A message or ad promises, “Let an expert trade for you, guaranteed profits, no effort.” For thousands each year, this is the first step into a devastating scam.

Managed forex account scams are designed to look legitimate. They use official-sounding terms like PAMM, MAM, and LAMM accounts, display convincing dashboards, and share “success stories” that never happened. Behind the scenes, unlicensed brokers and fake account managers are misusing your trust to take your money, and often, they vanish before you realize what’s happening.

The losses can be more than financial. Victims face frozen accounts, blocked withdrawals, and sometimes the risk of identity theft. These scams target anyone, new investors, retirees, and even experienced traders, through social media platforms like WhatsApp, Instagram, Telegram, or also through fake broker websites.

In this guide, you’ll learn how these scams really work, the red flags most people miss, how to check if a forex account manager is genuine, and the exact steps to protect and recover your money.

A managed forex account is like hiring someone to trade forex for you. Instead of doing all the research, placing trades, and watching the markets 24/7, you let a forex portfolio manager handle it.

It sounds simple, and that’s the appeal.

It’s meant for people who want to invest in forex but don’t have the time, skill, or desire to trade themselves. You fund the account, and a trader (or a team) makes decisions on your behalf.

There are different styles:

When it’s done right, managed forex trading can offer passive income and diversification. But it only works when your money is in the hands of a licensed, experienced, and trustworthy manager.

The problem? Scammers often pretend to be just that.

That’s why it’s so important to understand how real managed accounts work so you can tell the difference between a legit service and a clever scam.

