You’ve been trading Forex and watching your account grow. Maybe you’ve even started planning about what you’ll do with those profits: pay off debt, make a big purchase, or finally relax a little.

Then, out of nowhere, a message pops up.

It’s from your “broker” or someone claiming to be a tax official. They say you need to pay a hefty tax before you can withdraw a single dollar. Sure, taxes are normal, but this just doesn’t feel right.

If this sounds familiar, or you’re trying to avoid getting caught in such a trap, you’re not alone. This desperate demand for a "tax" payment isn't a legitimate part of Forex trading or forex taxation. Instead, it's one of the most pocket-breaking tactics employed by fraudsters in a sophisticated Forex tax scam, designed to squeeze every last cent out of their victims.

In this blog, we’ll break down how these so-called Forex tax scams work, what warning signs to watch for, and, most importantly, how to protect yourself from becoming their next target.

Table of Contents

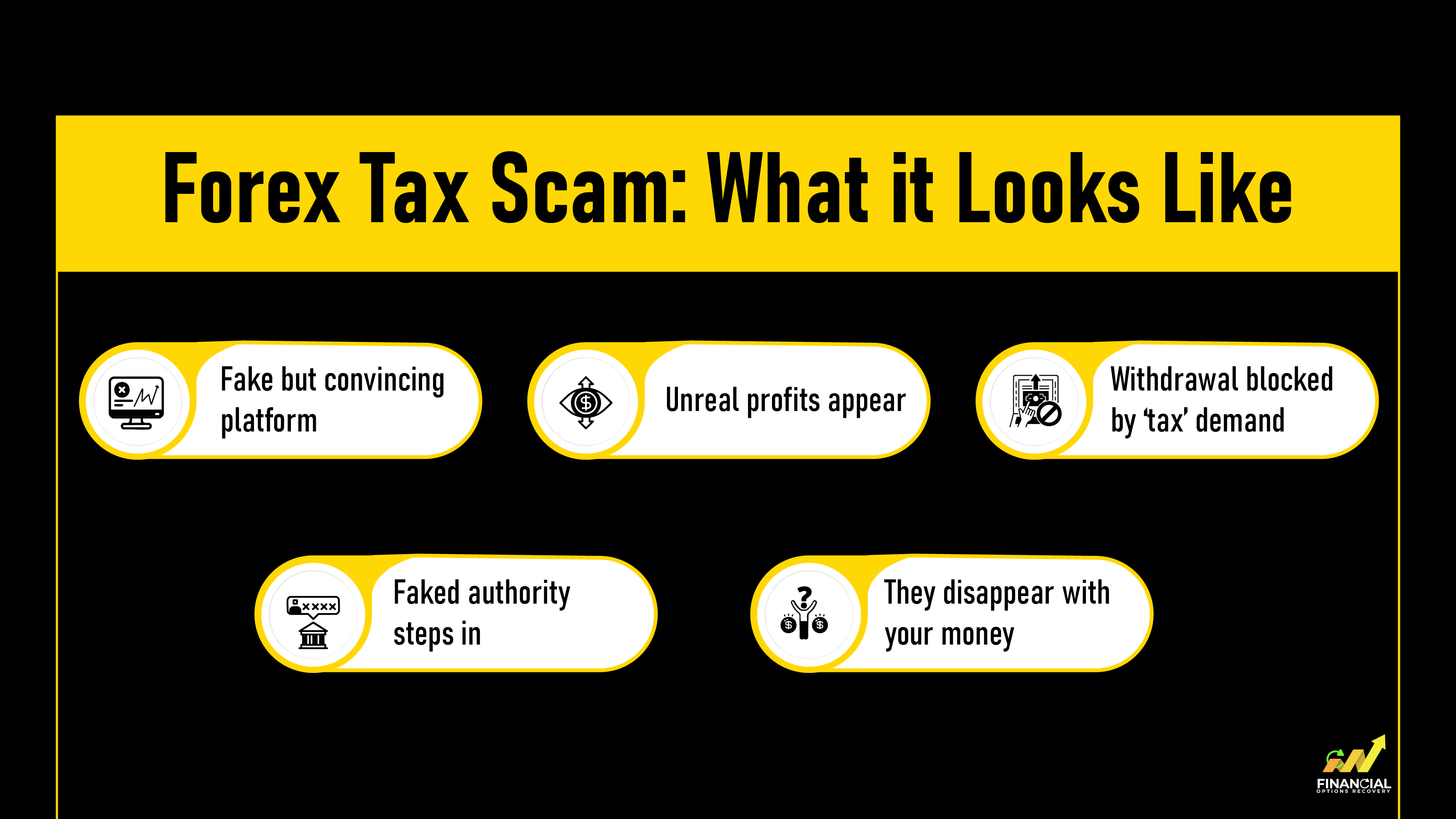

Forex trading is tricky enough, but tax withdrawal scams make it even riskier, turning potential profits into big losses. Let’s see what really happens in a Forex tax scam:

