Ever had someone message you saying you could turn $500 into $5,000 just by copying a few trades? If yes, you’ve already come face-to-face with the world of Forex Scams, and trust us, you’re not the only one. These scams are spreading quickly online, especially on social media, where exaggerated profit claims and fake success stories mislead people into risky financial traps.

Behind every promising screenshot of sky-high returns is a well-maintained scrapbook of fake brokers, high-pressure “signal groups,” and bogus trading bots. One FTC lawsuit even revealed a single forex-education MLM that siphoned $1.2 billion from hopeful traders, proof that the scammer’s pitch is now louder and slicker than ever.

In this article, we’ll walk you through how forex scams work, the different types you should watch out for, and how to spot the warning signs early. Whether you’re curious about forex trading or already considering an investment, this guide will help you stay informed and safe.

Table of Contents

A Forex scam is a trick used to steal your money by pretending it’s going into real currency trading. These scams often promise big profits with little effort, but behind the scenes, there's no real trading happening, just clever lies. It’s not just about fake platforms or fake brokers; forex fraud today can show up as Instagram traders promising mentorship, flashy apps with fabricated profits, or “experts” selling signals that go nowhere. Many of these methods overlap with common social media scams, making them harder to spot.

What makes these scams so dangerous is how real they look. Some copy the branding of legitimate firms. Others use social proof like fake reviews, paid testimonials, or edited screenshots of trading success to build trust fast. And once they have your attention, they hit you with promises: Quick profits. No experience needed. Guaranteed returns.

But let’s get one thing straight: there’s no such thing as guaranteed success in forex trading. The real foreign exchange market is legal, volatile, and complex. It's where global currencies are bought and sold, often by large financial institutions, hedge funds, and experienced traders who understand the risks.

Forex scams, on the other hand, are built on illusions. Whether it's a "limited-time" investment offer, a flashy trading course, or a fake platform showing made-up profits, the end goal is the same: get your trust, take your money, and vanish.

Because they sound like the perfect way to make quick money.

The forex market is huge; over $7 trillion is traded every day. It carries an aura of excitement and fast money. For newcomers looking to escape financial stress or earn a little extra on the side, it sounds like the perfect opportunity. These huge numbers make it seem like there’s a lot of money to be made, and scammers use that to grab your attention by using tempting messages like:

“I made $10,000 in two weeks; join my trading group!” “This platform changed my life. You can start with just $250!”

These messages often come with fake screenshots, reviews, or even fake success stories. If not careful, it’s easy to believe them.

That’s why learning how forex scams work is your best protection. The more you know, the harder it is for someone to fool you.

Forex scams come in many forms. Some are easy to spot, while others are made to look very real. But all of them have one thing in common: they are designed to steal your money. Here are the most common types of forex scams you should know about:

Scammers posing as legitimate forex brokers are a growing threat. They often set up professional-looking websites and offer convincing customer support to win your trust. But once you’ve deposited your funds, the red flags begin, sudden withdrawal issues, hidden fees, or complete silence. These brokers are typically unregulated and operate outside the law. To understand how these forex broker scams work and what to watch out for, check outthis detailed blog post on common forex broker scams.

Some trading platforms may look legitimate, but they operate without any regulatory oversight. These platforms often lure users in by displaying fake profits and fabricated trading dashboards to build false confidence. The real trouble begins when you try to withdraw your money, they either block your account or demand unexpected fees. In many cases, there’s no actual trading taking place at all. Learn how to spot and verify a platform’s legitimacy in this guide on checking if a trading platform is real.

Some scams promise steady returns once you invest money or refer others to join. They may call it a “forex program,” but in truth, it’s just a scam that uses money from new investors to pay older ones. These schemes collapse quickly, and most people lose their entire investment.

Signal sellers offer paid advice on when to buy or sell in forex trading. They promise high success rates but rarely deliver. Many of these sellers give poor-quality or random advice. In the end, you lose money on trades and the signals themselves.

