A caller says there is a warrant in your name. Another claims your bank account’s been frozen. A third pretending to be your boss, rushing you to make an urgent payment. Others offer fake crypto investment schemes, promising guaranteed returns, often resulting in lost money to a crypto scam.

Different voices with the same trap: imposter scam.Impostors disguise themselves as authority, urgency, and trust. And every year, they cost innocent people billions.

So, what exactly is the imposter scam, and how can you spot and outsmart it?

Table of Contents

Here, the real danger is in who they pretend to be, more than what they say.

An imposter scam is when someone poses as a trusted figure to deceive you into handing over money, personal information, or access.

They may act like a government official, bank executive, tech support agent, company CEO, family member in distress, or crypto agent advising guaranteed returns. These scams don’t rely on breaking into systems; they rely on breaking into your trust. The scammer earns your trust, creates pressure, and pushes you to act before you get a chance to think things through.

With personal details available through data leaks and social media, scammers customize their approach to sound more convincing. They may use your name, job title, or recent activity to build your trust. From fake crypto deals to urgent government notices, they know exactly how to push the right buttons.

Notably, these scams don’t have just one type that fits everywhere; they adapt to who you are, where you work, and even what you invest in. From everyday bank frauds to fake crypto gains, they are evolving to scam you better. Let us learn about some common types of impostors to look out for.