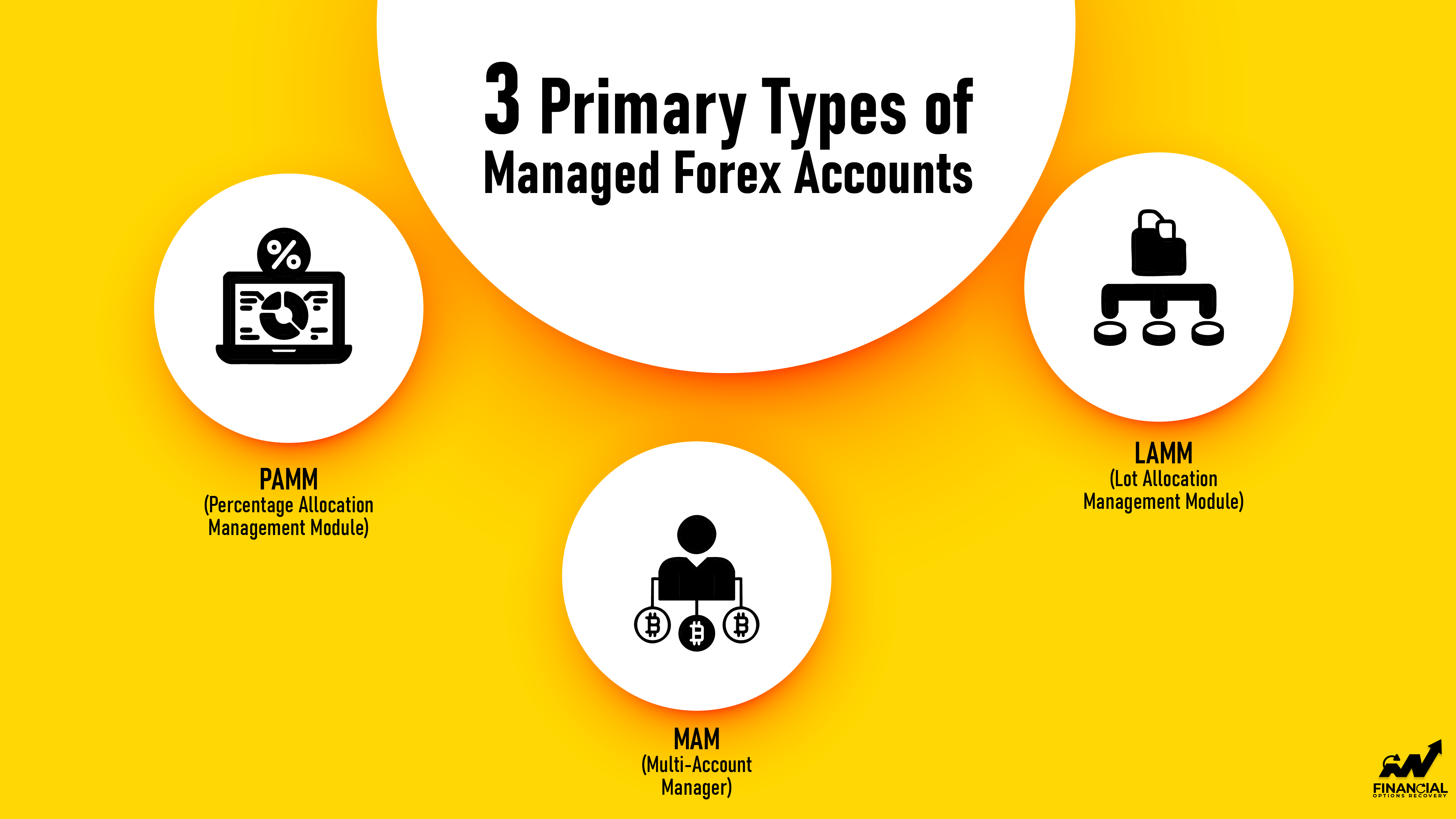

Not all managed forex accounts operate in the same manner. Some give you more control. Others let the trader do everything. But knowing the difference can help you avoid getting caught in a forex account scam.

Here are the three main types of managed forex accounts:

PAMM accounts work by pooling your money with other investors into a single account. A professional trader manages that pool and makes trades on behalf of everyone involved. Whatever profit or loss is made is divided among all investors in proportion to the amount each one contributed.

This setup is completely hands-off. You don’t have to do anything once your money is in, which makes it simple for beginners. But it also means you’re relying fully on the manager’s skill and honesty; if they lose money, so do you.

In a MAM setup, you still have your own trading account, but a single manager places trades across multiple client accounts at once. It’s a bit more flexible than PAMM because you can adjust your own risk settings or trade size, even while the manager controls the main strategy.

This model is popular in copy trading platforms, where investors follow experienced traders while maintaining some control over how much risk they’re taking.

LAMM accounts are simpler. Instead of allocating profits based on how much you invested, everyone gets the same trade size, no matter their account balance. This model only really works well when all investors have similar amounts invested.

It’s easy to understand and follow, but it’s less personalized and not ideal if your investment amount differs greatly from others in the group.

Scam forex brokers often use around terms like PAMM, MAM, or LAMM to sound professional.

But behind the techy words, they may be running a forex trading scam, faking results, hiding losses, or blocking withdrawals.

Knowing how real forex account management scams works helps you spot the lies early.

So before you send money, ask:

“Is this PAMM, MAM, or LAMM, and can I verify who’s really managing my funds?”

