Table of Contents

Crypto, just saying the word makes people feel something like curiosity, excitement, confusion… maybe even the feeling that you're missing out on something important. Cryptocurrency is the future of finance, but it's not just a revolution with risks; it's also a riddle.

But here is the real question:

Do you truly understand what you're investing in, or are you simply following the crowd, hoping you’re making the right move?

Behind the professional apps, trending tokens, and promises of financial freedom, there’s another side to crypto. It's not something people share in group chats or flaunts on Instagram stories.

Scammers often present themselves as legitimate opportunities, leveraging urgency and hype to manipulate their targets. Moreover, cryptocurrency is built in a space that has anonymity and decentralization. With zero chargebacks, it is a playground for scammers.

This blog isn’t here to tell you crypto is bad. It is here to ensure that you are not the one stuck with empty promises while the scammers run off with real money. Let us break down how these scams actually work, how to spot the red flags early, how to protect yourself, and what to do if you have lost money to crypto scams.

Before we talk about what these scams actually look like, it is important to understand why the crypto world is such an easy ground for scammers in the first place.

Cryptocurrency is exciting, no banks, no middlemen, and full control over your money. But that same freedom is also what makes it risky. Unlike traditional finance, there are no built-in safety nets. If something goes wrong, there’s often no one to call for help.

Here’s why cryptocurrency scams take place:

Most cryptocurrencies operate outside of government regulations. That gives people more freedom, sure, but it also means less protection. If you get scammed, there's no central authority to step in or help reverse the damage. It’s not like calling your credit card company to dispute a charge.

Crypto wallets don't need real names. Cryptocurrency allows one to operate anonymously through alphanumeric addresses, making post-fraud traceability extremely challenging.

Crypto payments are final. Once you send funds, they are gone. There is no undo button, and scammers are aware of this.

Crypto is complex, but it’s often promoted as a fast, easy way to get rich. Many new investors jump in without fully understanding how it works. That lack of knowledge creates the perfect opportunity for scammers to step in and take advantage.

Crypto moves fast, and no one wants to miss out on the next big thing. Scammers know how to play on those emotions, rushing people with fake urgency, too-good-to-be-true promises, and pressure to ‘act now’. When emotions take over, it gets difficult to think straight and choose wisely

Now that we know why crypto scams thrive, let's take a closer look at how they actually happen and what you should be watching out for.

Crypto might be built on code, but scams are painfully human, they are all about trust, urgency, and manipulation. Crypto promises freedom, speed, and massive returns, and scammers know exactly how to twist that to their advantage. From unreliable tokens to fake trading apps, here are the most common crypto scams that even smart people fall for.