On platforms like Instagram, Facebook, and Telegram, many scammers present themselves as successful forex traders or financial influencers. They flood their profiles with luxury photos, fake profit screenshots, and glowing testimonials to appear credible. Once you reach out, they’ll offer to manage your forex account or trade on your behalf, but it’s all a setup. After you send them money, they either vanish or pressure you for more. To dive deeper into how these managed account scams work, readthis article on fake forex account managers.

These scams center around automated trading software often marketed as “forex robots” or Expert Advisors (EAs), which promise guaranteed profits with zero effort. Slick sales pages showcase fake performance stats, glowing reviews, and unrealistic returns to lure you in. But behind the scenes, most of these bots either don’t work, are programmed to lose after a few small wins, or come loaded with hidden fees. Some may even compromise your data. If you’re considering one, take a step back and readthis article on forex robot scams to understand the risks.

Eddy Alexandre, a New York-based CEO of a company called EminiFX, promised people huge returns from forex and crypto trading, up to 5% every week. Over 25,000 people trusted him with their money, thinking it was a smart investment. In reality, it was all a lie.

Instead of investing the $240 million he raised, he used much of it on himself, buying luxury cars and paying for personal expenses. The trading “technology” he claimed to use didn’t exist. It was one of the largest forex-related scams in the U.S., and in 2023, Alexandre was sentenced to 9 years in prison.

Read the full case report here

This case shows how even smart, everyday people can be tricked by slick promises and fake platforms. The biggest red flag? Guaranteed high returns. That alone should’ve been a warning.

The takeaways from this case:

Stories like the one above are not rare, and that’s exactly why it’s so important to know how to spot the warning signs before it’s too late. In fact, not all scams involve fake trading platforms, some hide behind personal mentorship offers and social proof. For another example, see our forex mentorship scam recovery case study and how one victim fought back.