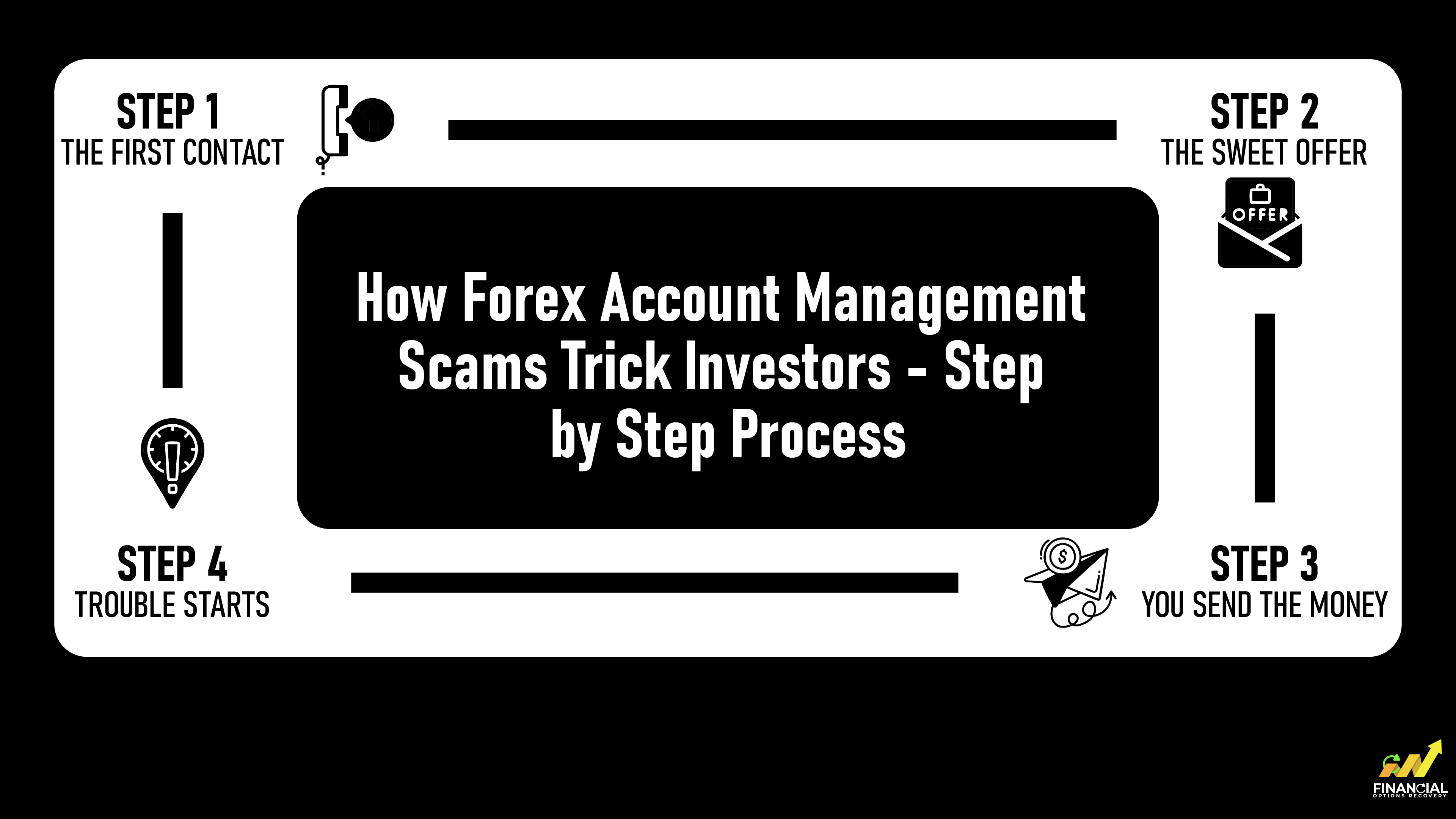

Forex scams don’t happen all at once.

They follow a plan, a calculated process. Here's how the forex scam process usually plays out:

It starts with a message, usually on Telegram, WhatsApp, Instagram, or even dating apps.

They seem friendly. Maybe they say they’re a “trader” or part of a forex group.

They slowly gain your trust.

“I’m earning passive income every week. Want me to show you how?”

They promise high returns through a managed forex account.

You’re told you don’t need any experience; they’ll trade for you.

They show you fake trading results or testimonials to prove it works.

“I made $5,000 last month for a client just like you.”

You’re asked to deposit funds into their “broker platform” or through crypto or wire transfer.

They may even give you access to a fake dashboard showing your “profits.”

It all looks real, but it’s not.

Soon, you hit a wall.

You can’t withdraw your money. They ask for more to “unlock” it.

They vanish.

The forex trading scam is complete, and your money is gone.

These scams work because they mix trust-building with technical-looking platforms.

People fall for it because it feels legit. Especially when others in the group seem to be making money (spoiler: they’re often fake accounts too).

