any other contact method.

Scammers have increased their activity on social media to dupe people by impersonating any company or personality. Nowadays, social media is all about influencers, and people are defrauded in the name of famous influencers. Social media helps scammers reach a wider audience. And people are falling victim to a variety of scams and losing their lost funds.

As it is not easy to eradicate scammers from social media and immediately stop them, social media platforms are enhancing their security and screening processes to decrease the number of scams on social media.

In this blog, you'll learn how these scams work, the red flags to watch for, and how to protect yourself or take action if you've been targeted, and also recover your funds.

Table of Contents

Social media investment scams occurred due to heavy advertising and people getting engaged in these scams and following the con artists' instructions. The scammers have a greater advantage because it is quite difficult to track any scammer on social media. After all, they can open multiple accounts, impersonate some celebrities, or create a fake profile and publish their campaign until someone reports it.

Social media is the easiest, cheapest, and quickest way to reach a larger audience at once. That’s the reason for the increase in the rate of social media investment scams. Social media is vast and has multiple platforms, with Facebook leading the scamming market as people in the older age group tend to use Facebook more. We often hear about facebook investment scams, and people who are retired or have savings for their future are being looted.

Many people think they are smart and can’t be defrauded or scammed, but it's all a myth. Scammers get in contact with their victims easily and build a strong connection. Let’s understand how social media investors are scammed.

In social media investment scams, the con artist entices people by promising them high and quick returns by investing in their project or where their advice. They make people fall for their trap by using multiple tactics. If the investor gets alerted about the scam, they try to use high-pressure sales tactics so investors don’t have much time to think.

With such tactics, the con artist makes the investor make hasty investment decisions. After the investment is made, the scammer becomes unresponsive and disappears. Attract investors with fake posts, testimonials, or endorsements. To get more attention, they make fake profiles of famous influencers or celebrities.

Social media platforms have become a hunting ground for scammers who know exactly how to exploit trust, appearance, and algorithms. These scams often follow a predictable pattern, but when it’s happening to you, it feels anything but obvious.

Here’s a step-by-step look at how these scams usually unfold:

It often starts with a friendly message on Instagram, Facebook, TikTok, or WhatsApp.

The scammer might pose as:

They appear legitimate with attractive profile photos, mutual followers, and posts that show “success.”

Once contact is made, the scammer will quickly shift to promoting an opportunity:

“I made $10K in 2 weeks with this platform. Want me to show you how?”

They may offer:

Scammers take time to build credibility. You’ll see:

You’re reassured constantly: “Others are doing this too,” or “It’s totally safe; I’ll walk you through it.”

They ask you to:

You might even see a small early “profit” to build trust. This is part of the trap.

When you try to withdraw:

Victims are often left shocked, embarrassed, and financially devastated.

But remember: You’re not alone, and it’s not your fault. These scams are expertly engineered to deceive even the smartest investors.

There are many other scams going on on social media, and many people are not aware of such scams, as con artists target older adults, as they have more savings. Let’s see more of these common investment scams.