You’re introduced to what looks like a legit Forex trading site, maybe through a social media post, a dating app chat, or an online ad that catches your eye. Once you sign up, things seem to go well. Your account shows small, steady profits, and you even get to withdraw a little money at first. That’s all part of the trap.

After a while, your account shows a huge jump in profits. It looks like you’ve made a fortune. You start picturing what you’ll do with the money, maybe pay off some loans or take that trip you’ve been dreaming about. It feels like everything’s finally paying off.

You try to withdraw your full balance, but instead of getting the money, you’re told there’s a tax you need to pay first. It’s not a small fee, it’s big. Sometimes it’s a percentage of your total earnings; other times it’s a lump sum. Either way, they won’t release a cent until you pay it.

To convince you it’s real, they might send what looks like government paperwork or emails from a so-called tax agent. They might even arrange a call with someone pretending to be from a tax office or financial authority. It’s all fake, designed to pressure you into sending money.

The moment you send the “tax,” the silence starts. No replies. Your account gets locked. The platform disappears. Your money, along with that fake tax payment, is gone.

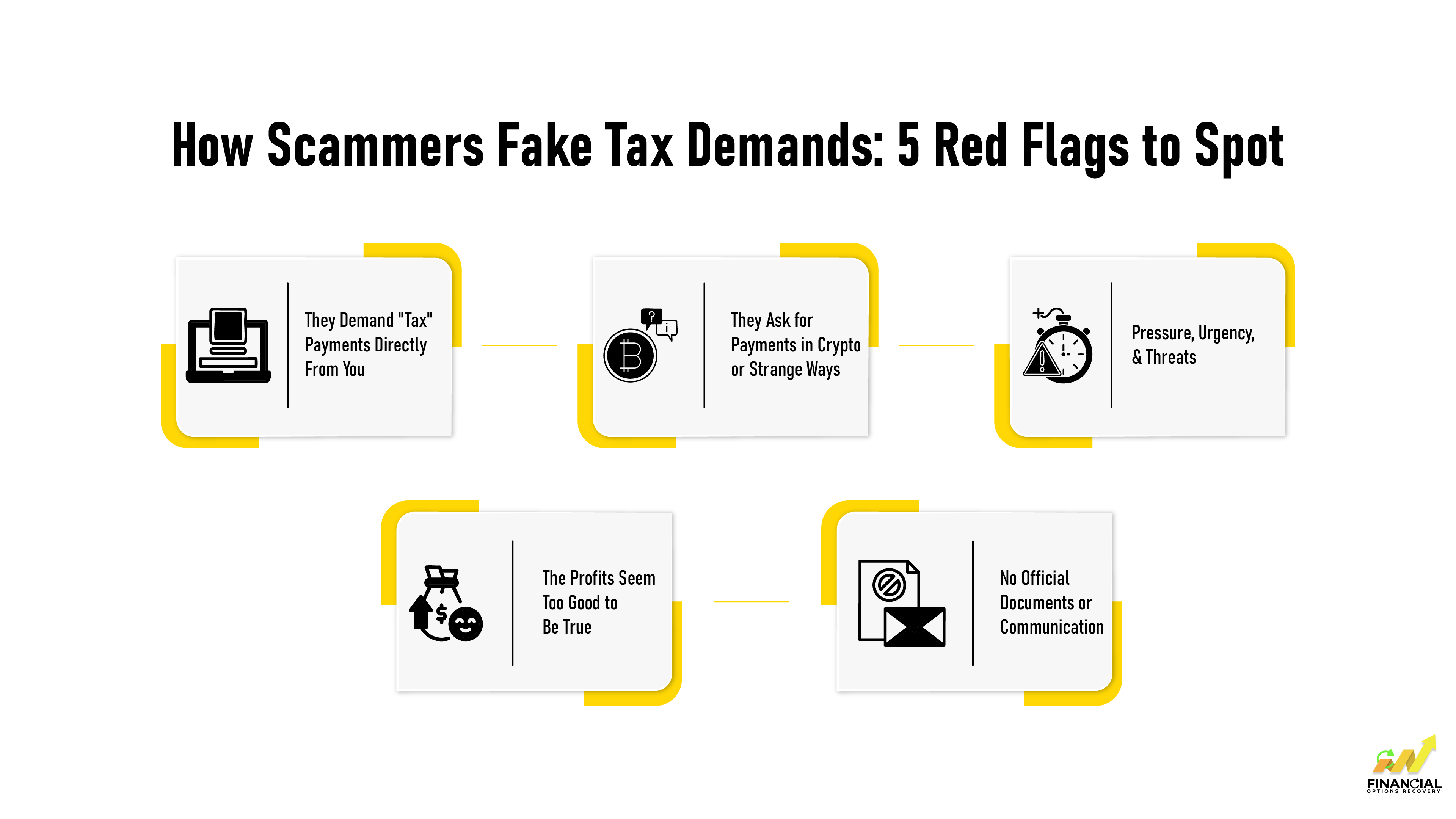

Now that you know how the fake tax trick works, let's talk about the specific red flags. If you see any of these, stop immediately and do not pay any more money.

Recognizing these red flags is your most powerful defense. If something feels off, it almost certainly is. Never let the fear of losing "profits" push you into paying more money to a potential scammer.

