Have you ever wondered what really happens to your money when you invest in crypto?

Today, people use cryptocurrencies, NFTs, and other digital tools to trade, invest, and save money online. These are called digital assets, and they exist online, secured by blockchain technology.

But here’s the problem: scammers love digital money too. They create fake platforms, copy real websites, or promise huge profits just to steal from you. And since crypto is harder to trace than traditional money, it’s a favorite target for online fraud.

According to the CFTC, fraud involving digital assets is on the rise. Thus, in this blog, we’ll walk you through what digital assets are, how scams operate, and, most importantly, how to spot and avoid online fraud before it’s too late, and alsoways to recover your lost funds.

Table of Contents

Digital assets are anything valuable that you can own and use online, but they’re not physical like cash or gold. Instead, they exist in a digital form, stored on the internet, and are often secured by technology like blockchain.

Some of the most common types of digital assets include:

Your digital assets can be bought or sold and may even be stolen online. This is mainly due to the expansion of digital finance; learning to keep virtual currencies and digital properties safe is more important. Unfortunately, scammers know this too, and they often create fake apps or platforms to trick people into handing over their tokenized assets.

Unfortunately, scammers know this too, and they often create fake apps or platforms to trick people into handing over their tokenized assets.

Digital assets may be revolutionary, but they’re also risky. Because crypto, NFTs, and other online assets are often anonymous, fast-moving, and hard to trace, they’ve become the perfect playground for scammers.

Here’s why scammers love them:

Many cryptocurrencies allow users to stay hidden, making it difficult to trace who’s really behind a wallet. This makes it easier for scammers to disappear with stolen funds.

Traditional banks have fraud detection systems. But in the blockchain world, you’re often dealing with decentralized systems, meaning no one’s watching your back if something goes wrong.

Crypto moves fast. Scammers create fake websites or platforms that vanish just as quickly, before investors even realize what happened.

Anyone can set up a professional-looking crypto platform or app or even impersonate legit exchanges. This false trust leads to huge losses in online investment fraud.

The digital asset world is still new, and many scams operate in legal gray areas or outside regulated markets.

With the explosion of digital assets, scammers are getting more creative than ever.

Here are the top crypto-related scams to look out for and how to avoid falling into their trap.

|

Type of Scam |

What It Looks Like |

Red Flags to Watch |

Who They Usually Target |

How to Protect Yourself |

|

Phishing Scams |

Fake emails, texts, or links that mimic crypto platforms to steal info. |

Spelling errors, unusual URLs, urgency to act fast. |

New investors, careless users, or those unfamiliar with crypto security. |

Double-check URLs, don’t click suspicious links, never share your private keys. |

|

Fake Investment Schemes |

Crypto “opportunities” offering huge returns with no risk. |

Guaranteed profits, unrealistic promises, pressure to act fast. |

Greedy or inexperienced investors, especially during market hype. |

Research thoroughly, avoid FOMO, never invest based on hype alone. |

|

Rug Pulls |

New crypto projects/tokens that disappear after raising investor money. |

Anonymous team, no whitepaper or roadmap, sudden disappearance. |

NFT and DeFi investors chasing new trends. |

Avoid projects with no real team or credibility, look for third-party audits. |

|

Pump and Dump Schemes |

Groups artificially inflate coin prices and sell off quickly. |

Sudden spikes in price, hype with no fundamental reason. |

Greedy or uninformed traders on Telegram or Reddit. |

Don’t invest based on social media hype. Do your own analysis. |

|

Online relationships where the “partner” pushes crypto investments. |

Intense emotional bonding, sudden crypto talk, secrecy. |

Single, divorced, or older adults on dating apps. |

Don’t send money or invest at someone’s request unless verified. |

|

|

Fake Wallet Apps |

Fraudulent apps that steal user funds once crypto is deposited. |

Off-brand app names, poor ratings, no real dev contact. |

Mobile users, especially Android users in emerging markets. |

Only install wallets from official sources (e.g., Trust Wallet, MetaMask). |

|

Giveaway Scams |

Social media giveaways asking you to send crypto first to “receive more.” |

“Send 0.1 BTC to get 0.2 BTC,” fake celebrity endorsements. |

Twitter users, YouTube viewers, and event participants. |

Real giveaways don’t ask for payments. Report and avoid. |

|

Scammers posing as influencers, support agents, or crypto experts. |

DMs from “verified” profiles, offers of help or investment advice. |

Beginners seeking help or advice on platforms like Telegram/Discord. |

Always verify identities via official platforms before acting. |

|

|

AI Voice/Deepfake Scams |

Calls or videos using AI to mimic people you trust, asking for urgent transactions. |

Odd phrasing, rushed demands, refusal to verify identity. |

Business owners, investors, or employees with asset access. |

Always confirm using a secondary channel (text/email/URL). |

Scammers are experts at deception. They know how to gain your trust quickly and use it against you.

Here’s how they usually operate:

“Guaranteed returns”

“Exclusive investment opportunities”

“Now or never investment”

Once they get your money or personal info, they disappear without a trace.

