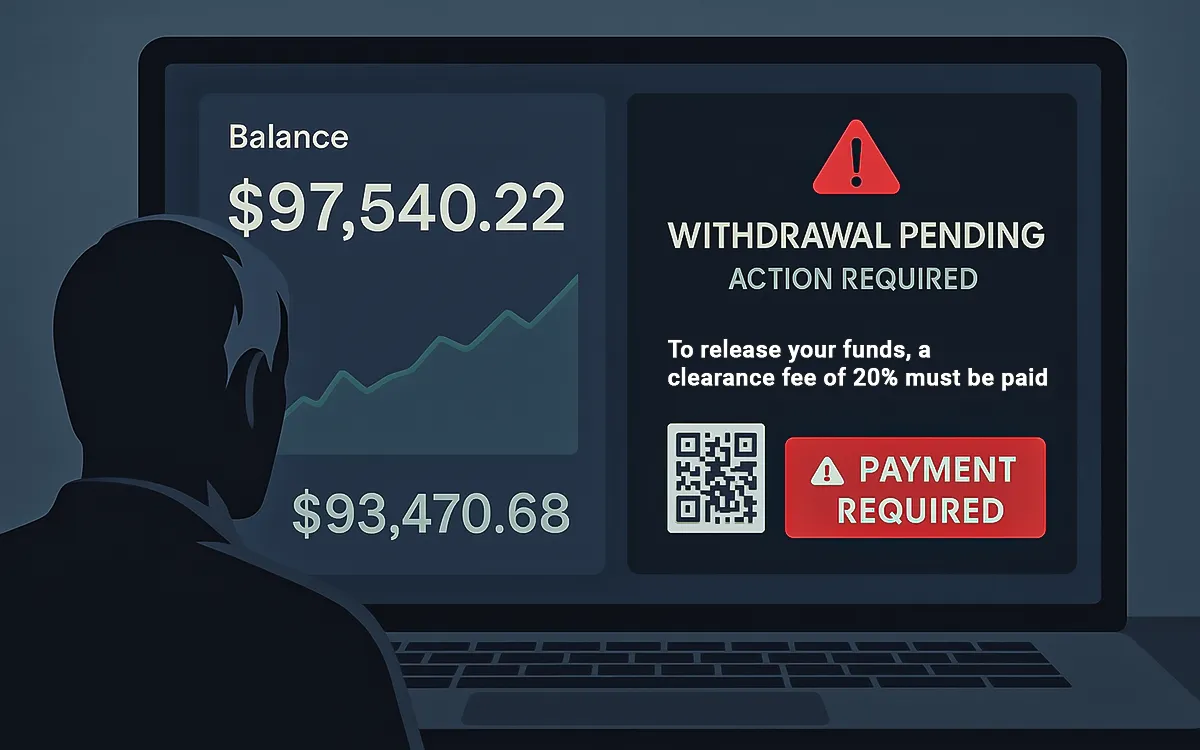

It often starts with excitement, an online crypto investment that seems to grow fast, with promises of big returns. The account balance keeps rising, and everything looks real. But the moment someone tries to withdraw their earnings, the trap is revealed.

Suddenly, there is a message: a tax or compliance fee must be paid before the funds can be released. It sounds official and feels urgent. And it always comes with the same outcome: your money is gone, and the withdrawal never happens.

Table of Contents

This type of scam is becoming more common across the U.S., catching new and experienced users off guard. These "crypto tax scams" are stealing millions by exploiting a knowledge deficit: the lack of understanding of how taxes on cryptocurrencies function. In this blog, We will break down how these scams work, why they feel so convincing, and how to recognize the red flags before it’s too late.

You've invested in crypto, watched your holdings grow, and now you're thinking of taking out some of your profits. You hit "withdraw," expecting your money to land in your bank account.

But then, a message pops up. It says you owe "capital gains tax" first. And here's the trick: they demand you pay this tax in crypto, right then and there, to an address they give you. It sounds official, a little threatening, like you better pay up!

That is a crypto tax scam. These scammers create neat-looking websites, complete with fabricated profits, to fool you. They are aware that learning crypto taxes is complicated, and they prey on newbies' ignorance. They play on your anxiety of getting it wrong with the tax authorities.

But here's the important fact you need to keep in mind: In America, you remit your crypto taxes directly to the IRS when you submit your tax returns. A reputable site will never request that you pay taxes in advance via a crypto wallet for your funds to be released. If a site requests crypto for "taxes" to withdraw, it's a scam. No question about it. They're simply attempting to steal your hard-earned crypto.

