In the past few years, crypto has created new ways to make money, but it has also become a common place for scams. Among the most dangerous are fake crypto platforms: websites and apps that pose as legitimate exchanges or investment firms but are designed purely to steal your money.

They look real. They sound convincing. Some even claim to be licensed or “partnered” with big names in the industry. But behind the polished website, fake reviews, and high-return promises is often nothing more than a well-built trap.

These scams are rapidly increasing and making victims unaware that they have been scammed, whether it's a fraudulent crypto trading platform, a fake Bitcoin investing app, or a replicated NFT exchange. In 2024, users lost over $10 billion globally to crypto scams and hacks, including Ponzi schemes, phishing attacks, and fake cryptocurrency platforms.

The scams exploit trust and urgency, making them a challenge to identify. Many victims don’t immediately realize they were scammed until they have run out of time to withdraw their funds.

What’s more troubling? These scams are no longer just targeting big investors. Every day, people, retirees, students, and first-time crypto users are getting pulled in by social media ads, WhatsApp messages, or random DMs promising “secure platforms” or “guaranteed daily profits.”

If you’ve ever been tempted to sign up for a new crypto site because of a flashy ad or a fast-talking advisor, this guide is for you. We’ll break down how fake crypto platforms work, what red flags to look for, and how you can protect yourself or recover your lost money.

Because in today’s crypto world, it’s not just about being smart. It’s about being careful.

Table of Contents

Fake crypto platforms are fraudulent websites or applications that pose as legitimate cryptocurrency exchanges, investment services, or wallets. These platforms are often well-designed, with convincing branding, fake testimonials, and even fabricated security badges. Their main goal is to attract investors to deposit money or cryptocurrency, which is then stolen.

These scams are often advertised on social media platforms, as spam emails, in WhatsApp messages, or by influencers on social media. Victims are convinced that they will earn high returns, their investment will be safe, or they will be given access to insider trading opportunities, but after depositing funds, the ability to withdraw funds is delayed, blocked, or denied altogether.

Fake crypto investment platforms often target:

They may operate for weeks or months before disappearing, taking with them all user funds and personal data.

These scams often appear sophisticated and legitimate but are designed to exploit trust, urgency, and lack of technical knowledge. Here’s a breakdown of how they operate:

|

Types of Scam |

What It Looks Like |

What They Say |

How It Works / Harms You |

|

Fake Crypto Exchanges |

Look-alike trading websites with fake dashboards, charts, and login portals |

“Trade like the pros. Instant withdrawals. No KYC needed.” |

Simulate trading activity but block withdrawals once deposits are made |

|

Platforms offering daily returns and referral bonuses |

“Earn 10% daily ROI! Refer friends for double income!” |

Run on Ponzi logic; collapse when user inflow slows, wiping out user funds |

|

|

Phishing-Based Wallet Apps |

Mobile apps or browser extensions mimicking real wallets |

“Secure your wallet now. Download the new update!” |

Steal private keys or drain funds after users log in or sign transactions |

|

Rug-Pull Token Platforms |

New tokens are hyped online with flashy branding but no substance |

“Next 100x coin. Early buyers will be millionaires!” |

Sell fake tokens, pump prices artificially, then exit by draining liquidity |

|

Fake sites claiming to sell rare or exclusive NFTs |

“Limited drop! Only 100 NFTs leftmint yours before it’s gone!” |

Require upfront crypto payments or wallet connections, then disappear or steal assets |

Pro Tip: These scams often rely on FOMO (Fear Of Missing Out) and create urgency using limited-time offers, influencer promotions, or fake testimonials. Always research thoroughly before sending funds or connecting your wallet.

