You downloaded Cash App to send $20 to your friend for dinner. A few weeks later, you are buying bitcoin with the same ease, Eventually, someone messages you with a “once in a lifetime opportunity”. It sounds exciting, perhaps even a little too good to be true.

Because it is.

As cryptocurrency becomes more accessible, so do the traps that come with it. What used to be a complex tech space is now as simple as clicking ‘buy’ on your phone. Platforms like Cash App have made bitcoin investing easy for anyone. But this is not it, as scammers are also working just as hard to make your money as their money. That’s why it’s essential to understand the most common Bitcoin and crypto scam types before you unknowingly fall into one

However, this blog isn’t about scaring you off from using Cash Apps for crypto transactions. It’s about guiding you with clarity. We will break down how Bitcoin works on Cash App, what common scams are targeting users like you, and what to do when things go wrong. Whether you are new to crypto or just want to be smarter about it, this guide will help you move forward with confidence.

Table of Contents

Built by Block (formerly Square), Cash App is a mobile payment app that makes sending, receiving, and managing money incredibly easy, right from your phone. It is widely used in the U.S. to split bills, pay rent, or even receive direct deposits from employers.

But what really makes Cash App stand out is how much it’s grown. It’s not just a way to move money around anymore. You can now use it to invest in Bitcoin (BTC), receive direct deposits, and even use a Cash App debit card for everyday spending.

Cash App simplifies what used to be complicated. Buying bitcoins no longer requires signing up for a crypto exchange or understanding technical terms. With just a click on your phone, you can invest and track your Bitcoin (BTC) holdings.

But with such convenience comes vulnerability that makes it an easy target for scammers. Scammers now have easy access to exploit those who are new to crypto. Hence, it is important to understand the scope of what Cash App offers and what it doesn’t.

Before we get into how bitcoin scams unfold in Cash App, there is an important point to clear up: Cash App only supports one cryptocurrency, Bitcoin (BTC).

That might sound like a minor detail, but it’s a common mistake. The names are similar, and many users assume they’re the same thing. They’re not, and here’s the quick breakdown:

When you send BCH to a Cash App BTC wallet, you could lose your money permanently.

Scammers know this. They often take advantage of the confusion between BTC and BCH to trick users into sending funds to the wrong place. That’s why it’s so important to understand what Cash App supports and what it doesn’t.

Now that you know what Cash App is and how it supports Bitcoin, let’s break down the basics of how it works for users.

Now, let’s take a quick look at how Bitcoin works inside the Cash App.

Cash App makes the process of investing in Bitcoin feel as familiar as sending money to a friend, and that’s both its greatest strength and potential risk.

Now that you understand how bitcoin functions on Cash App, let's dive into the most common scams that crypto scammers are targeting.