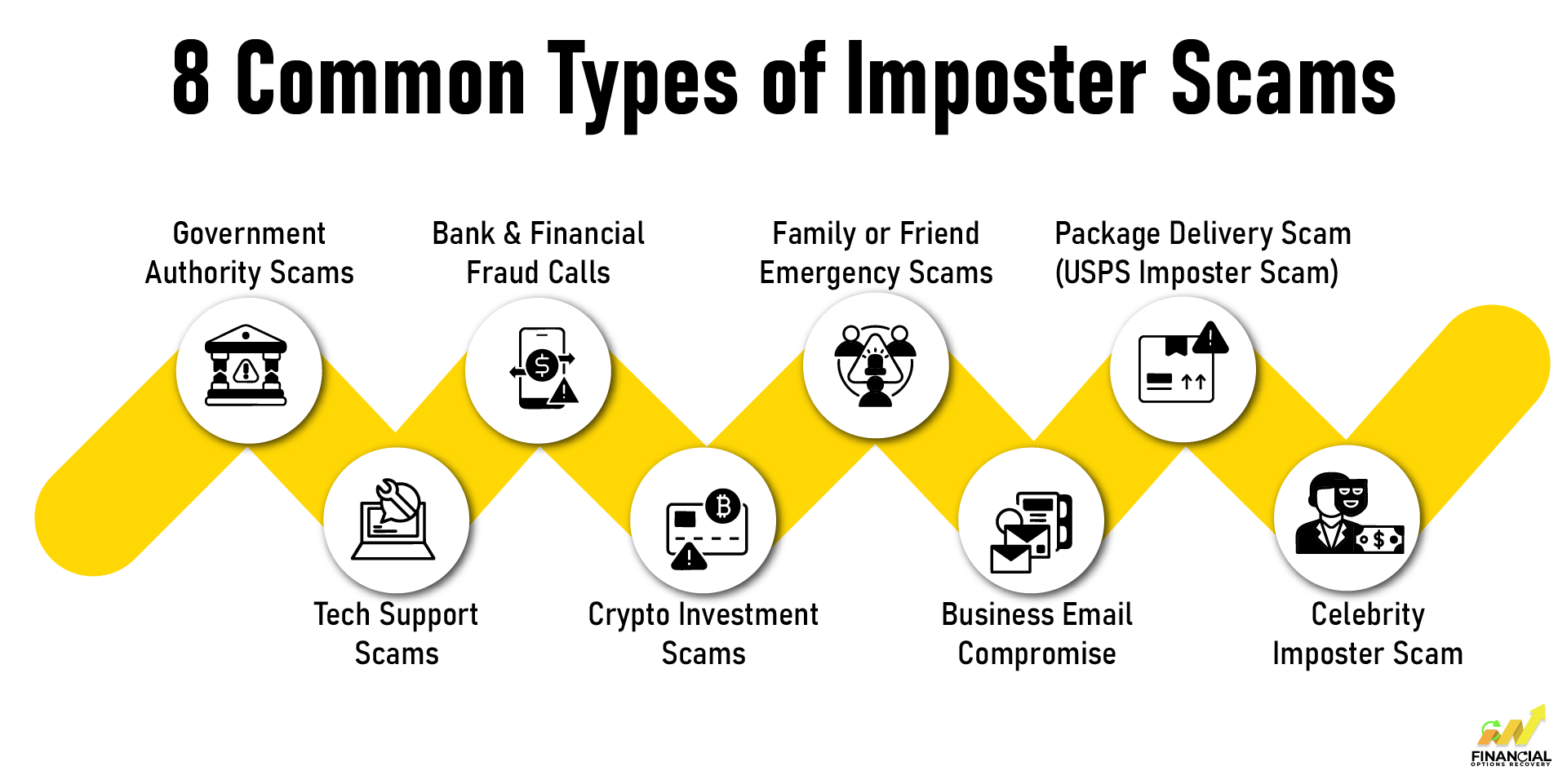

Imposter scams come in various forms, but they all share one thing: someone pretending to be someone that they are not. Here are the most common types you should watch out for:

Scammers often pose as officials from the IRS, Social Security Administration, or law enforcement agencies. They may claim you owe fines or taxes or are under investigation, threatening legal action if you don't pay immediately. These impostors often use spoofed caller IDs and scripted language to sound convincing.

Scammers claim there is a virus or breach on your device. The ‘technician’ will ask you to install remote-access tools, giving them full access to your system. Once in, they may steal files, plant malware, or demand payment for fake repairs.

These involve fake alerts about account freezes, suspicious transactions, or credit card issues. Innocent people are tricked into sharing OTPs, PINs, or downloading malicious apps. Some even create fake websites or apps that look identical to your bank’s interface.

One of the growing categories is scammers impersonating as advisors or influencers for crypto platforms, offering fake investment plans or giveaways. They all promise high returns or exclusive coin deals, directing you to fake exchanges or asking you to transfer bitcoin to their wallet. Some scammers even set up fake Telegram groups and Discord servers that are built to impersonate real trading communities. These scams often fall under the broader category ofinvestment scams, which continues to evolve in more deceptive ways.

Scammers message or call, pretending to be someone you know, claiming they’ve lost their phone, been in an accident, or need help urgently. They often use emotional triggers and urgency to stop you from thinking logically.

This type of scam is designed to trick people in roles like finance, HR, or senior management. You might get an email that looks like it’s from your CEO or a trusted vendor, asking you to urgently transfer funds or share sensitive details. And because these emails often use domains that look nearly identical to real ones, they easily avoid getting detected by spam filters and seem completely legitimate, until it’s too late.

You receive a text or email claiming your USPS package is on hold due to unpaid fees or incorrect address information. The link leads to a fake tracking page that asks you for credit card details or personal data. Scammers often create fake USPS or FedEx delivery alerts that look genuine, especially during holidays, Amazon Prime Days, or sale events.

Celebrities/influencers from Elon Musk to Ophar, scammers create fake social media pages or hack verified accounts to claim giveaways, crypto returns, or charity events. They often run ads or post flashy videos with fake comments to build trust. This is especially common with crypto “doubling schemes” or exclusive NFT drops.

Of course, these aren’t the only traps out there. Scammers use everything from fake dating profiles and fraudulent job offers to AI-generated voice clones and fake social media accounts. They’re constantly evolving with time, but no matter the disguise, scammers almost always leave behind a trail of red flags, you just need to know what to look for.

It’s scary how convincing these scams can be. In 2024, imposter scams were the most reported type of fraud, costing people nearly $3 billion. That’s not just a number; it’s thousands of real folks who thought they were talking to someone from the government, their bank, or a company they trusted.

Over 845,000 reports were filed with the FTC, and those are just the ones we know about. These scammers are getting better at pretending. They sound official. They create urgency. They know exactly what to say to make sure that you let your guard down.

