Table of Contents

One of the most unsettling experiences for any crypto holder is attempting a routine transaction, only to find that their wallet is suddenly inaccessible. Anxiety follows almost immediately. With cryptocurrency involved, what appears to be a minor glitch can easily be considered a significant crisis, especially with the rise in crypto scams.

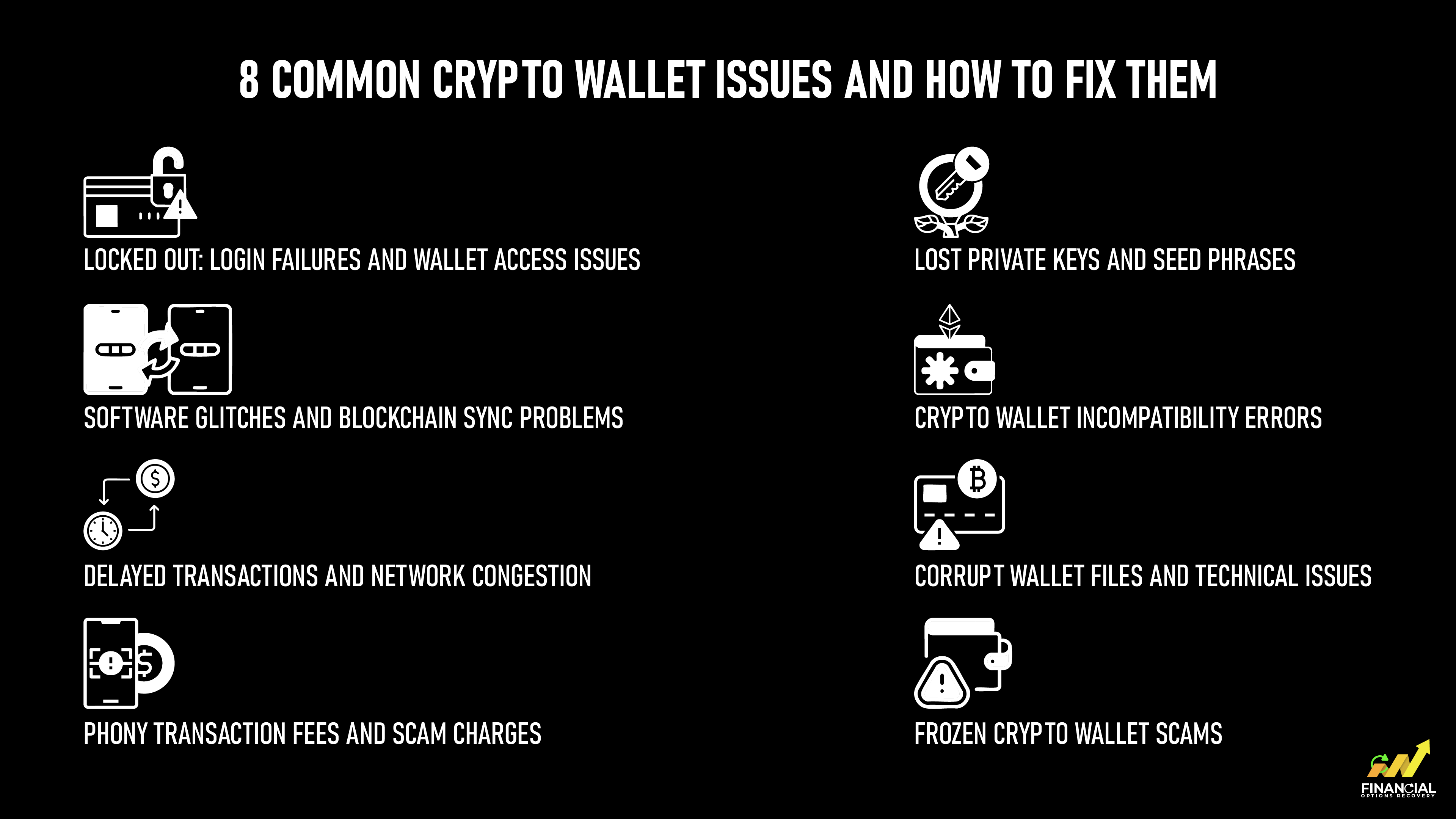

Crypto wallets are essential tools for managing digital assets, but they also come with inherent risks. From login issues to malicious files and compatibility issues, these technical issues can block access, slow down transactions, or even compromise your funds.