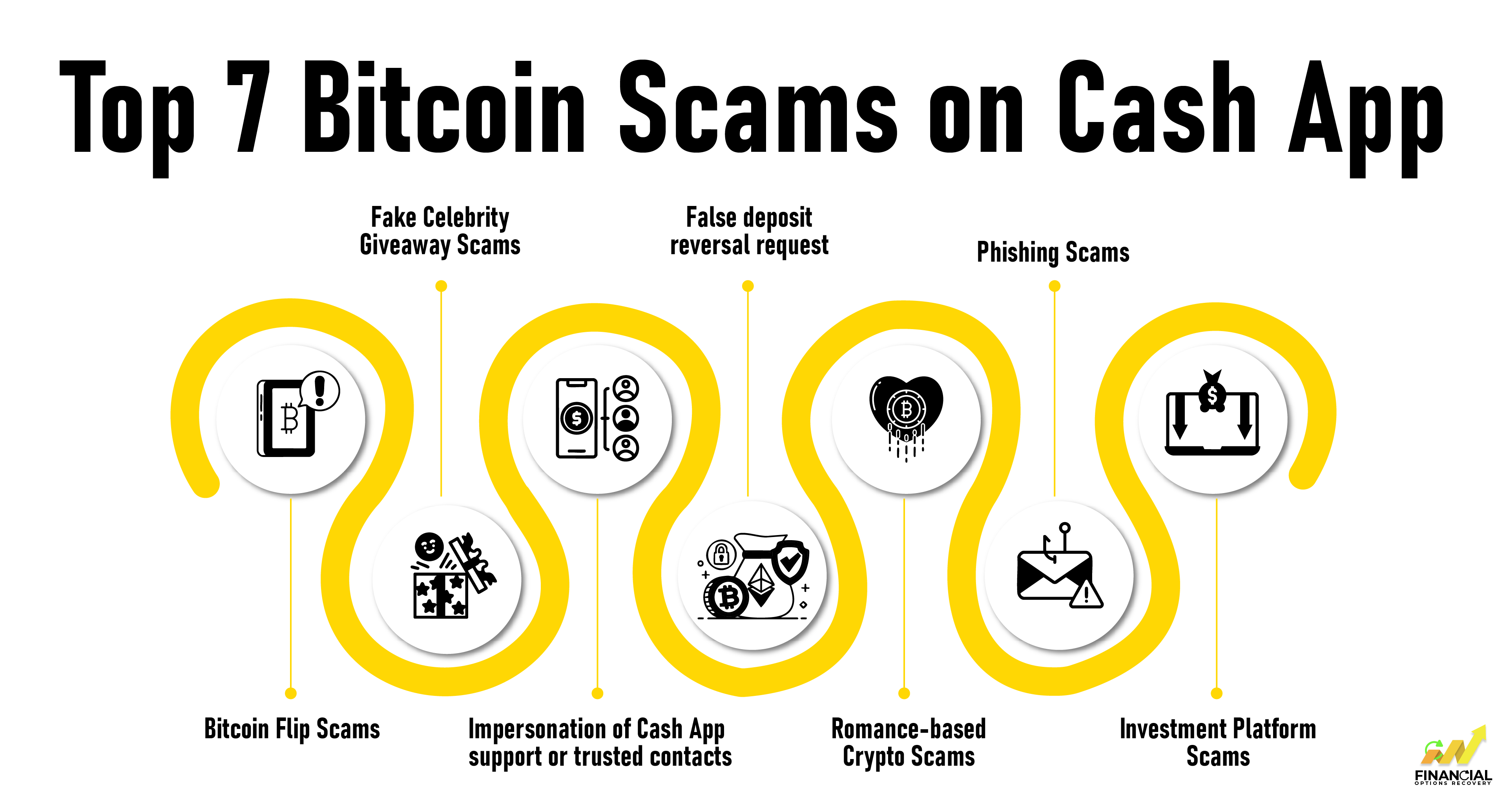

With the rise of bitcoin’s popularity, scammers are getting more creative on Cash App. Here are some of the most common scams to watch out for:

These scams involve fraudsters claiming they can ‘flip’ your bitcoin, promising to double or triple your crypto if you send them a certain amount upfront. Once you send the funds, the scammer disappears.

Scammers impersonate celebrities, influencers, or even Cash App itself, posting fake giveaways on social media. They ask users to send bitcoin with the promise of sending back a larger amount, something that never happens.

In imposter scams, fraudsters pose as Cash App representatives or even people from your contacts. They reach out through texts, emails, or social media, asking for personal information or a bitcoin transfer to resolve an issue. You can learn more about imposter scams in detail through our blog.

Scammers claim that they accidentally deposited bitcoin into your account and ask you to send it back, often urgently. In reality, no such deposit exists. They may even show fake screenshots to gain your trust.

Often called ‘ romance scams,’ these involve building trust through relationships before requesting bitcoin for emergencies, travel, or fake investments. Victims are emotionally manipulated and defrauded over time. Read here to know more about romance scams - ways to spot and avoid them.

Phishing scams attempt to steal your login credentials or trick you into clicking malicious links. These often come disguised as urgent Cash App notices or bitcoin promotions.

Scammers direct victims to fake investment platforms that mimic legitimate Bitcoin trading sites. The interface may look real, but withdrawals are impossible, and once your Bitcoin is sent, it’s gone for good. Learn more abouthow to spot and avoid investment scams in our ultimate guide.

