They say the worst scams are the ones that come just when you think you’ve won.

You’ve finally made it, your crypto portfolio is showing big profits, and you're ready to cash out. But then comes a sudden request: ‘Just pay a small withdrawal fee to process your earnings.’ It sounds reasonable. After all, platforms have fees, right? But in these cases, the fee is fake, and so are the profits you’re trying to withdraw.

In reality, there’s no money waiting. No real platform. Just a careful setup of an illusion and a fake fee, designed to squeeze one last payment out of you.

Crypto withdrawal scams are some of the most financially manipulative and emotionally devastating cons out there. And they’re becoming alarmingly common.

In this guide, we’ll break down how these scams actually work, the signs that are often overlooked, and what you can do if you’ve been targeted. A little awareness now can save you from a costly mistake later.

Table of Contents

High-fee crypto withdrawal scams are a type of financial fraud where scammers convince individuals to pay upfront charges. Often labeled as “withdrawal,” “processing,” or “network” fees, in order to release their cryptocurrency funds or profits.

These schemes typically operate through fake trading platforms, investment websites, or impersonated exchanges. Victims are shown fabricated account balances or investment gains to make the scam appear legitimate. When they attempt to withdraw their funds, they are told a fee must be paid first.

In reality, there’s no money waiting, no real platform, just a careful setup of an illusion and a fake fee, designed to squeeze one last payment out of you.

Crypto withdrawal scams are some of the most financially manipulative and emotionally devastating scams out there. And they’re becoming alarmingly common. Unfortunately, many victims are often caught up in similar crypto investment scams that follow the same pattern of false profit claims and fake fees.

Here’s how these scams typically work:

Scammers don’t just ask for money; they work hard to make everything look believable. Fake crypto platforms are built to copy the design and behavior of trusted services. Here’s how they create a false sense of security:

All of this is designed to make you feel confident. By the time you’re asked to pay a large withdrawal or processing fee, it feels like a routine step, not a red flag. That’s how these scams pull people in and keep them hooked until real money is lost.

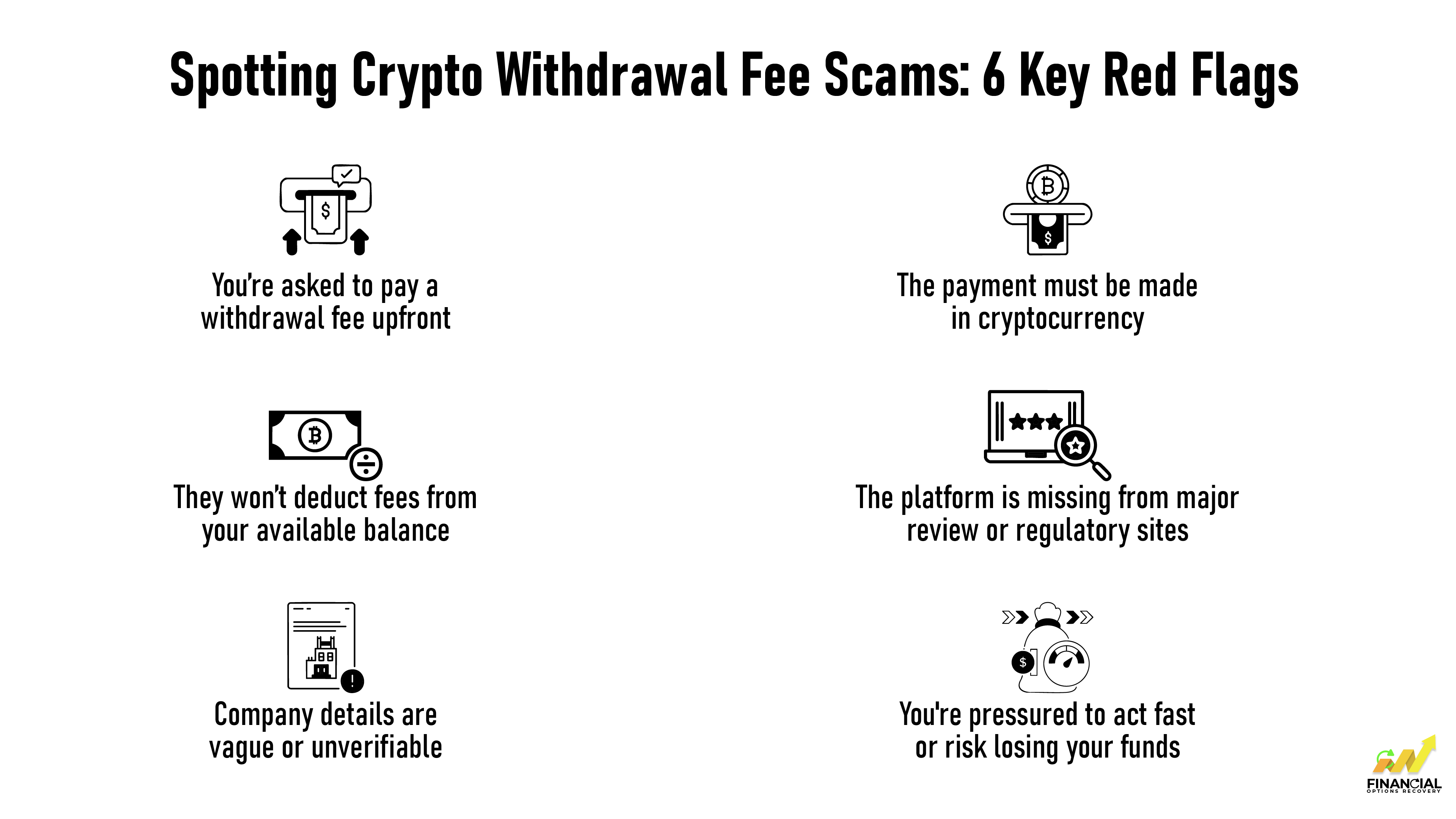

These scams work because scammers are getting smarter at making these scams look and feel legitimate. But no matter how convincing they seem, there are always warning signs. The key is knowing what to look for before you send any money.