Let's understand how legitimate Forex trading profits are actually handled when it comes to taxes in the U.S. This information is crucial because it clearly shows why those "tax demands" from scammers are completely fake.

The most important point to remember is this:

Your trading broker or platform does NOT collect taxes from you on behalf of the government. Your responsibility for taxes begins and ends with the U.S. Internal Revenue Service (IRS), your national tax authority.

Think of it like this:

The U.S. tax system has different rules for different kinds of investments. For Forex, trades usually fall into one of two main categories, and knowing the difference can be important:

The type of Forex product that you're trading stipulates which rule governs, and finally, what amount of tax is owed. Your broker must issue tax reports (such as Form 1099-B) that categorize your trades so you can report accordingly.

The core message to take away:

A legitimate Forex broker's role ends at providing you with trading services and statements. They are not authorized to collect tax payments from you on behalf of the U.S. government. Any demand from your broker for "tax" money is a definitive red flag of a scam.

In August 2024, a U.S. investor shared on Reddit how they were trapped in a forex scam that used fake tax obligations as a withdrawal barrier. After seeing supposed profits on the platform, they were told to pay a 15% “IRS tax” before funds could be released. The scammers even set a deadline, pay by August 5th at 11 p.m., warning of credit score damage and legal consequences if ignored.

Thankfully, the victim caught on before paying, but others may not be as lucky.

Scams like this exploit trust and urgency. Victims either lose thousands trying to “unlock” profits or live in fear after refusing, believing they've broken tax laws. These tactics mimic official language and IRS procedures to confuse and manipulate U.S. citizens.