Now that you are aware of the most common scams, the next step is learning how to spot these scams.

Spotting Bitcoin scams on Cash App doesn’t have to be hard. Many scams use similar tricks, like rushing you to act fast or asking for personal information, which can be confusing. But once you know the common warning signs of Bitcoin Cash App scams, it’s easier to spot fraud and protect your money. Here’s how to spot these scams before it’s too late

When it comes to sending money or sharing information on Cash App, the best defense is staying calm and double-checking anything that feels off before you act. If something seems fishy, don’t hesitate; reach out to Cash App’s customer support for guidance. Being alert to the warning signs of scams is your best way to protect yourself from bitcoin fraud and keep your money safe.

Even when you’re careful, scammers are getting smarter, especially in the evolving world of cryptocurrency. When you think someone’s trying to scam you or worse, you’ve already lost money on a bitcoin scam through Cash App, don’t panic. Act fast. While bitcoin transactions can’t be reversed, there are still important steps you can take to protect your account, report the scam, and potentially limit the damage.

Remember, you’re not alone, and the sooner you act, the better your chances of safeguarding your funds and getting help. Unfortunately, these types of scams are common. Here’s a case of how others have recovered crypto from fake exchanges and scam investments.

When you’ve been scammed, first, take a deep breath. It happens to a lot of people, and you’re not alone. What matters most now is taking the right steps quickly to protect yourself and possibly recover your money. Here are some steps to take immediately after being scammed on Cash App:

When you’ve been scammed, first, take a deep breath. It happens to a lot of people, and you’re not alone. What matters most now is taking the right steps quickly to protect yourself and possibly recover your money. Here are some steps to take immediately after being scammed on Cash App:

Open the app, go to your transaction history, tap on the suspicious payment, and select Report or Need Help & Cash App Support. Cash App has a dedicated fraud team that investigates these cases.

In case your Cash App is linked to a debit or credit card, let your bank know what happened. They may be able to stop the transaction or help you dispute the charge.

Immediately change your Cash App PIN and turn on features like two-factor authentication or face/fingerprint ID. This helps block further access if your account details were compromised.

Scammers often come back pretending to be “support,” offering to help recover your money. Be careful, Cash App will never ask for your password, PIN, or for you to send money.

Visit FTC, to file a complaint. Also, consider reporting to the FBI. This helps authorities track patterns and prevent others from falling victim to the same scam.

Save screenshots, emails, payment confirmations, everything. These are useful for reporting the scam as they act as a proof in front of the authorities.

Especially if a large amount of money is involved, filing a local police report can help in some cases, particularly when identity theft or impersonation is part of the scam.

In case personal information (like your SSN or bank account), has been shared, freeze your credit cards, bank accounts and monitor for suspicious activity using free tools from Equifax, Experian, or TransUnion.

In cases of uncertainty or emotional distress after a scam, seeking assistance from reputable recovery specialists is strongly recommended.For example,Financial Options Recovery helps scam victims trace and recover funds lost to online fraud, including crypto and Cash App-related scams. Their team can guide you through the recovery process and take action when needed.

Think You’ve Been Scammed Through Bitcoin on Cash App?

Let’s Talk.

If you’ve been scammed, it’s okay to feel confused, upset, and stuck with a question: what to do next? You don’t have to carry this burden alone. Just talking to someone who truly understands what you're going through can bring real relief and real help.

Visit or contact Financial Options Recovery for a free, no-pressure case evaluation. Our expert fund recovery team is here to listen, guide you, and help you take the next step at your own pace.

Yes, if you stay within the app and never send Bitcoin to unknown parties. The in-app Bitcoin buying feature is secure. Just avoid external links or offers that claim to help you "double" your Bitcoin.

Cash App has occasionally done verified promotions, but they’ll never ask you to send Bitcoin first or share personal information. If someone says, "send $100 in BTC and get $1,000 back," it's 100% a scam.

You can report a Bitcoin Cash App scam by:

Cash App typically cannot refund Bitcoin because the blockchain is irreversible. However, if you sent USD and it hasn’t been accepted yet, you may be able to cancel the transaction. Always act fast and contact support.