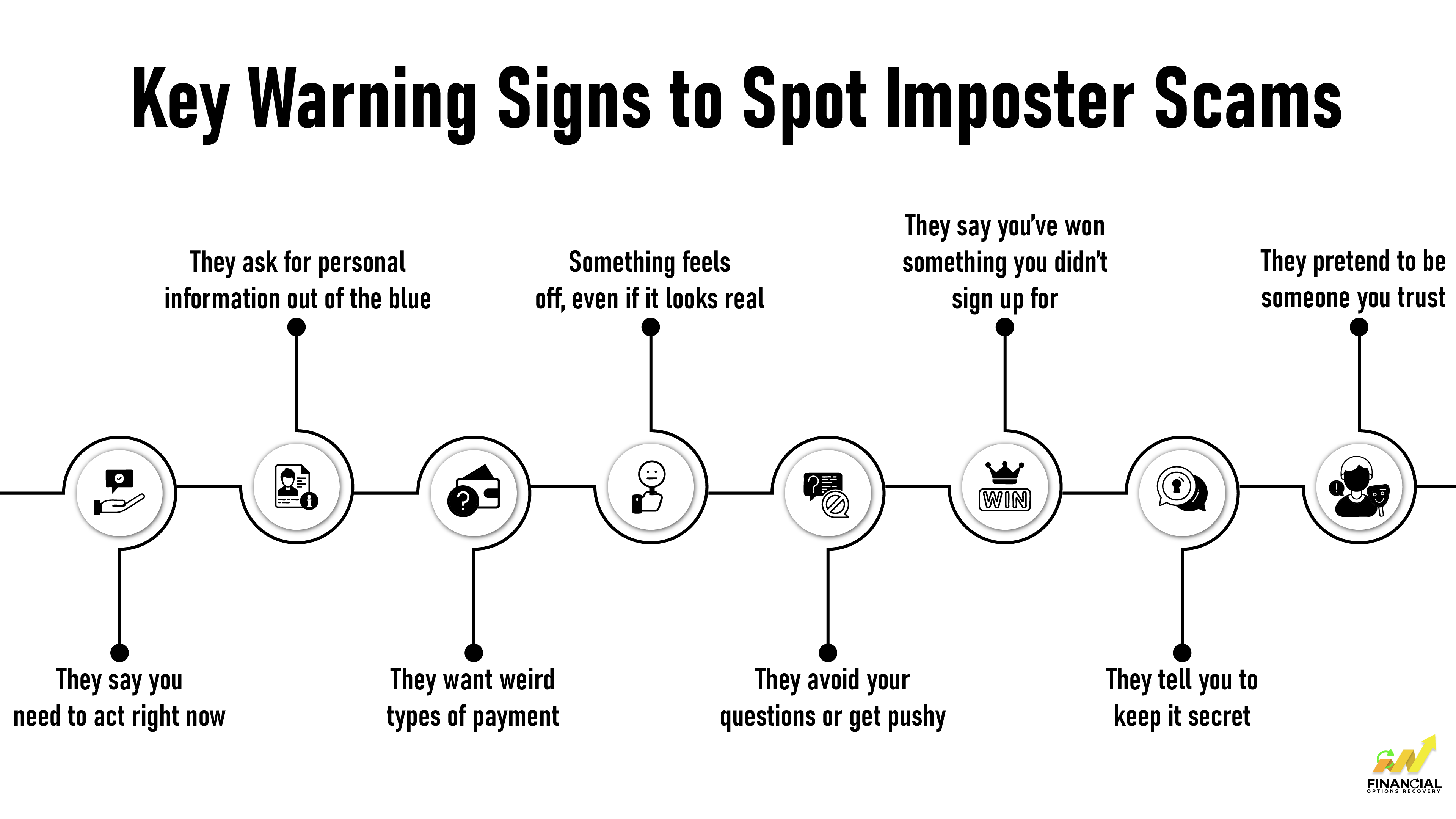

So, how do you tell what’s real and what’s not? Let’s break down these red flags and help you spot a scam before it’s too late.

Imposters aren’t just clever; they are calculative. And what makes their tactics dangerously effective is how well they understand human behavior.

It’s not just about tricking you; these scams tap into how we react under pressure, how we trust familiar names, and how fear can cloud judgment. Here is what makes them so effective:

They are not thieves who break in; these imposters are scammers who are invited in because, for a moment, they sound just right.