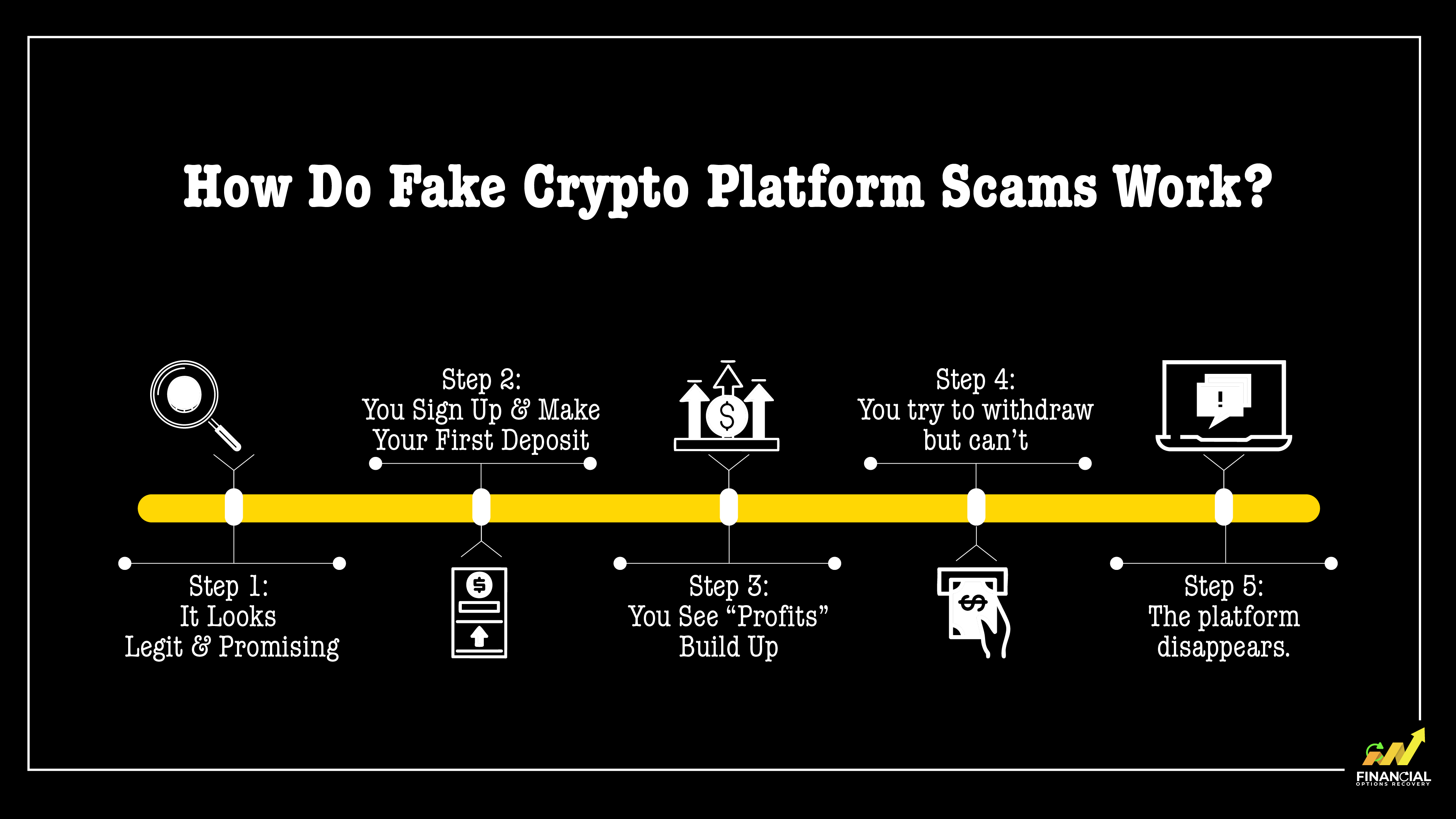

Fake crypto platforms don’t start as obvious scams. They unfold slowly, step by step, making them harder to spot until it’s too late. Here’s how these scams typically play out.

This scam begins with a polished website, sleek branding, and bold promises. Maybe it’s an ad that appears while you’re browsing, a Telegram message, or a tip from an online “expert” on YouTube. The platform claims to be the next-gen crypto exchange, an exclusive NFT launchpad, or a high-yield investment opportunity.

It all sounds exciting, especially when it talks about guaranteed returns, passive income, or early access benefits.

Once you visit the site, everything feels professional. The signup process is smooth, and you’re encouraged to deposit cryptocurrency, typically a small amount, to get started. Maybe $100 or $250. It feels safe. You’ve seen this kind of platform before. You find your wallet and start exploring.