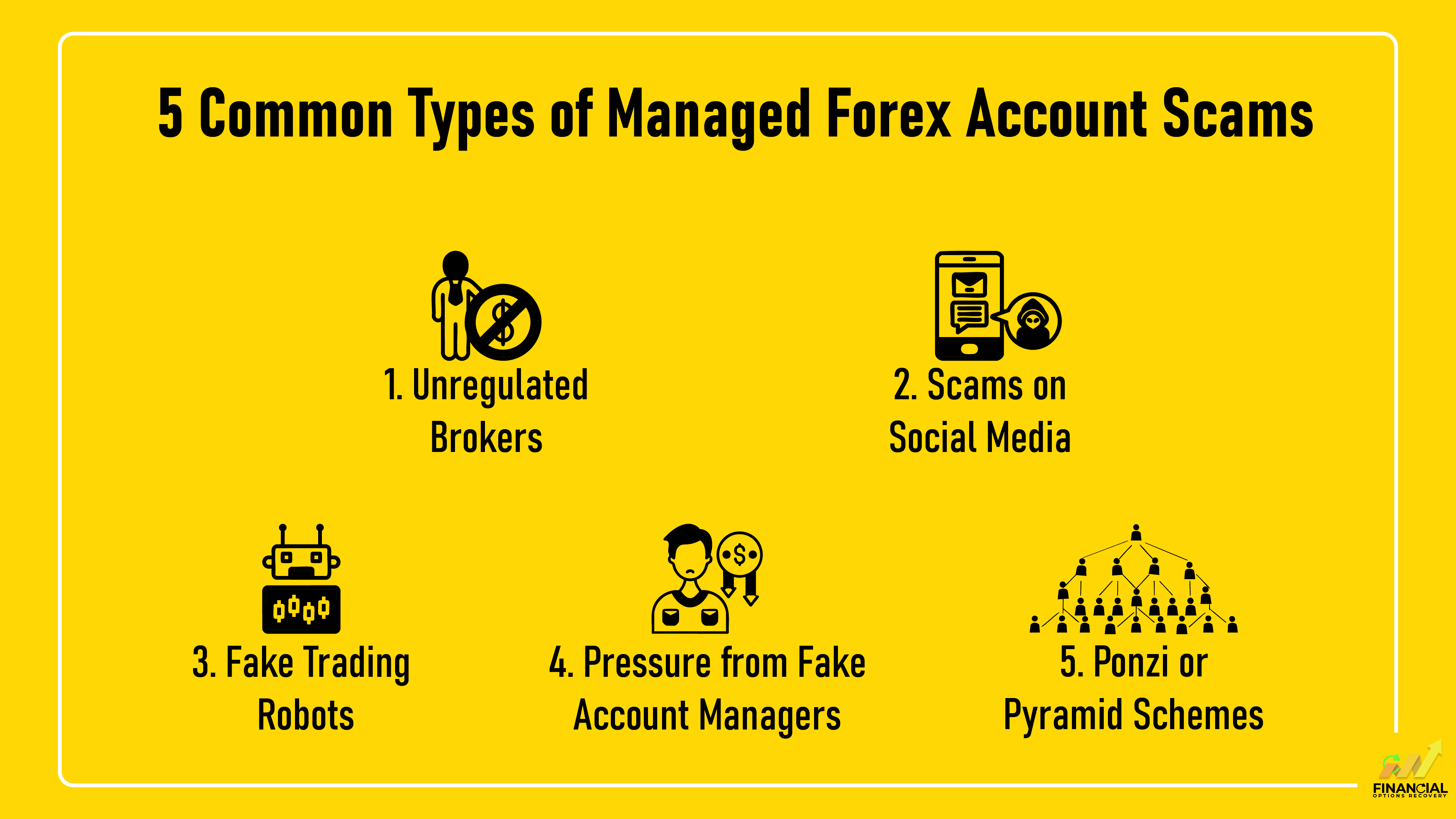

Not all managed forex accounts are safe. Some are scams made to trick you out of your money. Knowing the common scams can help you avoid getting burned.

These are those brokers who don’t follow real rules or licenses. They can fake your trading results or disappear with your money. Before you trust any trading platform, make sure it’s licensed because many victims have fallen prey to unregulated forex broker scams. Thus, it becomes crucial to always verify the legitimacy of brokers.

Scammers love Instagram, WhatsApp, and Telegram. They send friendly messages and stories about easy money from forex trading. But it’s often fake. Don’t trust offers that come out of nowhere online, as those are mostly social media scammers.

Some scammers sell “magic” trading robots that promise big profits. Most of these robots don’t work or are designed to lose your money. Therefore, be careful before buying or using any automated system. Get to know in-depth analysis about trading bot scams in our guide.

Sometimes scammers pretend to be expert traders managing your money. They push you to invest fast or risk missing out. Further, real managers won’t rush you or force you.

These scams pay old investors with money from new ones. They promise steady, high returns with no risk. Eventually, they collapse, and most people lose everything.

Quick Tip:

Always do your homework. Ask questions. And don’t be shy to say no.