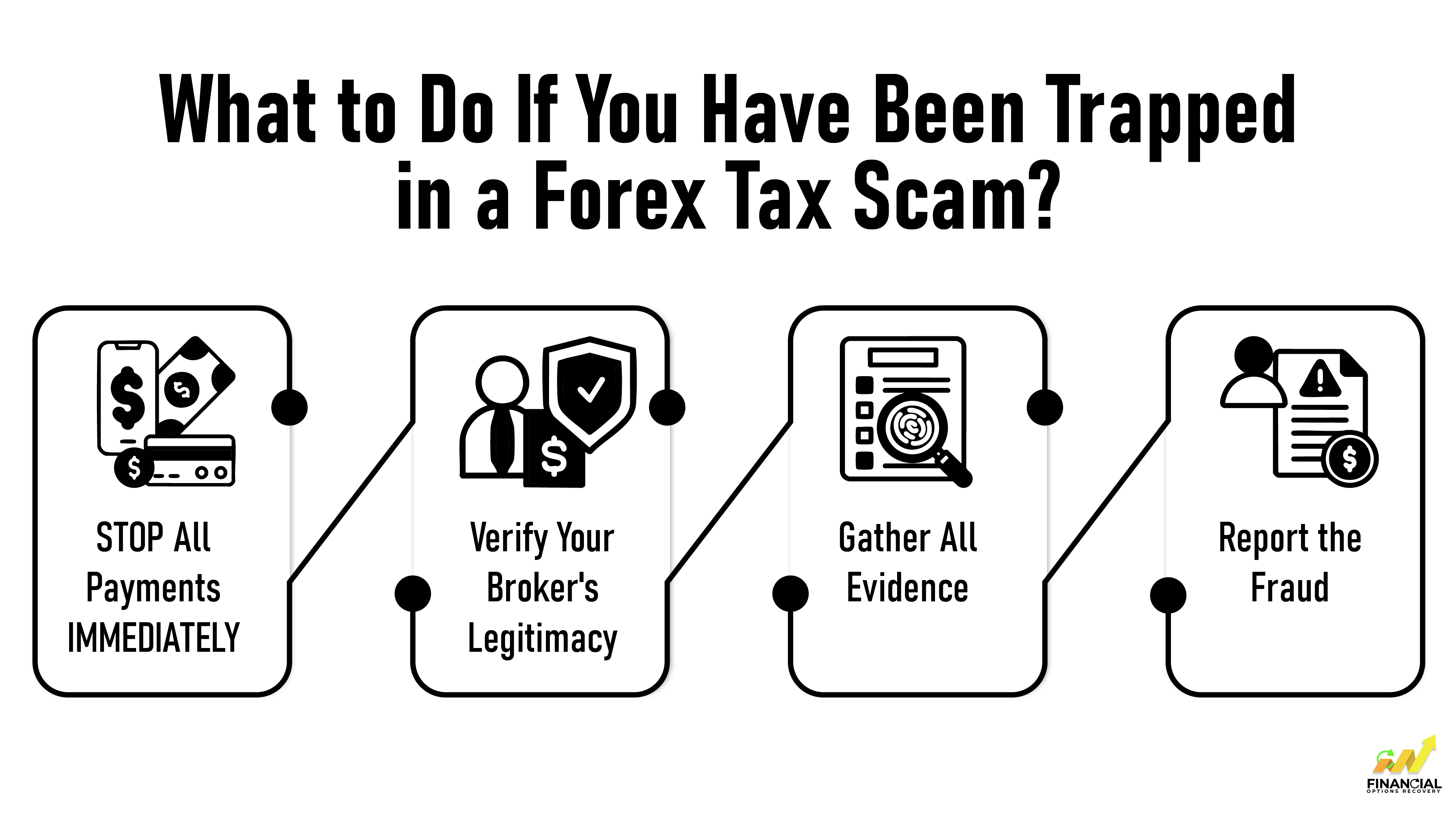

If you suspect you're caught in a forex tax scam, knowing the immediate steps to take is essential. Your swift action can help prevent further financial loss and is crucial for reporting the crime.

Consider contacting a reputable scam recovery firm experienced in handling forex and cryptocurrency fraud cases. Professionals like Financial Options Recovery, can assess your situation, trace stolen funds, liaise with relevant authorities, and improve your chances of recovery. Ensure the recovery service itself is legitimate by checking independent reviews and verifying business registration.

Forex scams are evolving fast, and the tax-before-withdrawal tactic is one of the most manipulative. Scammers know how to mimic legitimacy, using urgent deadlines, fake profit dashboards, and even referencing the IRS, to pressure victims into sending more money.

If you’ve already fallen victim, you’re not alone, but you don’t have to deal with it alone either.

If you've been scammed or suspect foul play, don’t wait. Get in touch with a recovery expert at Financial Options Recovery and take the first step toward reclaiming control of your finances.

In the U.S., taxes on forex earnings are paid after you’ve actually received the money, typically when filing your yearly tax return. No real broker or platform will ask for tax payments before releasing your funds.

To check if a Forex broket is legit or not,Look for registration with U.S. regulators like:

Never. The IRS or U.S. tax authorities do not use WhatsApp, Telegram, or social media DMs to contact people. If someone reaches you this way, it’s a scam.

Recovering money after a scam can be tough, but not impossible. If you paid by bank transfer or crypto, it’s harder to trace. Still, you should:

Report the scam to the FTC and IC3

Notify your bank or wallet provider

Seek legal help or recovery assistance, but vet them carefully to avoid more scams

To protect yourself from a forex tax scam:

Never pay taxes upfront to unknown platforms

Only trade with licensed brokers

Be skeptical of high-return promises

Avoid platforms that only communicate via chat apps

Ask questions and verify before you send money