Within days or even hours, you start to see your balance grow. The dashboard shows trades happening in real time. Maybe your account is up by 20%. There might be messages telling you that you’ve qualified for a bonus or that your earnings will increase if you invest a little more.

Everything looks like it’s working. The platform even sends you congratulatory emails or offers referral incentives.

Then comes the first red flag. When you try to withdraw your funds, you're told there's a “verification” step. Maybe you’re asked to deposit a small “unlock” fee. Or a tax. Or you’re told there’s maintenance happening. No matter what you try, your money stays stuck. Support replies slowly, if at all. And the explanations start to sound suspicious.

At some point, everything goes silent. The website may stop loading. The support team vanishes. Your account is inaccessible. Even your transaction history may be gone. The cryptocurrency you sent is lost, and the wallet it was sent to is either empty or untraceable. You’re left with no way to recover your funds and no one to contact.

This step-by-step flow represents how many fake crypto sites operate, including scams with phony NFT marketplaces, rug-pull token sites, and high-yield crypto investment scams. Just knowing this pattern at a high level is enough to avoid falling into these traps altogether.

Fake crypto platforms can appear professional and legitimate. This is precisely what makes them so dangerous. While the appearance may be organized and formal, the people behind it are rarely legitimate. The good news is that if you watch out for warning signs, you are less likely to lose both your money and your state of mind.

Here are some red flags you can be on the lookout for:

Legit platforms are transparent about who runs them. They usually list names, professional profiles, and company information. Scam sites, on the other hand, keep things vague. If there’s no mention of a real team, no LinkedIn profiles, and no way to verify who’s in charge, that’s a sign to stay away.

If a platform says you’ll “earn $1,000 per week” or “double your investment with zero risk,” that’s a major red flag. Crypto markets are unpredictable—no real company can promise fixed returns. These offers are designed to hook you emotionally and get you to deposit fast.

Scammers often pressure you to move fast. You might see phrases like “offer ends today” or “only a few spots left.” This urgency is meant to stop you from thinking things through or asking questions. If you’re feeling rushed, take a step back. Real investments can wait.

A trustworthy platform explains how it works, how they make money, what services they offers, and how you benefit. Fake platforms usually skip over this or use confusing technical terms to sound impressive. If you can’t make sense of their model, there’s probably a reason.

It might look modern at first glance, but read closely. Are there grammar mistakes? Does the content feel vague or copied? Scam sites often reuse templates, images, and wording from other places. If it feels rushed or sloppy, that’s a bad sign.

Some platforms post overly positive reviews, everyone’s making money, and everyone’s happy. But dig deeper. Check independent sites, forums, or Reddit. If the only praise is on their page and nowhere else, it’s likely fake.

This is one of the biggest giveaways. You invest, maybe even see fake profits, but when you try to withdraw, they stall. Suddenly, you need to pay a “release fee” or verify your ID again. Then, support goes silent. If a platform makes it hard to access your own money, it’s probably a scam.

Fake crypto platforms are popping up everywhere, and many look just like the real thing. They use fancy websites, big promises, and even copy the names and logos of trusted exchanges. But behind the scenes, these sites are built to steal your money. The good news? You can avoid them with a few simple steps.

If you're new to this. First, check the website you want to go to. Scammers will create "fake" sites that are basically the same; they may use the real name with some character changes, like they use a dash, space, or number, or a different domain name (Cryptobase.com vs. Coinbase.com). If it looks suspicious, it probably is a fake site.

Be cautious of platforms that give you fast profits or "guaranteed" returns. Legitimate investments carry risk; guaranteed returns are a common scam tactic. Follow your gut because if it is too good to be true, then it most likely is.

Be sure to only use a platform that is reputable and registered. If a site does not reference any regulations or security measures, this is a red flag. Trusted exchanges are usually excited to talk about their licenses, audits (or lack thereof), or partnerships. If you do not see this proudly displayed, it may be time to look away.

Before putting in a big amount of money, test the platform. Try making a small deposit and see if you can withdraw it easily. If they delay your withdrawal or ask for extra fees to release your funds, stop immediately. These are common scam tactics.

Also, avoid links shared in random chat groups, emails, or social media comments. Scammers often pose as helpful traders or “admins” in Telegram, WhatsApp, or Discord. Stick to official websites and never trust someone just because they sound friendly online.