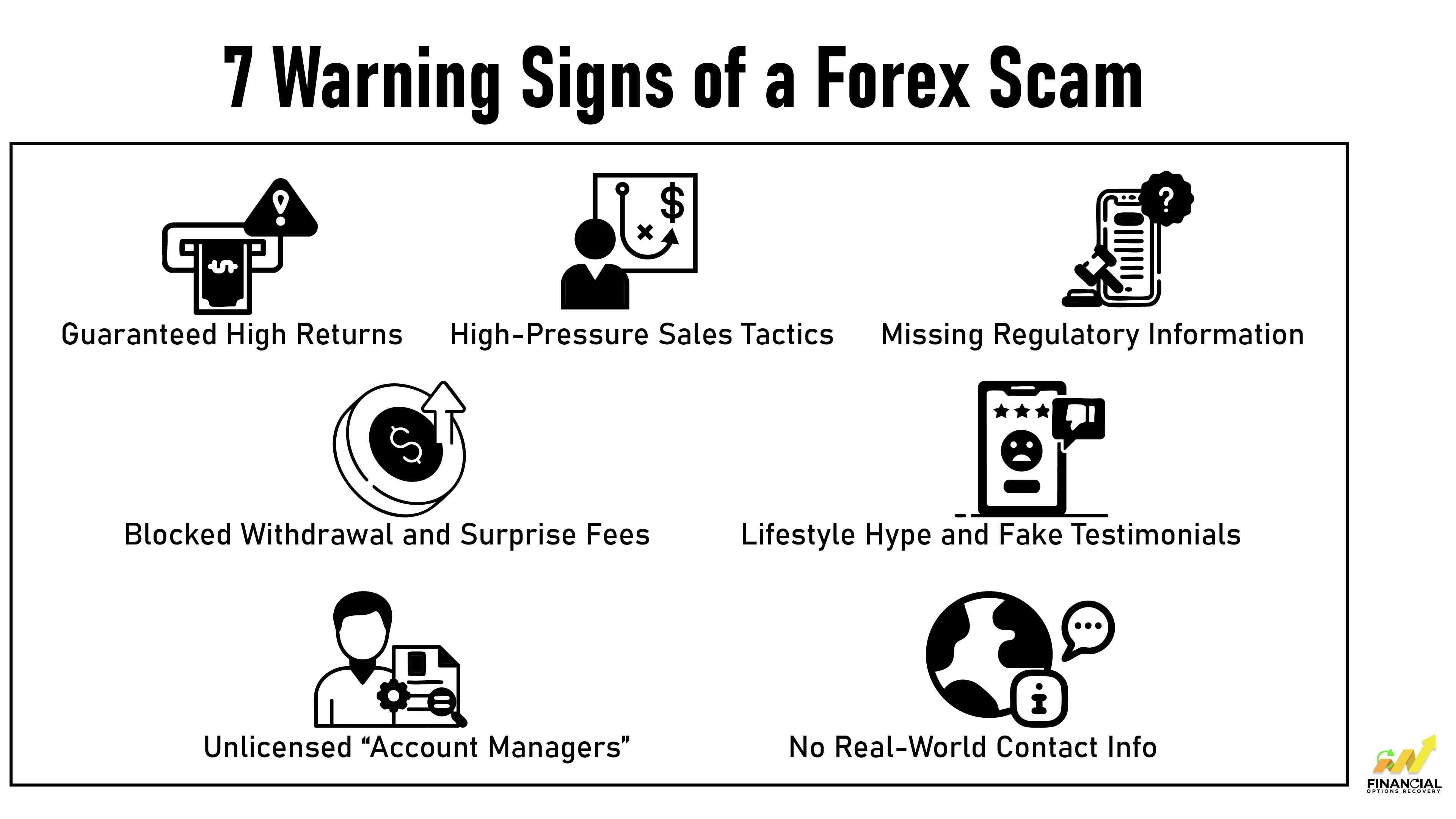

Scammers present their schemes with the same polished image you’d expect from real brokers, professional websites, eye-catching social media photos, and persuasive “traders” flaunting unrealistic gains. The good news? Once you know the warning signs, you can see past the surface and protect your money.

If someone promises 5 % a week or a guaranteed double in 30 days, walk away. Legitimate forex trading involves risk; even seasoned professionals can’t lock in fixed profits. A guarantee in a market that moves every second simply doesn’t add up.

Scammers thrive on urgency: “Limited-time bonus!” or “Last chance to join our exclusive group!” The rush is designed to keep you from doing basic homework. A real broker will give you space to think, compare, and verify.

Reputable U.S. forex brokers register with bodies like the CFTC or NFA, and you can confirm that in minutes on the regulators’ sites. If the firm dodges questions about licensing or claims “offshore status,” consider that a flashing red light.

The surprise processing charges, sudden tax bills, or long delays when you try to cash out are hallmarks of a scam platform. Genuine brokers publish clear fee schedules and never hold your money hostage.

Be cautious of feeds filled with luxury cars, beach selfies, and screenshots of skyrocketing balances. Scammers buy stock photos, recycle the same glowing reviews, and deploy bot accounts to create the illusion of success.

A friendly voice on Telegram offering to “trade for you” might feel reassuring, until they disappear with your deposit. Unless the manager holds recognized credentials and works for a regulated firm, keep control of your account.

Legitimate financial companies list an office address, phone number, and professional email support. When the only contact options are WhatsApp or a private chat room, you’re not dealing with a transparent business.

You don’t need to check every box to walk away, one warning sign is enough to hit pause and dig deeper. Remember, scammers rely on confusion and emotion to cloud your judgment. Slow down, verify the details, and keep your hard-earned money where it belongs.

Scammers are smart. They study human behavior and know how to make their offer look trustworthy. They don’t just go after people who are greedy or careless, they often target those who are simply looking to grow their savings or recover from financial hardship.

Here’s how it typically works and how you can protect yourself.

Scammers don’t just get lucky. They know exactly who they’re looking for and how to win your trust. Most people who fall for forex scams aren’t careless or greedy. They're often just trying to grow their savings, recover from a loss, or get ahead financially.