Note: None of this happens in real U.S.-regulated exchanges.

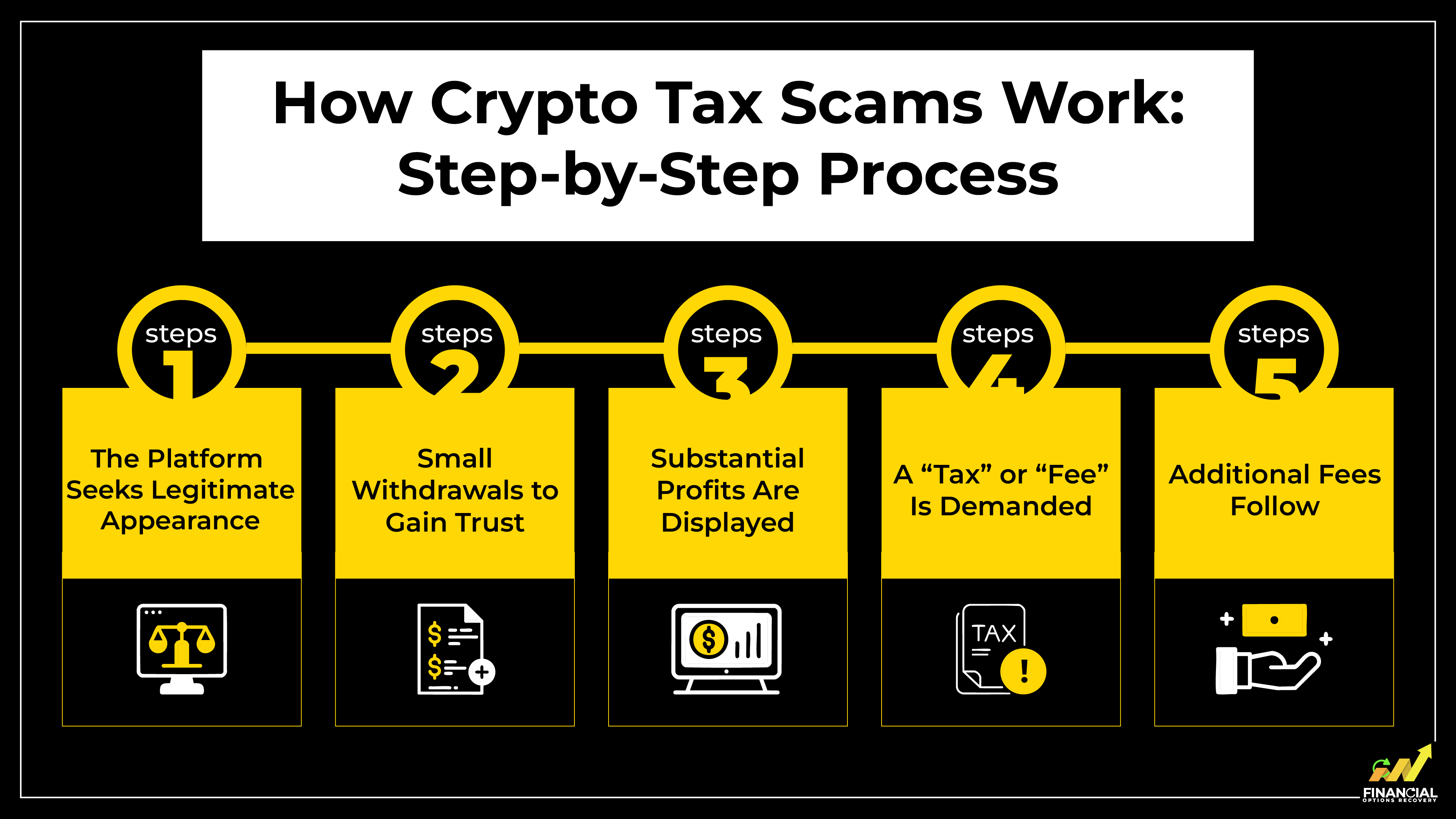

Cryptocurrency tax scams work through a multi-step process that is intended to trick individuals. Even experienced investors may fall victim to such scams, mostly because of the fake tactics used and psychological vulnerabilities being exploited.

The process generally goes like this:

Scammers begin the scam by posting highly professional-looking websites and dashboards that closely copy genuine cryptocurrency exchanges or investment platforms. These imitation sites frequently feature realistic touches, including mock customer support chats, to establish trust at first glance.