Scammers get trickier every day. But there are some common forex scam warning signs you can watch for. Spotting these red flags in forex early can save you from big losses.

|

Red Flag |

What It Means |

Example Scenario |

|

Promises of Guaranteed or Huge Profits |

No one can promise steady, huge returns without risk. If it sounds too good to be true, it probably is. |

A “manager” tells you you’ll earn 20% every month with zero risk. |

|

Pressure to Invest Quickly |

Scammers want you to act fast before you think it through. Real professionals give you time to decide. |

You get a call saying the “deal” ends in 24 hours act now or lose out! |

|

Lack of Clear Information |

If you can’t find details about the trader, company, or broker, that’s a warning sign. Legit businesses are open about who they are. |

The website has no real contact info or background about the manager. |

|

Unregulated Brokers or Managers |

Always check if the broker or account manager is regulated by a trusted authority. Unregulated ones can disappear with your money. |

They refuse to share their license number or regulator info. |

|

Requests to Send Money via Untraceable Methods |

Be cautious when they ask for payments by crypto, gift cards, or wire transfers you can’t track or reverse. |

Asked to send funds via Bitcoin or prepaid gift cards only. |

|

Fake or Too-Good-To-Be-True Trading Dashboards |

Sometimes scammers show you fake accounts or trading results to lure you in. Always verify with independent sources. |

They send screenshots of big profits, but you can’t verify the broker. |

Always stay alert to these red flags. Scammers rely on tricks like these to steal your money.

Giving someone control of your money is a big deal. So before you say yes, here’s how to make sure the managed forex account and the person running it are the real deal:

A legit forex trader or broker should have a license from a trusted authority like the FCA, CFTC, or ASIC. No proof of registration is a big warning sign.

Search online for reviews or any news about the trader or company. Real pros usually have some history or feedback you can find. No reviews or bad reviews? Be cautious.

Good traders will gladly show you clear records of their past trades. But beware of fake screenshots or numbers that don’t add up.

Make sure the trading platform is popular and trustworthy. If it feels sketchy or you can’t verify it, don’t invest.

Websites like Myfxbook or FxBlue can confirm whether their trading results are real. It’s like a second opinion you can trust.

If possible, reach out to others who have worked with the trader. Honest feedback from real people is gold.