Another smart move? Use tools like Revoke.cash to check and remove any unwanted wallet permissions. And always use two-factor authentication on your crypto accounts for extra protection.

In short, stay alert, take your time, and never invest in something you haven’t fully checked out. A little caution now can save you from big losses later.

Not sure if a platform is fake? You can always reach out to our team before you risk your money. We're here to help.

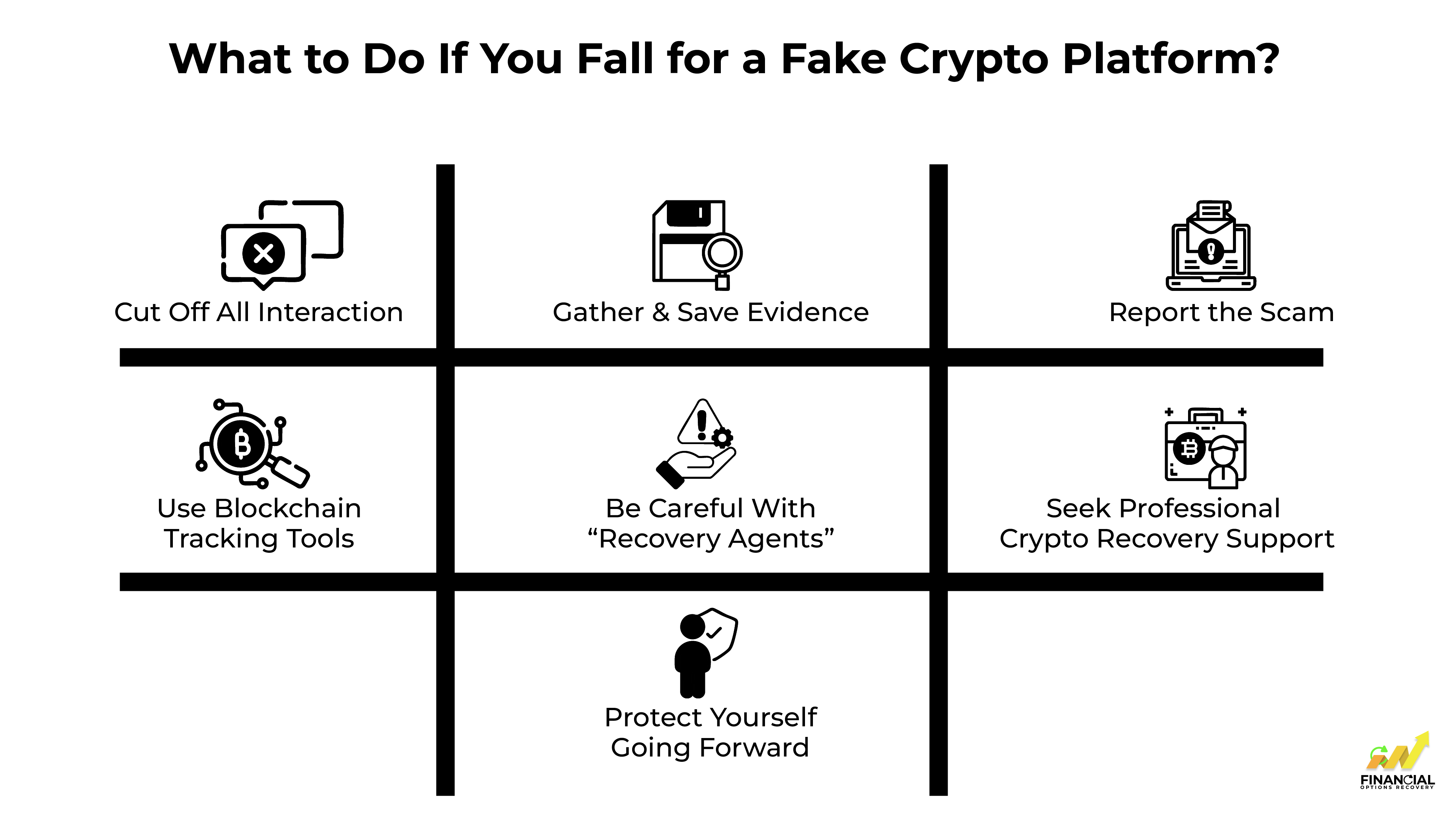

Realization of being scammed can be painful. The experience can be financially and emotionally distressing. Some might even blame themselves, but here's the truth: these apps work against the victims; they are deceivers. They are supposed to look trustworthy, and these platforms have scammed thousands of smart, careful people. If this has happened to you, you are far from alone; here are some steps you can take immediately.