That’s exactly what these scammers prey on.

They show up on social media, in flashy ads, or even your inbox, posing as successful traders or friendly “mentors.” You'll see luxury cars, screenshots of profits, and promises of easy money. They make it all look so real.

Sometimes they let you earn a little in the beginning, just enough to gain your trust, to boost your confidence. But once you’re in, they start pushing. They’ll say Act fast, you’ll miss out, or just a little more and you can withdraw. That pressure is part of the trap.

Scammers build trust quickly and break it even faster. And by the time you realize what’s happening, it’s often too late.

Now that you know how they work, here’s how you can stay ahead of them and protect both your money and your peace of mind.

By understanding how scammers work and following these steps, you put yourself in control. The best defense against forex scams is staying informed and cautious. Remember, it’s okay to ask questions and take your time before investing.

When you're stepping into forex trading, choosing the right platform can make all the difference between smart investing and falling into a trap. A legitimate forex platform isn’t just about professional design or big promises; it’s about trust, transparency, and proper regulation.

Real platforms are registered with recognized financial authorities like the CFTC in the U.S., FCA in the UK, or ASIC in Australia. These regulators don’t mess around. They enforce strict rules that are designed to protect everyday traders like you.

A trustworthy platform will:

A legitimate forex platform puts you in control of your money and your choices. It won’t rush you, confuse you, or make unrealistic promises. Some of the most reliable names in the industry include IG, OANDA, FOREX.com, and CMC Markets. These platforms have been around for years, building a solid reputation through consistent service, regulatory compliance, and tools that help traders make informed decisions, not blind bets.

Discovering that you’ve been scammed, especially in forex trading, can be overwhelming. It’s normal to feel shocked, angry, or even embarrassed. But remember that you are not alone, and there are real steps you can take to protect yourself and possibly recover your money.

Here’s what you should do immediately:

Scammers count on confusion and silence. Take a deep breath, and don’t let fear paralyze you.

Save every detail like transaction IDs, emails, screenshots, chat logs, platform names, and account details. The more proof you have, the stronger your case.

Block them on every platform. Do not respond to any new offers, threats, or requests for verification fees or taxes, these are just more tricks.

If you transferred money through your bank, card, or wallet, let them know right away. They might be able to flag the transaction or start a dispute.

After collecting your proof, make sure to report the scam. This step is important as it helps build a case and can stop the scam from spreading to others. If you're in the U.S., here’s where you can report it:

If you’re outside the U.S., check with your national financial regulator or cybercrime agency. For example: FCA (UK), ASIC (Australia), Cybercrime units or police portals in your respective country. Be honest and clear when filing your complaint. Share all supporting documents and explain how the scam unfolded. It helps investigators spot patterns and potentially take action against the scammers.

Scam cases, especially involving international forex platforms or crypto payments, can be complex. That’s why many victims turn to specialized scam recovery firms for guidance and support.

One trusted example is Financial Options Recovery, a professional recovery service that helps victims track stolen funds, analyze scam transactions, and work toward legal or forensic solutions. Their team understands how online scams operate and provides personalized support to guide you through the recovery process.

Check if the broker is regulated by authorities like the CFTC or NFA (in the U.S.). Look for clear contact info, real client reviews, and avoid brokers promising guaranteed returns; that’s a major red flag.

Recovery is possible in some cases. You can report the fraud to the FTC, CFTC, or IC3, and consult with recovery professionals who specialize in scam resolution and fund tracing.

Most likely not. Many forex scams begin through Instagram, WhatsApp, or Telegram DMs. If a stranger is offering investment help or mentorship, it’s best to ignore or block them, real brokers don’t recruit this way.

Yes, though rare. Some scams happen even through impersonation or cloned websites. Always double-check URLs and avoid brokers pushing you to trade aggressively or deposit more than you're comfortable with.

Yes, this is a common red flag. Scam platforms often allow deposits but block withdrawals by asking for more fees or inventing reasons. If this happens, stop sending money immediately and report the platform.