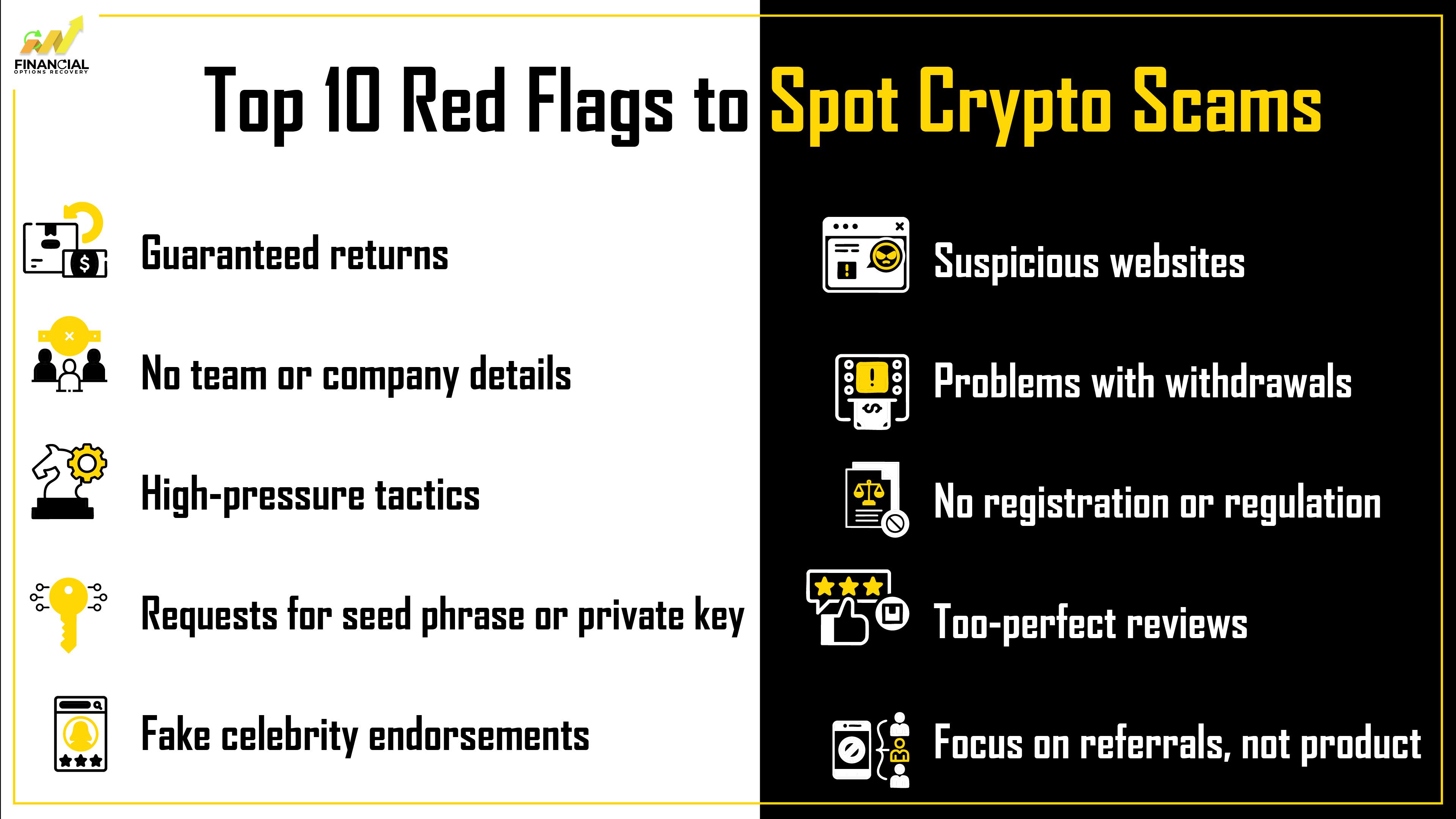

Knowing the types of scams is only half the story. The real power lies in spotting them before they reel you in.

Scams don’t always look like scams. They can appear helpful, trustworthy, or even exciting.

So, before you act, here is a list of red flags that should make you think twice.

Scams aren’t statistics. They are stories of innocent people who clicked one link, believed one message, or trusted the wrong person. Here is one such story that shows how crypto scams can drain you.

In a devastating example of how crypto scams can destroy lives, a 64-year-old woman from Ohio lost over $200,000, her entire life savings, after falling victim to a sophisticated cryptocurrency investment fraud. The scam, masked as a legitimate investment opportunity, exploited the victim’s trust through online communication and false promises of high returns.

Key Facts of the Case:

This isn’t just another scam story, it’s a painful reminder of how manipulative and deceptive these frauds can be. Scammers don’t just steal money, they play on emotions, build trust, and slowly pull people in. Even smart, cautious individuals can get caught up when the platforms look professional and the promises feel real.

The damage goes far beyond dollars. Victims are often left feeling ashamed, betrayed, and painfully alone. They start to question their judgment, their choices, even their worth. And because crypto transactions are mostly unregulated and anonymous, there's often no clear way to get the money back.

It’s a heavy reality. But it’s one we can learn from, like in this case where a victim shares how she lost money to a crypto scam and began her journey toward recovery.

Let’s move forward and learn how to protect yourself before it happens to you.