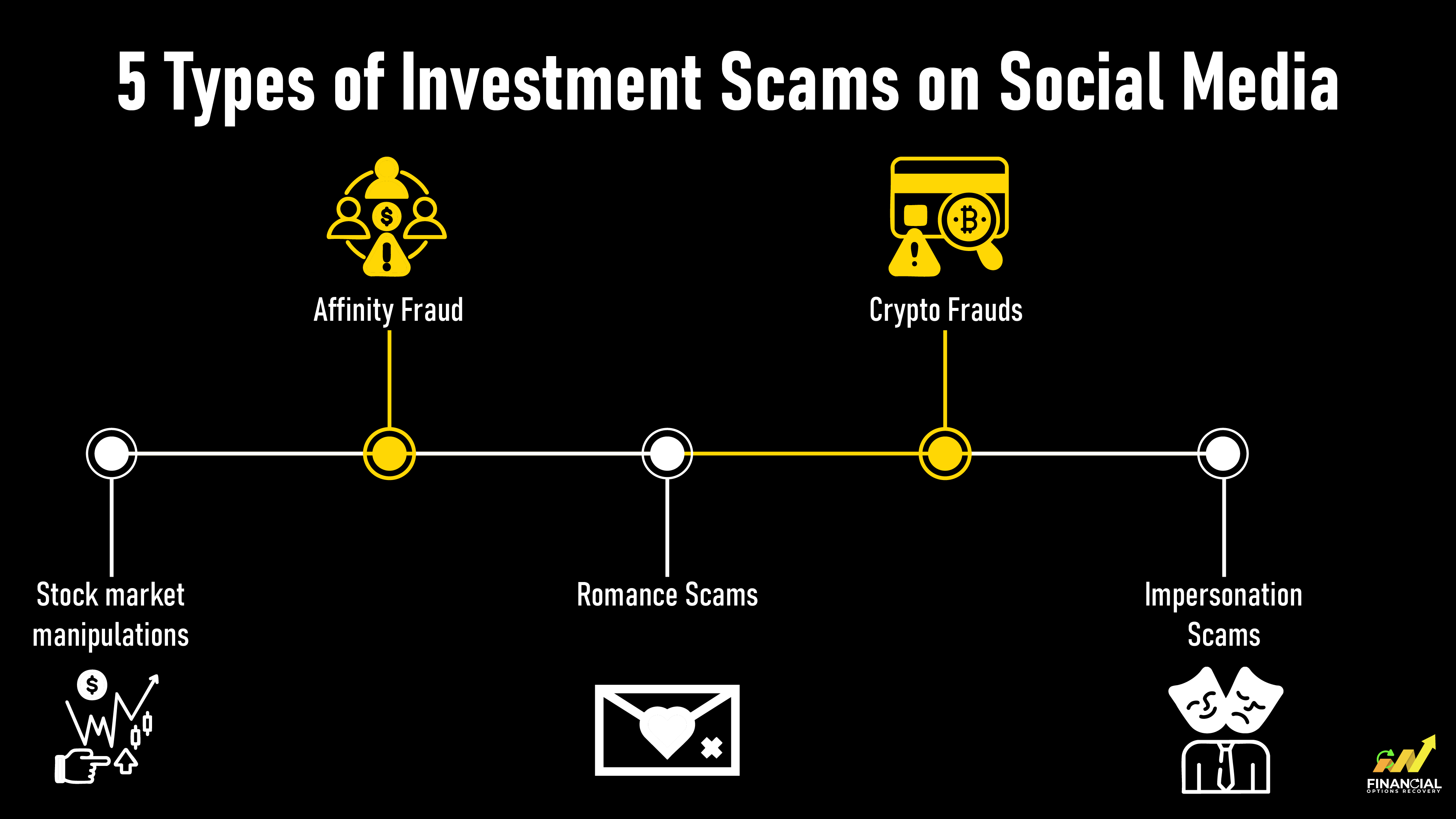

Apart from the common social media investment scams, most of us are aware of scams that are spreading like wildfire on social media but are not in the limelight. Let's take a look at some of the different types of social media investment scams.

Stock market manipulations were practiced before digitization was implemented in the world, and the 1990s were famous for share market scammers. After the digital world was introduced, con artists had the advantage of reaching a larger audience with minimal effort.

Con artists spread rumors and fake news on social media with paid promotion or by making fake accounts. You can also see paid posts in the form of memes, spreading news all over the platform so more people can invest in particular stocks. They try to manipulate stocks both negatively and positively.

Along with scalping and touting, which are two other scams perpetrated by con artists, pump and dump is one of the oldest and most widespread stock trading scams ever.

After stock market fraudsters, we have scammers who practice affinity fraud to target people who follow specific groups, like religious groups or ethnic communities. As these scams happen in groups, maybe not many outsiders are aware of them. In affinity fraud, a fraudster pretends to be a member of a group and convinces the leader of the group about the scheme.

They try to involve every individual in the group in the scheme or get the funds from the group. As everything is happening inside the group, the relationships are exploited, and until everyone becomes aware of the scam, the fraudsters flee with the funds.

Romance scams are one of the most reported scams, after investment scams. Firstly, you should understand what romance scams are. In romance scams, con artists generally target people of old age, widows, or people who are alone. They show love and affection and pretend to be falling for them. Con artists try to build a relationship and gain their trust to get all the personal information.

As scammers dupe people on social media, they try to avoid meeting physically or attending any video calls, as they dupe people of both genders. By gaining their trust, scammers try to ask for some money as they are stuck in an emergency situation or try to convince the victim to invest. As the fraudster makes some good money, they become unresponsive and disappear from all social media platforms.

Crypto investment scams are quite famous on social media. The crypto industry is only a decade old, and because of its decentralized nature, it is quite vulnerable to scams. As scammers try to promote their platform so people can make more money, there will be little to no risk.

Schemes like this are direct indications of fraud; there is no way in the crypto industry where people can invest and get higher returns with little to no risk. To promote their schemes, scammers heavily market on social media, making people fancy their chances for once.

