Table of Contents

In 2025, Facebook is more than a place to connect with friends or browse marketplace listings. It has also become a common space where fraudsters target people with fake crypto investment schemes.

With over 3.35 billion daily active users worldwide, scammers see Facebook as an opportunity to promote false promises such as “Double your money in a week,”“Guaranteed crypto returns,” or “Exclusive investment offers.” These claims are designed to look convincing, but the reality is far from it. Most victims end up losing their money without any way to recover it.

This guide will explain the latest scam tactics seen on Facebook, how you can recognize the warning signs, and the steps you should take to protect yourself and your finances in 2025.

A Facebook investment scam is a fraudulent scheme that uses the platform to trick users into giving away their money. The scammer will create a fake page or ads, or even fake groups that look genuine. They will claim to offer investment opportunities in cryptocurrencies, stocks, or trading platforms that promise high and guaranteed returns.

The means used to achieve this end may differ, but one thing that remains common is that everyone tries to gain your trust as quickly as possible. Their goal is to get as much money out of you as they can. Once you pay these criminals, they either cease to communicate with you or continue to ask for more 'fees' and 'charges' until the unfortunate victim finally realizes it is a fraud.

These scams often use professional-looking graphics, fake testimonials, and even stolen logos of real companies to appear genuine. This makes it difficult for users to separate a real opportunity from a fake one.

One of the main reasons Facebook investment scams are so effective is that they are designed to look convincing. Scammers use details that make their offers appear trustworthy and professional.

They often:

Many victims fall for these scams because they look just like genuine financial opportunities. The promise of quick and guaranteed returns can be especially tempting, making it harder for people to pause and question the offer before acting.

Although scams on Facebook can appear convincing, they often share certain warning signs. Being knowledgeable about them can save you from getting conned:

By paying attention to these details, you can recognize when something doesn’t add up and protect yourself from falling victim to online investment frauds.