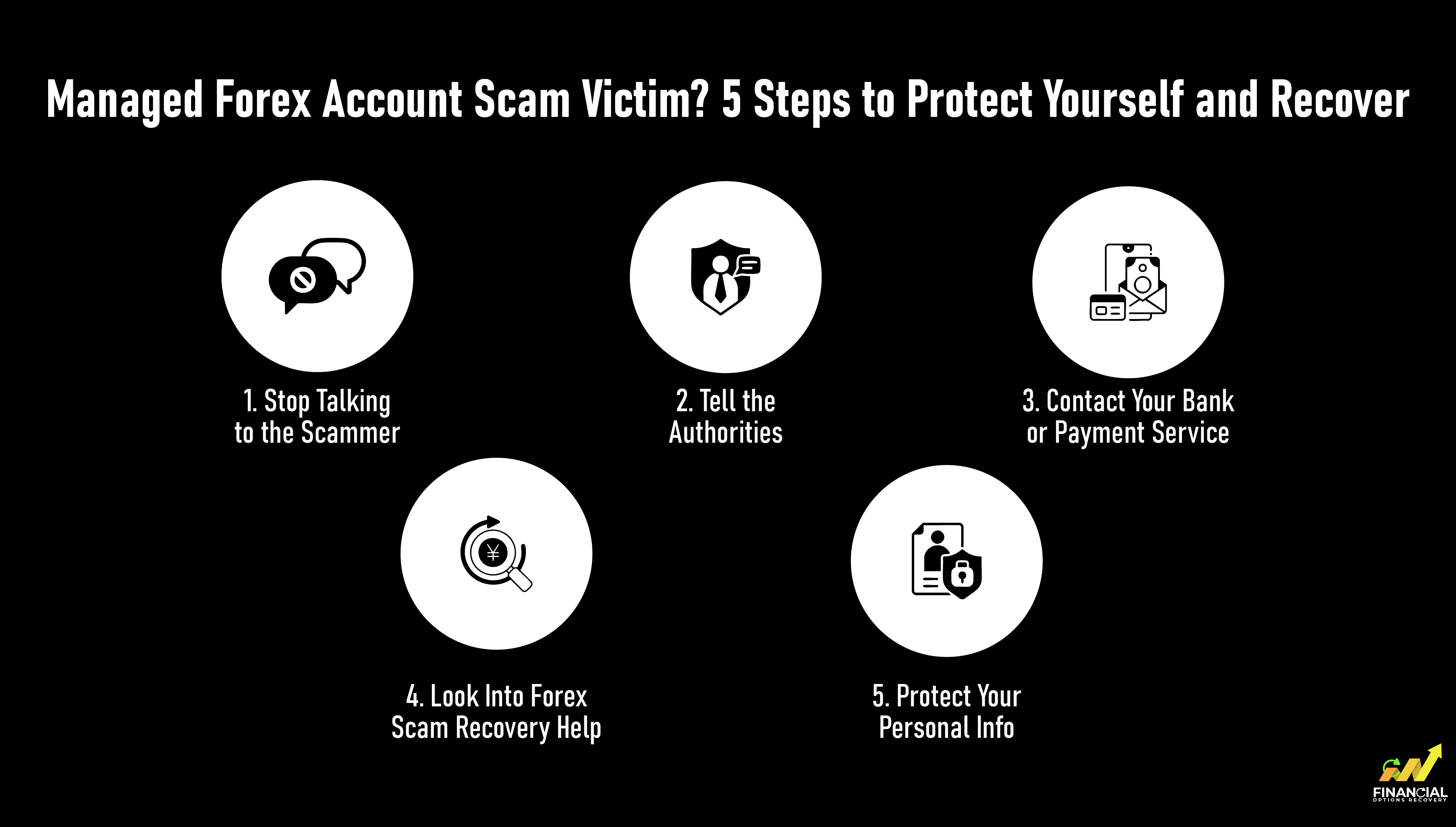

Finding out you’ve been scammed hurts. It’s confusing and scary. But don’t give up just yet; there are things you can do to fight back and protect yourself.

First, stop talking to the scammer. As hard as it is, cut off all contact. Scammers often keep trying to get more money or info. Don’t let them.

Next, tell the authorities. Report what happened to your local financial watchdog or consumer protection office. If you’re in the US, that might be the CFTC; in the UK, the FCA. The more people report, the stronger the fight against these scammers.

Then, contact your bank or payment service. If you sent money through a bank transfer, credit card, or PayPal, call them ASAP. They might be able to freeze or reverse the payment before it’s gone for good.

Also, look into forex scam recovery help. There are companies that specialize in helping people get their lost money back. It’s not always easy, but these pros know how to deal with scammers and the red tape.

Finally, protect your personal info. If you shared your personal details, be extra careful now. Change your passwords, check your accounts, and watch out for identity theft.

If You’ve Read This Far… Here’s How It Can Help You

If you made it this far, it means you're serious about protecting yourself and that’s powerful.

Managed forex account scams don’t just target beginners. They target people who are smart, curious, and looking for better ways to grow their money.

This isn’t just about avoiding one scam; it’s about building real financial confidence.

Here’s What You Can Do with This Knowledge: Protect your money before you invest in any managed forex account, Spot the signs of forex account manager scams early, Stay alert to online trading fraud, fake dashboards, and Ponzi-style schemes, Understand how to seek forex scam help and recovery support if you’ve been targeted.

Think you’ve been scammed or unsure if it’s legit?

Contact Financial Options Recovery, and we’ll help you take the right next step.

PAMM (Percentage Allocation Management Module), MAM (Multi-Account Manager), and LAMM (Lot Allocation Management Module) accounts are real tools, but scammers often fake or misuse them. If someone claims they’re managing your funds through one of these without proper licensing or clear reporting, it could be a scam.

Not necessarily. Scammers often use fake MT4/MT5 dashboards or demo accounts to show “profits” that don’t exist. Always verify the broker and ask if the platform is licensed and regulated.

Many forex signal groups on Telegram or WhatsApp are fake. They post fake testimonials and results to gain trust, then push you to send money to a “manager” or shady trading app.

Ask for their regulatory license, like an NFA ID (U.S.), FCA number (UK), or ASIC (Australia). Then search for that ID on the regulator’s official website. If they can’t provide one or avoid the question, that’s a red flag.

Copy trading lets you copy trades from experienced traders. Scammers use fake signal groups on Telegram or WhatsApp to lure you in, then steal your money or push risky trades.