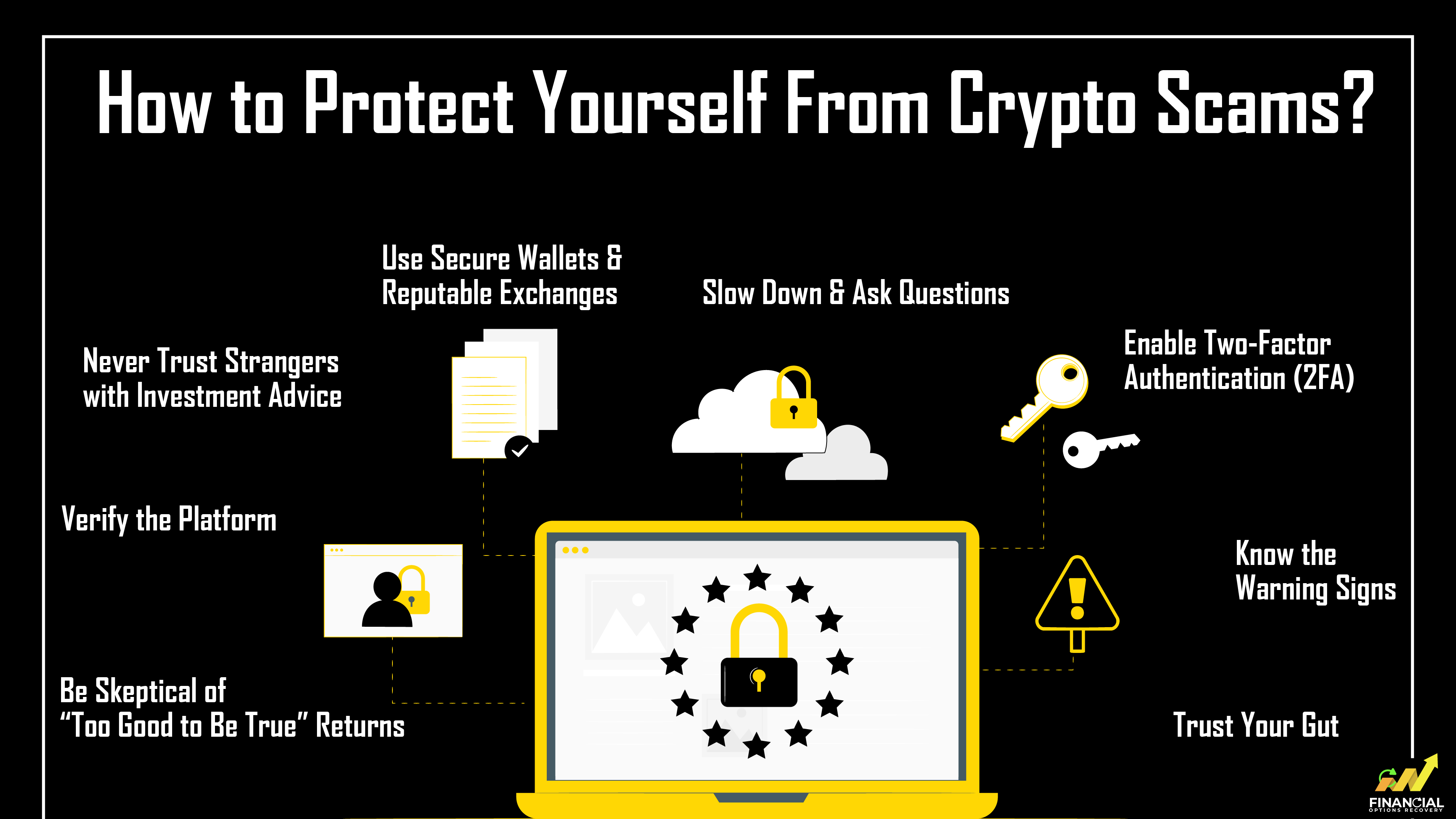

Does that last story make your heart sink? You’re not alone. The truth is, anyone can be a target. But here’s the good news: you can take steps to protect yourself, and they don’t require deep tech knowledge or financial expertise, just awareness and caution.

If you’ve fallen victim to a crypto scam, know this first: you’re not alone, and it’s not your fault. These scams are designed to trick even the most cautious individuals. The important thing is to act fast and smart.

Navigating crypto recovery can be complex and emotionally draining. That’s why many victims turn to professional recovery firms likeFinancial Options Recovery. Their team specializes in blockchain forensics, fund tracing, and scam resolution, helping victims take clear, guided steps toward potential recovery while avoiding second scams.

Ready to Take the Next Step?

If you've been scammed and need support from professionals, you can connect for a free consultation with Financial Options Recovery. Their team listens, understands, and helps you move forward with honesty, empathy, and real tools.

Stay Safe, Stay Smart

Crypto is a powerful technology, but like any tool, it can be misused. Staying informed, asking questions, and trusting your intuition can make all the difference.

You don’t need to be a blockchain expert to stay safe, you just need to stay aware.

Romance-investment scams and fake trading platforms are currently among the most widespread. Scammers build trust emotionally, then pitch fake investment “opportunities.”

It’s very difficult. Most crypto transactions are anonymous and irreversible. Some victims have success reporting to federal agencies or hiring recovery services, but results are not guaranteed.

You can report it to:

Not all. But new, unregulated, or international platforms pose higher risks. Stick to well-known, US-regulated exchanges and always double-check before investing.

They can help, but only if you're extremely cautious. There are genuine recovery firms that specialize in tracing blockchain transactions, filing legal complaints, and guiding victims through the process of potential fund recovery. However, the space is filled with fake recovery agents who prey on victims a second time, promising impossible results or demanding upfront fees.