No matter how professional a crypto platform looks, it still can’t cover all the loopholes of a fake platform. While crypto withdrawal requests are often seamless, withdrawal delays can be one of the first signs you're dealing with a scam.

If you’re unsure whether a crypto platform is genuine, these red flags can help you identify a scam before it’s too late:

Recognizing the warning signs is only the first step in protecting yourself from scammers. These fraudsters don’t rely on simple tricks; they use calculated tactics designed to confuse, manipulate, and pressure you into handing over your money. They may create a false sense of urgency, exploit your emotions, or use technical terms to overwhelm you.

Thus, understanding how these deceptive methods operate empowers you to stay one step ahead, resist their manipulations, and safeguard your finances from falling into the wrong hands.

Scammers are always coming up with new ways to fool people, especially investors. Here are some of the most common tactics they use to confuse and rush you:

If you encounter a request for a withdrawal fee, it’s crucial to act carefully. Here are the steps to protect yourself:

Scammers rely on rushing you. Take a moment to think before making any payment or sharing sensitive information.

Search online for the platform’s name combined with keywords like “scam,” “fraud,” or “review” to check for any negative reports or warnings.

Keep detailed records of every interaction, including emails, chats, and wallet addresses. This information can be essential if you need to report the scam.

Inform the proper agencies to help protect others and possibly recover your funds:

Be cautious of services promising to get your money back for an additional fee. These recovery scams often prey on victims again.

If you’ve lost funds, consider reaching out to reputable recovery firms that specialize in crypto fraud cases. For example, Financial Options Recovery (FOR) offers expert assistance in recovering lost assets while guiding you through the process safely.

Scams like these don't exist only in theory; they're happening every day to real people. Scammers are using clever tactics that sound official and believable. So, understanding how these frauds work can help you recognize the signs and avoid costly mistakes. To make you understand this better, here’s a recent case that shows just how serious and convincing these scams can be and why staying informed is your best defense.

Back in March 2025, Theresa, a woman from the UK, thought she had made it big. She has been investing in cryptocurrency, and her investments have shown a profit of £150,000. She was finally ready to cash out, but when she tried to withdraw her money, something strange happened. She was told she had to pay £29,000 in tax to HM Revenue & Customs (HMRC) before she could get her funds.

It sounded serious and official. But something didn’t sit right. Instead of rushing to pay, Theresa decided to double-check. She picked up the phone and called HMRC herself.

That one call made all the difference.

HMRC told her straight away: there was no such tax. It was a scam.

Theresa was lucky and smart. If she hadn’t reached out to confirm, she could have lost nearly £30,000 to scammers pretending to be the government.

Her story is a powerful reminder: if someone asks you to pay a large fee or tax before you can access your money, especially from a crypto platform, stop and check. Scammers are getting better at sounding official, but one phone call could save you from a big mistake.

Read the full story here.

Another victim shared their story after falling for a similar high-fee withdrawal scam, where they lost thousands believing their profits were real. Their journey to recovery highlights how support and expert help can make all the difference.

If you’ve been targeted or worse, lost money, you’re not alone. These scammers play with your emotions to trick money out of your wallet. The best way to protect yourself is by staying informed.

Never pay a fee to withdraw money that’s already yours. If something feels off, pause and talk to someone you trust before sending any payment.

If you’ve fallen victim and need help recovering your funds, don’t hesitate to reach out to a professional recovery firm like Financial Options Recovery. They specialize in helping victims get their money back and provide expert guidance every step of the way.

Protect your money and peace of mind. Contact Financial Options Recoverytoday for professional recovery support.

Yes, withdrawal fees are a standard part of crypto transactions. But they’re usually small and taken straight from your balance. If someone’s asking you to send extra crypto just to unlock your funds, that’s a Red Flag.

Absolutely not. Authentic platforms deduct any applicable fees from your existing balance during the withdrawal process, there are no surprise manual payments required. If they’re asking for crypto to “release” your funds, it’s likely a scam.

Recovering funds in case of a withdrawal fee scam be challenging, but it’s not impossible. The first step is to stop sending more money. Scammers often come back with new excuses to ask for more. Then report it to the FTC, IC3, or reach out to a trusted recovery service.

To know is a crypto platform is legit or not, do a quick check, look for real reviews, proper licensing, and see if it shows up on scam-warning sites. If it feels shady or if it is hard to find information, be careful.

Absolutely, yes. Scams are designed to deceive, even the most cautious individuals can fall victim. Reporting the incident is not just important for your own recovery, but also helps raise awareness and prevent others from becoming targets. There is no shame in being targeted; silence only empowers scammers. Sharing your experience can be a step toward resolution and resilience.