The promise of financial freedom through forex trading can be incredibly compelling. The markets are open 24/5, and there's this exciting possibility of turning a small bit of cash into something substantial. It's no wonder so many investors are turning towards forex trading.

But here’s the truth that doesn’t get talked about enough: not every broker out there is playing fair. A growing number of them aren’t even regulated, and that’s where the danger lies.

Unregulated forex brokers are some of the most dangerous players in the game. They look legitimate. Their websites, the way they talk or present themselves, it's all professional-looking, but behind the scenes, they’re often just scams dressed up as real businesses. They’re often just well-planned schemes designed to steal your hard-earned money and vanish into thin air right when you need them most.

So, if you’ve ever thought about getting into forex trading, or if you’re already involved, this guide is for you. We’ll break down how these scams operate, point out the warning signs you should watch for, and most importantly, show you how to protect yourself from losing everything you’ve worked so incredibly hard for.

Table of Contents

An unregulated forex broker is a trading venue that does not have proper authorization or regulation from well-established financial authorities. Simply put, just like banks need a license to deal with your money lawfully, forex brokers need to be regulated so they will abide by set financial rules and operate in their clients' best interests.

In America, regulatory requirements for forex brokers are clear-cut and stringently followed. Any broker who provides services to U.S. citizens is required to be registered with the Commodity Futures Trading Commission (CFTC) and become a member of the National Futures Association (NFA). These organizations are tasked with upholding integrity in financial markets and ensuring proper safeguards for investors

So, why is regulation such a big deal?

Well, it’s essentially your first line of defense. A regulated forex broker has to stick to some pretty tight rules. They’re required to be open about their finances, keep your money separate from their business funds, and handle your trades fairly. Plus, if things go sideways, there are established ways to help you sort out any disagreements.

Unregulated brokers, on the other hand, are pretty much a law unto themselves. No one’s really watching over them. There’s no one to make them accountable. And that makes it incredibly easy for them to lie, manipulate, and just disappear with your money. When there’s no one overseeing things, it’s not just risky; it’s genuinely dangerous.

Unregulated forex brokers are not bound by any financial authority or legal oversight. This lack of regulation allows them to use dishonest and often aggressive tactics to take advantage of unsuspecting investors. Their goal isn't to help you trade; it’s to take your money, and here's how they do it:

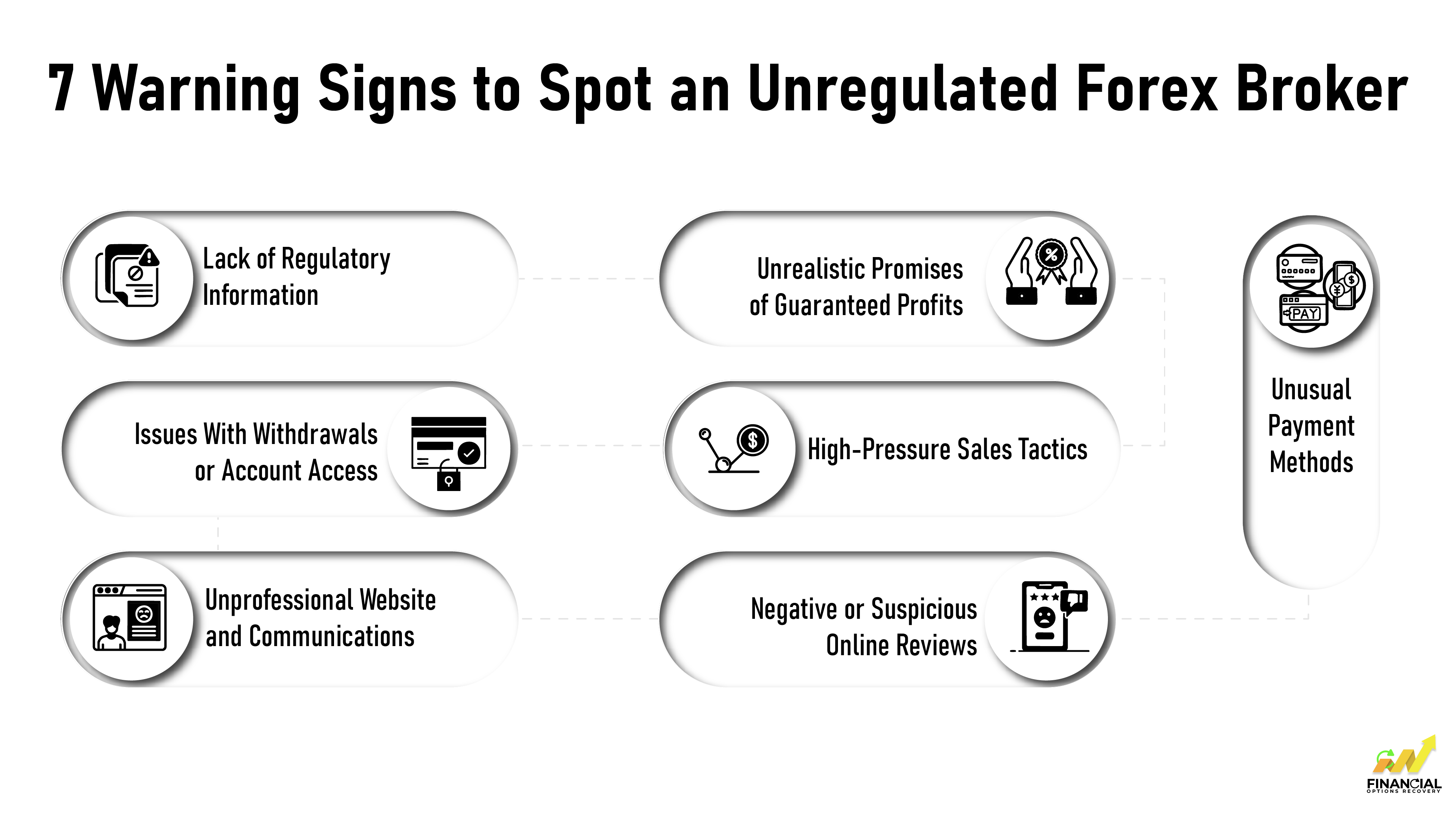

Protecting your money starts with recognizing the signs of a potential fake broker. Here are the most common warning signals to watch for:

A trustworthy regulated forex broker will clearly display their regulatory licenses and registration numbers. If this information is missing, vague, or tied to unknown foreign entities, it’s a major red flag. Always verify any license directly through official U.S. sources like the CFTC or NFA. Don’t rely solely on what the broker claims.

Be very cautious of brokers who claim to offer fixed returns, guaranteed profits, or risk-free trading. These promises are not only unrealistic, they’re deliberately misleading. No legitimate trading platform can guarantee profits, as all financial markets carry inherent risk. Scammers use these claims to create a false sense of security and to lure unsuspecting investors into depositing money quickly. In reality, any broker making such promises is likely more interested in your funds than your financial success. A credible broker will always be transparent about the risks involved.

Unsolicited calls, emails, or social media messages urging you to invest immediately are clear warning signs. Reputable brokers do not use aggressive sales tactics. If someone is pushing for large deposits, fast decisions, or asking for remote access to your device, it’s likely a scam.

Difficulty accessing your funds is a major red flag. If withdrawals are delayed without valid reasons, if fees seem excessive or unexplained, or if your account is suddenly frozen, you may be dealing with a fake broker.

Pay attention to the quality of the broker’s website and customer service. Signs of concern include frequent spelling and grammar errors, a generic or unresponsive support team, and no verifiable office address (only a P.O. Box or vague location).

Be cautious if the broker only accepts payments through untraceable methods like cryptocurrency or wire transfers. Legitimate brokers typically offer secure, standard options such as credit or debit cards. Avoid sending money to personal bank accounts instead of an identified company account.

Research the broker online. Consistent complaints or unresolved issues reported on independent review platforms (such as Trustpilot, Forex Peace Army, or SiteJabber) are strong indicators of trouble. Also, be wary of overly generic or overly positive reviews with no specific experiences mentioned; these may be fake.

It’s easier to avoid a scam than to recover from one. Here’s how to stay safe before you invest even a dollar:

We all want our money to work harder for us. And forex trading can seem like an exciting way to do just that. But it's important to know that alongside real opportunities, there are also serious scams designed to take your hard-earned money.

If someone promises you easy money, guaranteed profits, or tells you there's "no risk," that's your first major warning sign. These aren't just empty phrases; they're the hallmark of schemes that have cost real people real money.

Let's look at a recent case involving Roberto Pulido and his company, Lions of Forex LLC. Just this past January (2025), a U.S. court ordered them to pay over $685,000. Why? Because they defrauded investors.

Pulido used social media to present himself as a successful trader, promising guaranteed monthly profits if he managed people's money. Many individuals trusted him, hoping to build their wealth.

However, when these investors tried to withdraw their money or claim their promised earnings, a significant portion was simply gone. Over $170,000 vanished, taken by this fraudulent operation. It was a classic deception: make grand promises, then disappear with the funds.

Discovering you've been a victim of an unregulated forex broker scam can be devastating, but action is still possible.

Scam cases, especially involving international forex platforms or crypto payments, can be complex. That’s why many victims turn to specialized recovery firms for guidance and support. But be wary of fake recovery service providers. Scammers are often on the lookout for a second chance

One trusted and reliable financial fraud recovery expert is Financial Options Recovery, a professional recovery service that helps victims track stolen funds, analyze scam transactions, and work toward legal or forensic solutions. Their team understands how online scams operate and provides personalized support to guide you through the recovery process.

Reach out to Financial Options Recovery today for a confidential consultation. Let’s work together to hold scammers accountable and help you move forward with confidence.

The forex market offers real potential, but it’s not without real risks. Among the most dangerous are unregulated forex broker scams, which continue to deceive both new and seasoned traders by operating outside the boundaries of accountability. These entities thrive in the shadows, where there’s no oversight, no compliance, and no protection for your money.

But knowledge is your first line of defense.

When you understand how these scams work and, more importantly, how to spot them, you put control back in your hands. Verifying a broker’s regulatory status, staying alert to common red flags, and never rushing into promises of quick profits can mean the difference between a smart investment and a costly mistake.

You can verify a broker’s regulatory status by searching the CFTC’s RED List or using the NFA’s BASIC database. If a broker isn’t listed, they’re likely operating illegally or without proper registration, which should be a major red flag.

Not always, but many are. Without regulation, there's no guarantee that they follow ethical practices, safeguard your funds, or provide transparent pricing. It’s always safer to stick with brokers who are licensed by reputable regulators like the CFTC, NFA.

It’s difficult, but not impossible. If you've been scammed:

Report the fraud to the CFTC, FTC, or IC3.gov

Gather all communication and transaction records

Consider working with a reputable fund recovery service (avoid ones that ask for upfront fees)

To protect yourself:

Check their regulation status

Read real user reviews on trusted platforms like Trustpilot

Look for transparent fees, segregated client funds, and 24/7 support

Avoid brokers promising “risk-free trading” or “guaranteed returns”.

Many avoid regulation to sidestep strict financial rules and oversight. This allows them to:

Offer high leverage or unrealistic returns

Charge hidden fees

Operate offshore with no transparency

Legit brokers embrace regulation to build trust and credibility.