In order to legitimize the illusion, small withdrawals are permitted, e.g., a few hundred dollars, early on in the interaction with the site. This small success breeds confidence and leads to more investment, and the site appears genuine and trustworthy.

A key phase in the scam involves the display of dramatic, often fabricated, profits on the victim's account balance. These significant gains, appearing effortlessly acquired, are designed to generate excitement and an eager desire to cash out the supposed earnings.

Just as the victim attempts to withdraw their substantial "profits," an unexpected demand emerges. They are informed that a "tax" or "fee" (often ranging from 15% to 30% of their purported earnings) is required before funds can be accessed. Scammers falsely claim that this is a mandatory payment to a tax authority like the IRS, portraying it as standard protocol.

If the initial "tax" is paid, the scam intensifies. New and often escalating fees are introduced, such as "audit fees," "wallet unlock fees," or "final clearance fees." This continuous demand for payments creates an endless cycle, designed to extract as much money as possible. As one victim candidly stated, "I sent the tax because I didn’t want IRS trouble. Then they wanted a ‘security fee.’ That’s when I realized it was fake."

This combination of calculated deception and psychological manipulation proves highly effective in separating individuals from their assets.

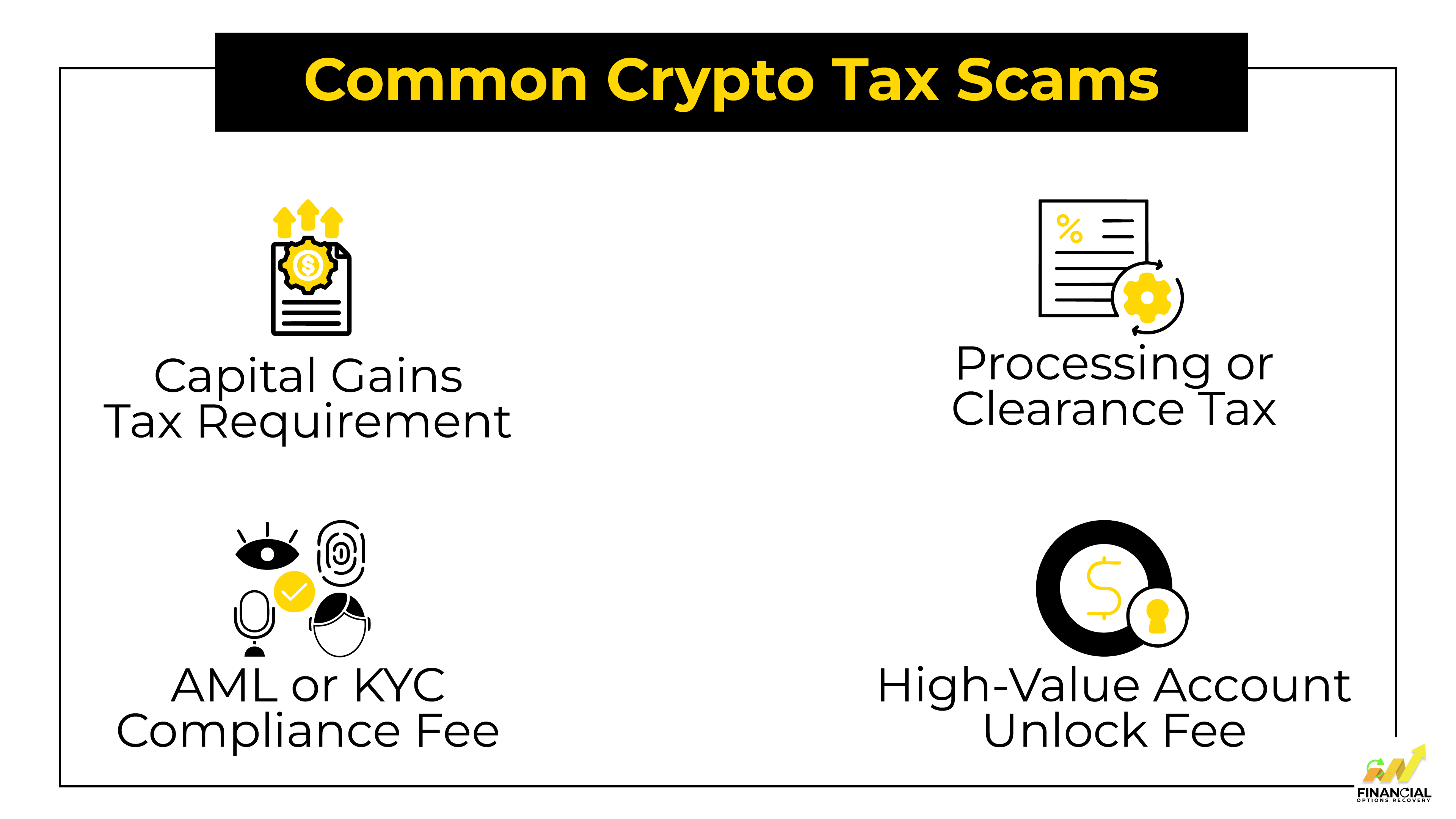

Although the underlying mechanics of crypto tax scams are always the same, scammers are clever at rebranding their requirements with different scenarios. They use words that sound official in the context of the financial and regulatory world to mislead victims into assuming these are official requirements.

Some of the most prevalent tax-related scam varieties you may face are listed below:

This is one of the most frequently used approaches. The scammer will inform you that your displayed "profits" are subject to capital gains tax, a legitimate concept in real financial markets. However, the demand itself is fraudulent.