Fortunately, most common wallet issues have practical solutions. Knowing how to address these wallet issues can prevent unnecessary loss of time, money, and peace of mind. What we'll be doing in this guide is going through eight of the most common crypto wallet problems and providing you with practical tips to resolve them and best practices to keep your assets safe.

Even the most experienced crypto users can run into wallet problems. From login failures to corrupted files, understanding these common issues and knowing how to fix them can save your digital assets and prevent unnecessary stress. The following are some of the most common issues with crypto wallets.

Probably one of the biggest frustrations is a failed login. This can occur when you repeatedly enter the wrong password; the app will temporarily suspend access, or it can also happen due to a software glitch.

How to fix it:

Having these steps in mind will minimize panic and allow you to recover quickly.

Seed phrases and private keys are the ultimate keys to your cryptocurrency assets. Losing them will make wallet recovery very challenging, at times even impossible.

Prevention and recovery advice:

Even if you do not remember the password to your wallet, a valid seed will let you restore your wallet on another machine.

Wallets can be slow to sync with the blockchain, with delays or imbalances. Possible reasons include out-of-date apps, poor internet connections, or partial syncing.

Resolving these issues:

A blockchain explorer may assist you in checking the status of transactions and seeing whether delays are due to network congestion.

Not every wallet is compatible with all cryptocurrencies. Sending Ethereum to a Bitcoin wallet, for instance, can result in transaction failure or irreversible loss of funds.

Best practices:

Transactions are delayed, and fees become higher during busy times on the blockchain. Network overload is a widespread point of frustration for crypto users.

Solutions to deal with delays:

Small fee increases tend to speed processing without endangering asset loss.

Wallet files might get corrupted because of malware, disrupted updates, or malicious downloads. Corruption can lead to incorrect balances, transaction failures, or app crashes.

Prevention and recovery steps from file corruption:

Accurate backups and offline seed phrases enable full recovery even in extreme instances.

Fraudsters typically pretend to be exchanges or trading sites, proposing counterfeit fees or concealed taxes to manipulate users into additional payments.

Protect yourself:

Even minor mistakes or omissions can leave you exposed, so caution is paramount.

Some scams disguise themselves as legitimate exchanges or trading platforms. Everything works smoothly while you deposit, but the moment you try to withdraw, your account is suddenly “frozen” due to supposed verification issues, pending tax payments, or suspicious activity. Victims only realize too late that the wallet was fake from the start. You can learn more about crypto withdrawal scams here.

How to avoid and respond:

If your wallet is frozen on a suspicious platform, act quickly, collect all transaction records, and contact a reputable crypto scam recovery service for investigation and possible fund tracing.

Reducing wallet problems and protecting your assets is simpler when you maintain a few key habits:

By doing this, technical problems are minimized, your money is safeguarded against fraud, and your digital assets can be accessed freely.

Your crypto wallet is the foundation of safe and efficient digital asset management. Familiarity with the most common problems, login issues, forgotten keys, compatibility issues, slow transactions, corrupted files, and scams, can help avoid expensive errors.

Being prepared with backups, keeping software updated, and staying informed about blockchain activity ensures your funds remain secure. With crypto changing so fast in our modern world, applying these best practices is essential to anyone who handles digital currencies. For those who want to understand the risks more deeply, especially around crypto wallet scam recovery, firms like Financial Options Recovery provide valuable insights into how victims can protect themselves and take action if things go wrong.

The most secure method is to use a hardware wallet. This is a physical device that stores your private keys offline, making it far less vulnerable to hacking attempts, malware, or online breaches compared to mobile or desktop wallets.

Yes. Accessing your crypto wallet through public Wi-Fi significantly increases exposure to cyberattacks, as hackers often exploit unsecured networks. Always use a private, secure internet connection, and consider enabling a VPN for an additional layer of protection.

Two-factor authentication (2FA) is strongly recommended. By requiring a second form of verification beyond a password, 2FA makes it substantially more difficult for unauthorized users to gain access to your wallet, even if your credentials are compromised.

Yes. Phishing attacks are one of the most common threats to wallet security. They often involve deceptive emails, fake websites, or fraudulent messages designed to trick users into revealing private keys or login information. Always verify website URLs, avoid clicking on suspicious links, and never share your recovery phrase.

Mobile wallets offer convenience for day-to-day transactions but are not ideal for holding large sums of cryptocurrency. For long-term or high-value storage, a cold wallet (offline storage) is considered a far safer option.