The result? Victims are left feeling helpless, embarrassed, and unsure of what to do next.

Recognizing these tactics is the first step in protecting yourself and starting the path to recovery.

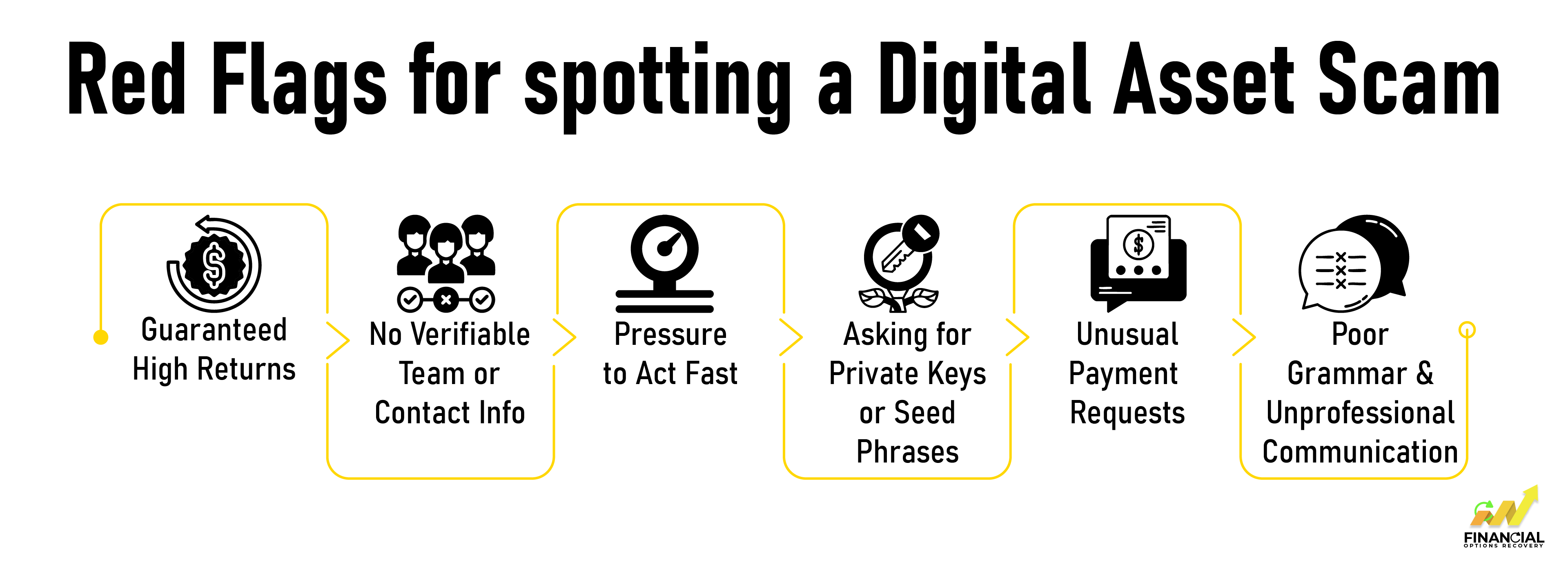

Spotting a scam starts with knowing what to avoid. Be cautious of anyone promising guaranteed high returns; no legit crypto investment is risk-free. If a platform has no real team info, pressures you to act fast, or asks for your private keys or seed phrase, it’s a major red flag.

Also, watch out for unusual payment requests (like gift cards or crypto only), poor grammar in communication, or fake-looking websites. These are all common signs of a digital asset scam or fraudulent crypto platform. Always research first and never rush into an offer that feels off.

If you’ve been scammed, don’t worry. Here’s what you should do next and why it helps:

Act fast and follow these steps. The quicker you act, the better chance you have to protect yourself and get your money back.

If you’ve read this far, chances are you or someone you care about has been affected by a digital asset scam, or you're trying to avoid one. First, know this: you’re not alone, and you’re not to blame. These scams are designed to trick even the most careful investors.

Understanding how scams work is your first line of defense. And now that you're more informed, you're already one step closer to protecting your assets and possibly recovering what you’ve lost.

If you’ve been scammed, get help now.

Our trusted specialists are here to guide you through the process, step by step.

Crypto transactions can usually be tracked with the right tools and forensic analysis over wallets and exchanges. By looking at the data, recovery experts can determine trends, trace stolen items, and help police or attorneys with their cases.

There is no way to reverse a crypto transaction. If money is sent and the recipient does not return it, you cannot get it back, so you must be careful.

Such a scam occurs when the crypto project developers suddenly make away with the funds and disappear, leaving the investors holding tokens and title to nothing. Always research the project team, consider a third-party audit, and never invest in anything that has an anonymous developer.

Yes,Some fake wallet apps or browser extensions can capture your private keys and drain your assets. Always download wallets from official sources and check for user reviews and verified developers.

Yes, if you connect your wallet to a scam website, sign an unverified smart contract, or interact with a phishing link, a scammer can drain your assets even if they have no password.