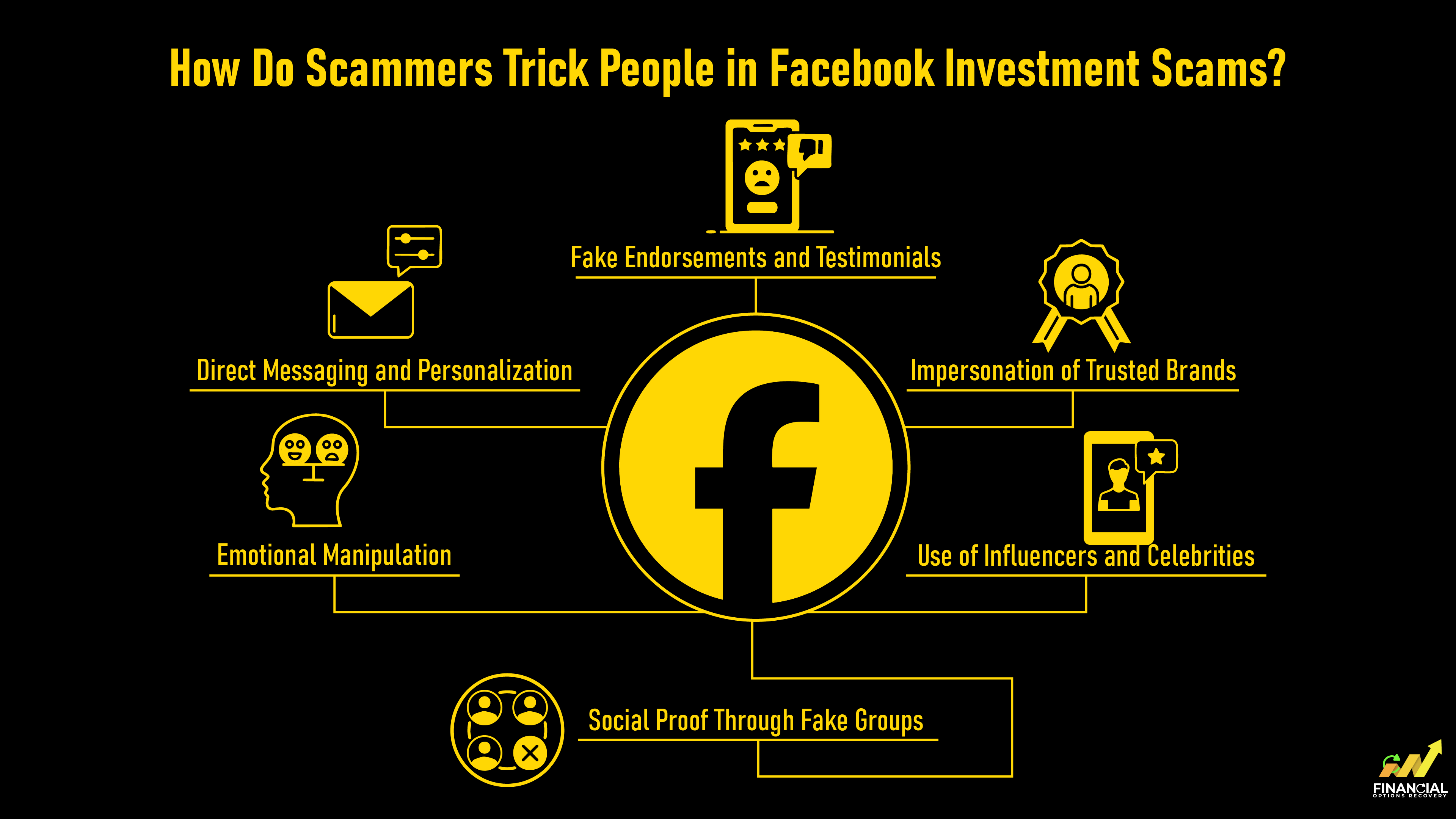

Investment scams on Facebook are not random; they are carefully designed to look believable and trustworthy. Scammers use a mix of psychological tricks and digital tools to convince people to part with their money. Some of the most common tactics include:

In 2023, a man from Warren County, New York, accepted a friend request on Facebook from someone he didn’t personally know. Their conversation quickly shifted to WhatsApp, where he was introduced to a cryptocurrency platform called NFT Universe via its website, NFT-UNI.com.

Over a period of five months, he was persuaded to make a series of deposits. He began with a payment of $13,196 and ultimately invested over $172,000, building trust as the site appeared to show growing returns

When he attempted to withdraw his funds, he was met with messages claiming “suspicious activity” and accusations of money laundering. The platform imposed fees and frozen access hallmarks of what investigators call a “pig-butchering” scam: fraudsters gain your trust, “fatten” you with simulated gains, then “slaughter” you by withdrawing funds and disappearing

By the time U.S. authorities intervened, more than $4.5 million had been stolen in total. While the website was seized, the victim’s losses remained, and recovery of funds was uncertain.

Read the full story here, Times Union.

Act fast. Quick action improves your chances of stopping more losses and documenting what happened.

If you’ve lost money and need extra support, you can explore legitimate scam recovery services. Organizations like Financial Options Recovery work with experts in tracing funds and will guide you through the recovery process. While no service can promise 100% reimbursement, expert help may improve your chances and give you a clear action plan.

The Facebook investment scam isn’t just another online trick, it’s a calculated attempt to exploit trust, social proof, and our desire for financial growth. Scammers thrive on urgency and credibility, but once you know how they operate, their tactics lose power.

The key lies in awareness: questioning unbelievable returns, double-checking pages that look “too professional,” and remembering that no genuine opportunity demands secrecy or rush. And if you ever find yourself trapped, don’t hesitate to seek recovery help; the sooner you act, the better your chances.

Online spaces can be empowering, but only when used wisely. By staying alert and sharing this knowledge with others, you not only protect yourself, but you also help build a safer community where scams lose their ground.

Victims of Facebook investment scams don’t have to face the aftermath alone. A trusted scam recovery service can assist with fund tracing, bank communication, and official reporting. Explore recovery options here to start reclaiming what’s yours.

First, change your password immediately and enable two-factor authentication. Then, report the account compromise to Facebook. You should also alert your friends and family that your account was hacked and any messages they received from it are fraudulent.

It is very difficult to recover money lost in an investment scam, especially if you used untraceable methods like cryptocurrency or wire transfers. However, you should still report the crime to the FTC, SEC, and your local law enforcement.

No, not all are. However, you should approach any unsolicited investment offer with extreme caution. Legitimate financial professionals typically don't pitch investment opportunities through direct messages or public social media posts to strangers.

Scammers use public information on your profile to target you. They may join groups you're in, target people who post about financial struggles or interest in making money, or use targeted ads to reach specific demographics.