Getting a call from your bank, the same number as on the back of your card. The representative sounds professional and says there's an issue with your account and offers to help you get a refund. You trust them, follow their instructions, and before you know it, your money’s gone. That’s exactly what happened to a Chase Bank customer, who lost over $120,000 to scammers pretending to be bank representatives.

These criminals spoofed the real Chase customer service number, so it looked completely legit. They built trust quickly and used a fake refund story to convince the customer to move the money right into the hands of the scammers.

This isn’t a one-off story. Imposter Scams are happening at a rising pace. According to the FTC, Americans lost $2.7 billion to Imposter Scams in 2023 alone. These scammers don’t just sound convincing, they’re professionals at creating panic and urgency.

Scams like this are emotionally draining and financially devastating. Sharing these real-life stories can help others stay alert and protected.

Scammers rely on psychological tricks, not just technology. They play on emotions like fear, urgency, greed, and even love. The good news? Once you understand how they operate, it gets much easier to spot and shut them down.

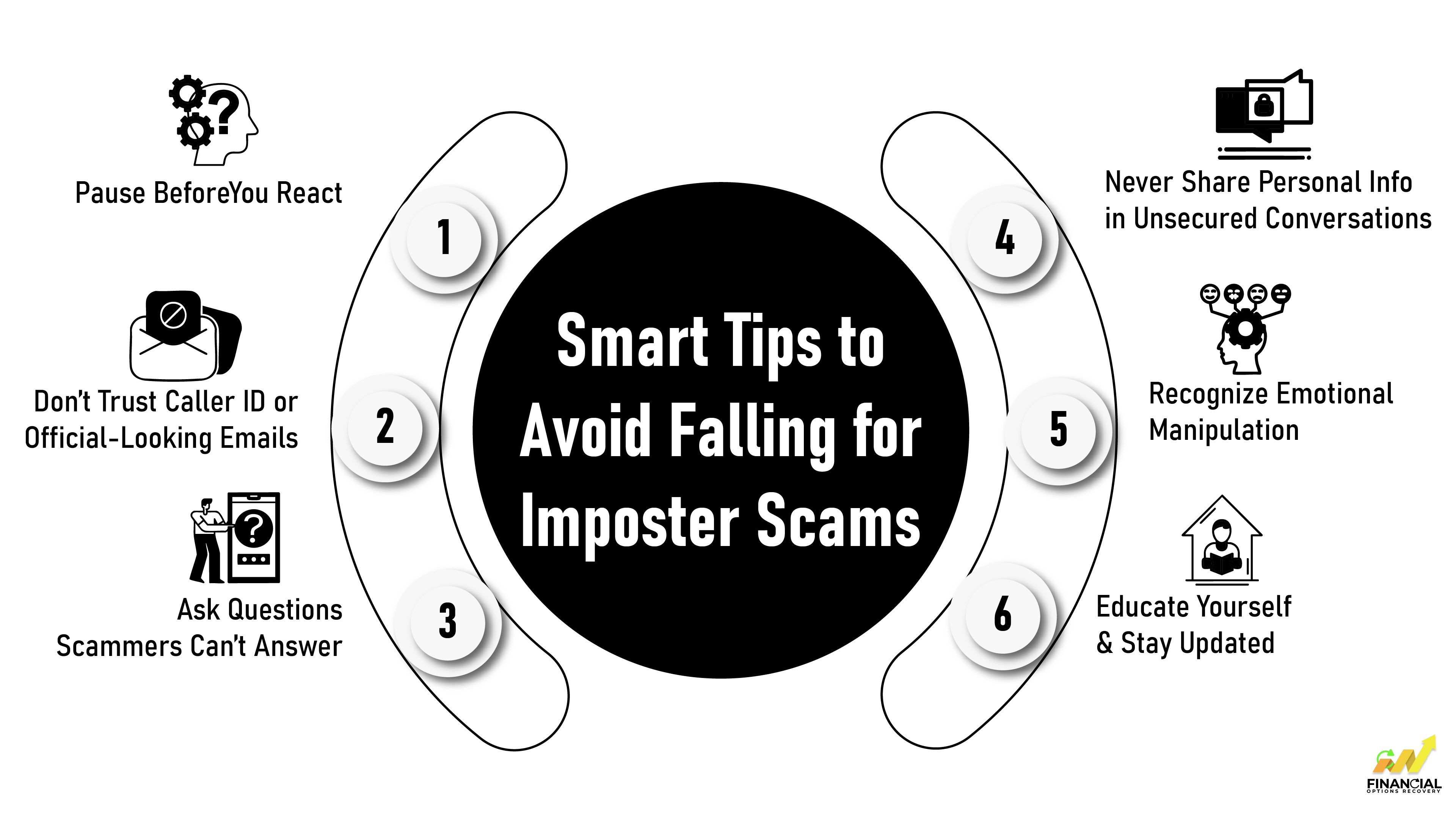

Here’s how to stay ahead of impostor scams:

If someone calls or messages you out of the blue with bad news or a high-pressure request, slow down. That “urgency” is part of the scam. Don’t do anything right away. Let it sit. Hang up. Think it through. Real companies and agencies don’t pressure you like that.

Scammers use a technique called spoofing to make it look like they’re calling from a trusted source, even the IRS, your bank, or a tech support line. Emails might look convincing, too, with logos, official language, and even fake employee signatures.

Moreover, don’t use the number they gave you. Don’t click their links. Just start fresh. No matter what the screen says, never trust contact information that comes to you. If it’s really important, the company or agency will let you hang up and call back through their verified number or website.

When the situation seems a little unsure, challenge them. Ask things like: What’s my account number? Can I call you back at your official number? Can you mail me something about this?” Asking puts you back in control. If they refuse or act irritated, that’s your signal to walk away.

Scammers will usually bail. They don’t want you thinking; they want you reacting.

No legit company will ask you to send passwords, full Social Security numbers, or banking details over a phone call or DM. If they do, that’s your sign to hang up. Treat any unexpected request for personal info as a red flag, even if it sounds official. When in doubt, don’t share. It’s better to double-check than to regret it.