Impersonation scams are one of the biggest ongoing scams on social media. Scammers impersonate a firm or an individual who is popular on the social media platform and try to promote their schemes or ask for money.

Scammers generally pretend to be a brokerage firm, direct investors to a fake website, and make them invest in their scheme. To safeguard yourself from such schemes, always verify the details or avoid getting involved in them.

Scammers follow patterns. Once you know the signs, you’re far less likely to fall for them. Here are the most common red flags and how to respond before it’s too late.

|

Red Flag |

What It Really Means |

How to Respond |

|

“Guaranteed” crypto returns |

No legitimate investment can promise profits |

Walk away, real returns are never promised |

|

DMs from strangers offering investments |

Classic scam opener used to build false trust |

Ignore or block unsolicited offers |

| Profile looks perfect, but feels off |

Could be a fake or stolen identity |

Reverse-image search their photos |

|

Asks you to move to WhatsApp or Telegram |

A way to avoid platform oversight and hide fraud |

Stay on the platform or stop communication |

|

Claims to “mentor” you for free |

They’re prepping you to deposit money |

Ask, “What’s in it for them?” |

|

Asks for upfront crypto payment |

There’s no recovery once it's sent |

Never send crypto to people you don’t know |

|

Offers a “special link” to a trading app |

These are often fake platforms that simulate profits |

Research the domain and check reviews & forums |

|

You see fake testimonials or screenshots |

Scammers often fabricate success stories |

Don’t trust screenshots, verify independently |

Pro Tip:

If someone pushes urgency, “Act now or miss out!” That’s almost always a scammer’s script.

Meet Sarah, a 32-year-old teacher who uses Instagram to follow finance influencers and crypto news. One day, she receives a friendly DM from someone claiming to be a successful crypto investor. His profile looks legit; it has sleek posts, hundreds of followers, and glowing testimonials in the comments.

Scammer: “Hey Sarah! I noticed you’re into crypto. I help beginners make passive income with a safe trading platform. Want me to show you how I turned $500 into $10,000 in a week?”

Intrigued, Sarah asks for more details. The scammer shares screenshots of “proof,” a link to a professional-looking trading website, and even offers a free tutorial. It feels real. The site shows fake live charts, account balances, and a “support chat” with fast replies.

Sarah invests $500. Within days, she sees her balance grow to $2,000. She’s excited; she tells friends and considers adding more.

But when she tries to withdraw her earnings, the platform says:

“To complete the withdrawal, please deposit a $200 unlock fee.”

She hesitates. The scammer reassures her:

“Don’t worry, it’s just a temporary hold. I had to do it too. Standard procedure.”

Trusting him, she pays the fee. But soon, she's told she must pay additional “taxes” or “anti-money laundering” charges. Her account gets locked, the scammer disappears, and the platform vanishes.

Total loss: $1,200

No real company. No way to get it back.

For real examples of how victims were scammed and recovered, see our Social Media Scam Case Studies.