Example: "Congratulations! You've earned $75,000 in profits from your crypto investments. To release these funds to your wallet, you are required to pay a capital gains tax of $9,500 immediately."

Scammers often use terms such as ‘Anti-Money Laundering (AML)’ or ‘Know Your Customer (KYC)’ compliance. The terms are plucked from the real world of stringent AML and KYC processes imposed upon genuine financial agencies and crypto exchanges, only to be twisted and reviled by scammers into demands for fictitious charges for "verification" or "clearance."

Example: "Per regulatory requirements, your account is currently under review for anti-money laundering concerns. A verification fee of $5,000 is required to complete the check and unblock your withdrawal."

Another common ruse involves claiming a "processing" or "clearance" tax. This fee is presented as a necessary step to finalize the transfer of your supposed earnings from their platform to your personal crypto wallet or bank account.

Example: "Good news! Your withdrawal request has been approved. Please send a 20% processing tax to authorize the final transfer of funds to your designated wallet address."

For victims whose fake balances have soared, scammers often invent a "high-value account unlock fee." This implies that accounts with substantial "earnings" require additional, special regulatory clearance, for which a payment is due.

Example:"Due to the significant value of your account, regulatory clearance is required for amounts over $100,000. A compliance payment is now due to unlock your funds."

Real tax obligations are typically paid through official government channels after you have received and realized your gains, and legitimate platforms will never hold your funds hostage for such payments. Always be wary of any service demanding direct payments for "taxes" or "clearance" before you can access your own assets.

Also Read: If you want to know more, you can go through Crypto Withdrawal Fee Scams.