If you’re still talking to the person who introduced you to the platform or to anyone claiming they can help recover your funds, cut off contact. Scammers often return under a new name or pretend to be recovery agents, trying to get even more money from you.

Don’t send any more money. Don’t share more personal information.

Before the site disappears or you lose access, gather everything you can:

Save it somewhere secure. This evidence will be useful for reporting the scam or seeking recovery help.

Reporting might not immediately get your money back, but it’s an important step. It helps authorities track trends and protect others. Here’s where you can report:

You can use blockchain explorers (like Etherscan or Blockchain.com) to look up the address you sent funds to. This won’t reverse the transaction, but in some cases, it can help identify if others were affected by the same scam.

It also helps professional recovery teams investigate further, if needed.

Many victims are targeted again by people who claim they can recover lost crypto for a fee. Unfortunately, most of these are just more scams.

Be extremely cautious. No real recovery professional will guarantee results or demand upfront payment without proof of service. If you’re not sure who to trust, talk to a professional scam recovery service with a proven track record.

If you’ve lost a significant amount and want to explore recovery options, look for a company that specializes in scam investigations. At Financial Options Recovery, our cryptocurrency scam recovery experts assist scam victims by analyzing the case, tracing the funds, and helping you take the next steps.

We understand what you’re going through, and we’re here to help, not judge. Even if you just want guidance, you can reach out for a free consultation.

Scammers often return. Now that your wallet or contact details are in their system, you may hear from “new” people pretending to offer help. Stay alert and skeptical of any unexpected offers, especially if they involve crypto.

Also consider:

If you are reading this much, you've made a smart move. The vast majority of individuals suffer devastating losses from fake crypto platform scams because they don't take the time to pay attention to what is going on around them. You've learned the warning signs, how the scammers work, and how to take better care of your crypto.

This effort can save you from losing money, time, and your peace of mind. And again, you'll know what to consider ahead of time so you can make an informed decision.

Also, try to stay one step ahead of the scammer's plans, which rely on individuals uniformly not taking the time to read the signs. You know how to confirm whether a platform is legit or engaging in illegal and unethical practices, how to recognize a fake platform offering fake opportunities, and what to do if you have made a mistake.

Never rush your decisions; think you never have to take the time to do research. Remember, you aren't using due diligence just because you saw a "polished website" or "a person in a Telegram chat group said it was great."

Stay careful. Stay informed. And most of all, trust your gut. It’s always better to ask questions than to lose your hard-earned crypto to a scam.

Been scammed already? Talk to Financial Options Recovery for expert help in tracing your lost funds and exploring recovery options.

Shadow trading refers to the illusion of real-time transactions using bots or fake accounts. Scam platforms often display fabricated order books and trade histories to make the exchange look active and trusted. If all trades look perfect or if volumes spike without reason, it’s likely staged to lure you in.

Yes. Ghost wallets are pre-filled dummy accounts shown on-screen to make users believe they’re earning profits. In reality, your funds are either unrecoverable or only visible within their fake dashboard. Once you try to withdraw, the scam becomes obviousbut often too late.

A honeypot scam tempts you to invest by showing that small withdrawals or early profits are possible. But once you put in a larger amount or try to exit, you’re blocked. It’s a bait tactic used to lower your guard and simulate trust before stealing your funds.

Many fake crypto platforms claim that your funds are locked in a staking contract, liquidity lock, or anti-whale timer, preventing withdrawals. These excuses are usually fake tech jargon meant to stall you while the operators make their escape. Real platforms are upfront about withdrawal terms; if it feels vague, walk away.

A pump-and-dump scam artificially inflates a token’s price before insiders sell off their holdings, while fake crypto platforms create fully fabricated trading environments, often with fake charts, fake balances, and no real market behind the scenes. In both cases, the goal is to trick users into investing before the collapse.