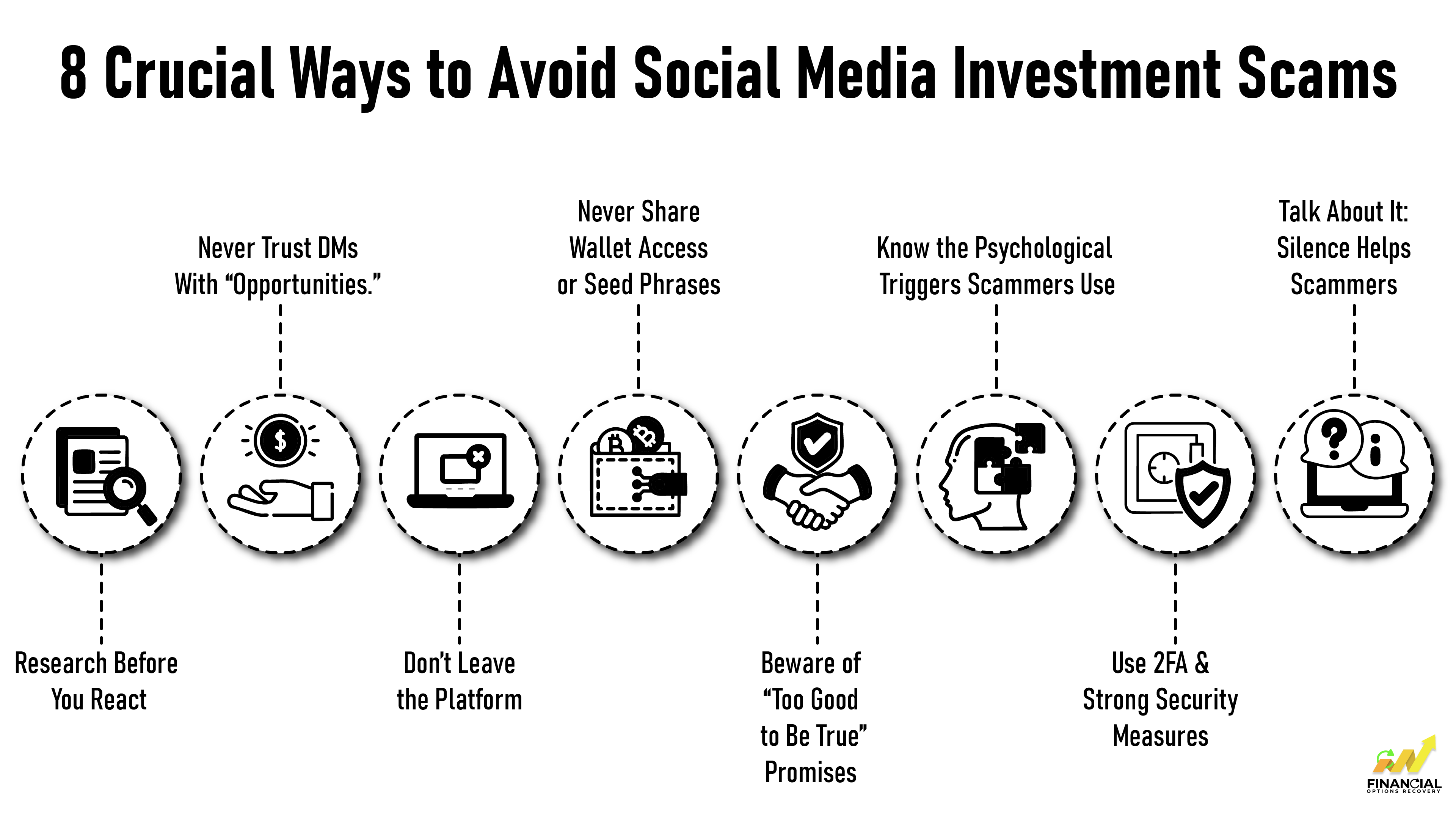

Avoiding social media investment scams isn’t just about being cautious; it’s about being informed, proactive, and alert to the tactics fraudsters use. Here’s how you can protect yourself and others:

Before trusting any investment opportunity, vet the person, platform, or project.

If it’s hard to find clear, independent information, that’s a red flag.

Scammers often reach out via private messages offering “once-in-a-lifetime” crypto deals, mentorships, or passive income.

Trust builds over time, not through a single message from a stranger.

Scammers usually try to move the conversation to WhatsApp, Telegram, or Signal, where they can’t be tracked or reported as easily.

Legitimate platforms and people will never ask for your private key, seed phrase, or full wallet access.

Think of your seed phrase like your bank’s vault key; never hand it out.

Scammers love to say things like

Investments always carry risk. If it sounds too perfect, it’s a setup.

Scammers often manipulate emotions:

Stay grounded. Take a step back before making decisions.

Enable two-factor authentication on your social media and trading accounts.

Your digital security is the first line of defense.

Scams thrive in silence.

Even if you're unsure, a second opinion could save you thousands.

To conclude this article, social media is an excellent technology where people can connect in no time, but fraudsters have the same advantage of exploiting the technology. Keep an eye out for such scams and try to avoid participating in them, especially on social media, where they are more likely to occur.

By understanding how social media investment scams operate and learning to spot the red flags, you’re already a step ahead of the scammers. This knowledge empowers you to protect your hard-earned money, avoid heartbreak, and help others stay safe too.

If you or someone you know has been targeted or lost funds, don’t wait; reach out to a reliable fraud recovery service now for a confidential consultation.

Yes. Scammers can hack or buy verified accounts to appear trustworthy. Even if someone has a blue checkmark, you should verify their claims and never send money based on status alone.

Absolutely. Even a small transaction helps trace scam patterns and wallet activity. Reporting also protects others and could support a recovery claim if part of a larger case.

Avoid tipping them off. Don’t accuse them or get emotional in chat; just stop engaging, take screenshots, and report/block. Scammers often escalate if they sense you're catching on.

Yes. Some advanced scammers now use AI-generated influencer videos, deepfake testimonials, or even AI voice clones to make fake Zoom calls or pitch investments.

Yes. Scammers harvest your publicly available info (photos, job, interests) to craft personalized pitches or impersonate you to scam your contacts. Always review your privacy settings and limit what’s public.