Some scammers use softer approaches, like posing as a grandchild in trouble, a romantic interest, or a long-lost friend who needs help. They tug at your heart, not just your fear. Sometimes your gut knows before your brain catches up. Maybe the tone is weird. Maybe the situation feels too dramatic, too fast, or just... odd. Listen to that feeling. You don’t owe anyone immediate answers, payments, or explanations. If you're unsure, step back and think.

Scams evolve constantly. The best defense is to stay informed. The more familiar you are with tactics, the easier it is to say “Nope, not today.”

Tips to keep learning:

Getting a message or call from someone pretending to be legit can shake you up, but don’t panic. Whether you shared information or caught on in time, here’s what to do next to stay protected:

Change passwords (especially email and banking)

Turn on two-factor authentication

Alert your bank or credit card provider

Where to Report:

Financial Options Recovery is a trusted firm dedicated to helping victims reclaim lost funds from online scams. Our team of experts understands how these frauds operate and can guide you through the recovery process with confidentiality and care.

After being scammed, don't stay silent; reach out to Financial Options Recovery today and take the first step towards getting your money back.

Stay aware, not afraid.

Imposter scams thrive on panic, pressure, and pretending. But when you’re informed, you’re in control. Take a step back. Ask questions. Trust your instincts. Real organizations will never rush you, threaten you, or demand secrecy. The more you slow down and verify, the harder it becomes for scammers to succeed.

Awareness isn’t about living in fear; it’s about being one step ahead. You’ve got this.

If someone contacts you unexpectedly, pretending to be from your bank, a government agency, or tech support, and starts asking for money or personal information urgently, it’s most likely a scam. Real organizations don’t pressure you like that.

Trust your intuitions, and when something feels off, you can do the following:

Hang up or don’t reply.

Don’t click any links.

Look up the official phone number or website of the company and contact them directly to double-check.

Unfortunately, yes. Scammers can make it look like they’re calling or emailing from a real business, even your bank or a government agency. That’s why you should never rely on caller ID alone. Always verify on your own.

Yes, definitely! Even if you didn’t fall for it, reporting the scam helps protect others. It gives law enforcement better insight into how these scams work and who they’re targeting.

If you're in the U.S., you can report it at FTC: ReportFraud.ftc.gov. Then you can also report it to your Local consumer protection office and to your bank or credit card company if you shared any financial information