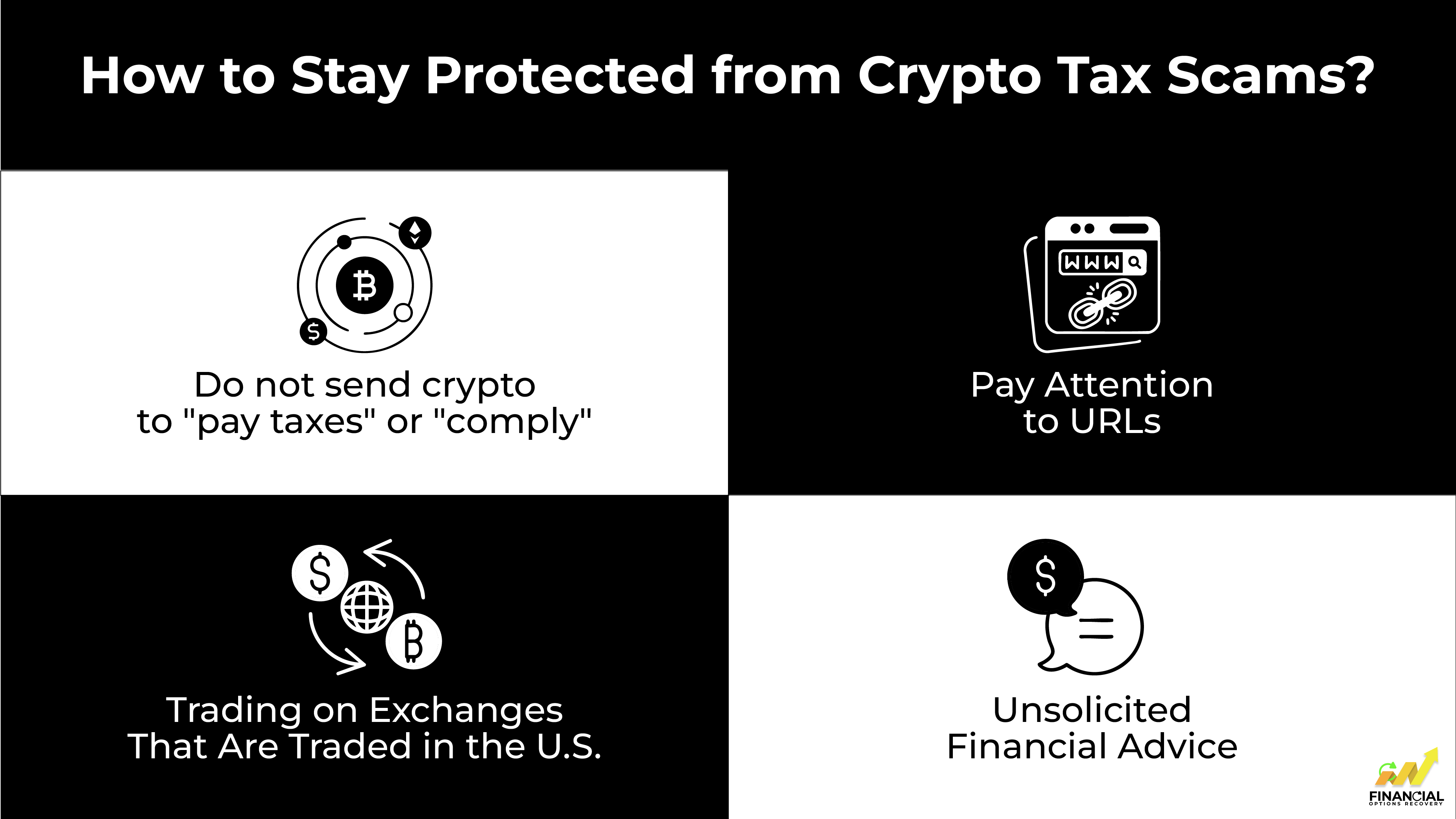

It's vital to understand the legitimate practices of cryptocurrency platforms and tax authorities to protect yourself from scams. Here's what you need to know:

The best way to fight against crypto tax scammers is prevention. You can protect your assets when you know their tricks and the things that scammers cannot do because it is not legitimate.

Here is how to be on top of the scammers:

Knowing what to avoid is crucial, but equally important is understanding your actual responsibilities. With the IRS's increased focus on digital assets, it's vital to be aware of your legitimate tax obligations. So, what exactly are the real crypto tax regulations in the U.S.?

The IRS defines cryptocurrency as a federal taxable "property," i.e., it is taxed as a form of stock or other investments. Learning these simple rules is critical for U.S. taxpayers.

Here’s what you need to know:

Always maintain thorough records of your crypto activities, and for complex situations, consider consulting a qualified crypto tax professional.

If you believe that you've been targeted by a crypto tax scam or are on an imposter platform, swift action must be taken to limit losses and assist authorities.

Taking quick action on these measures may hinder further monetary damage and assist with continued efforts to fight these scams.

If a crypto tax scam has impacted you:

It's a distressing experience, but you don't have to face it alone. We offer dedicated support for victims of digital asset fraud, focusing on effective recovery strategies.

Connect with our team at Financial Options Recovery to discuss your next best step.

A crypto tax scam is a deceptive scheme where a fraudulent investment platform demands an upfront "tax" or "fee" for you to withdraw your cryptocurrency. However, once you pay, they never release your funds, effectively stealing your crypto.

No. Tax authorities, including the IRS, do not directly collect crypto taxes through exchanges or crypto wallets. You are responsible for self-reporting your crypto capital gains or losses when you file your annual tax return.

You've likely been scammed. Stop sending any more funds immediately. Gather all your transaction records and seek professional help from a cybersecurity expert, legal counsel, or a scam recovery service as soon as possible.

Recovery is sometimes possible, but it's not guaranteed and often depends on how quickly you act. Your chances of recovery are also influenced by the method used for the fund transfer and the amount of evidence (transaction IDs, communication logs, etc.) you've managed to retain.